16 Oct 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

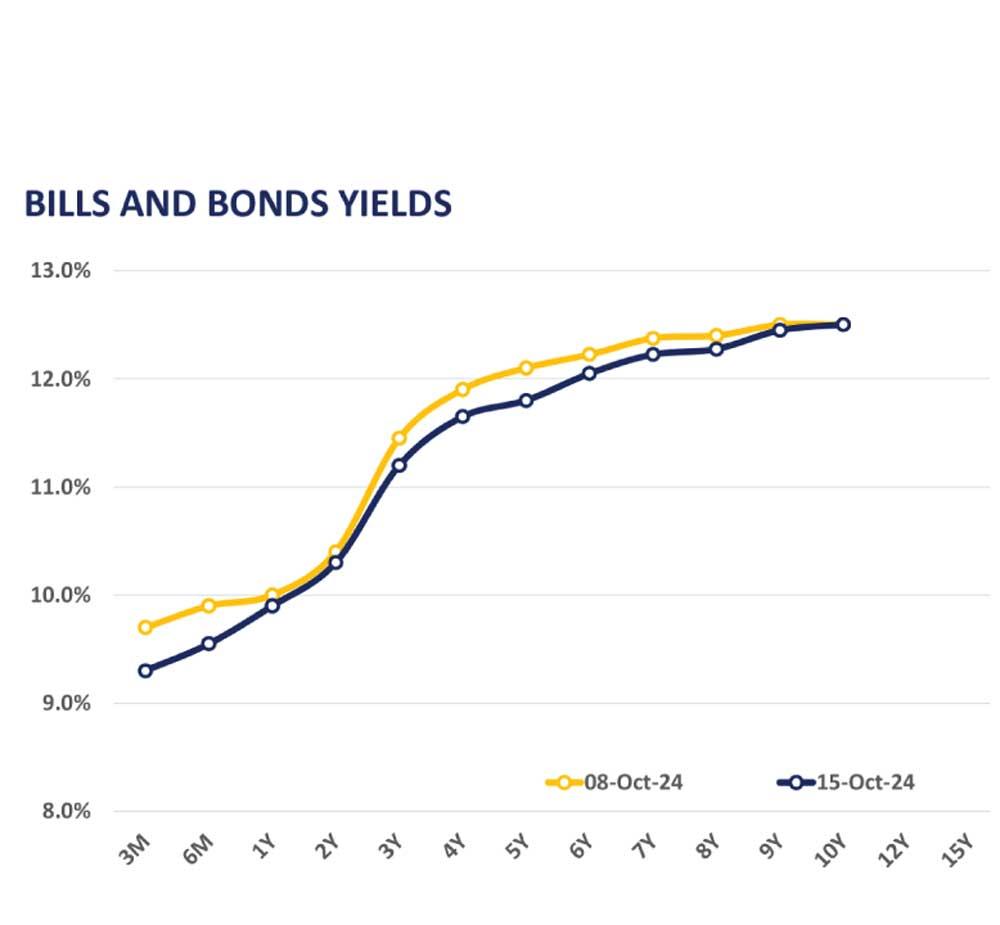

The secondary market displayed mixed sentiment throughout the day on mid-tenor bonds. Buying interest prevailed on the 3Yr maturity, with the 15.12.27 bond trading between the range of 11.30%-11.25%. In contrast, the 4Yr tenors faced selling pressure, with bonds such as 15.02.28, 15.03.28, 01.07.28, and 15.12.28 trading within the 11.55%-11.75% range.

The secondary market displayed mixed sentiment throughout the day on mid-tenor bonds. Buying interest prevailed on the 3Yr maturity, with the 15.12.27 bond trading between the range of 11.30%-11.25%. In contrast, the 4Yr tenors faced selling pressure, with bonds such as 15.02.28, 15.03.28, 01.07.28, and 15.12.28 trading within the 11.55%-11.75% range.

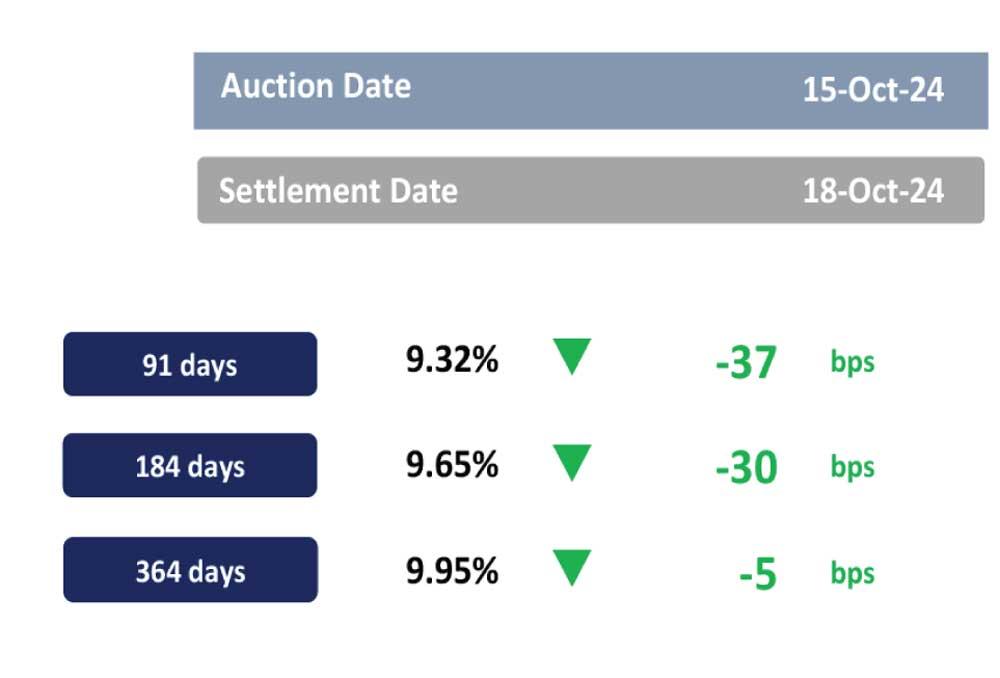

Meanwhile, at the weekly T-bill auction held yesterday, CBSL fully subscribed to the total offered amount of Rs.97.0bn, with auction yields experiencing a decline of up to 37bps across the board, continuing the downward trend for the 4th consecutive week. CBSL accepted the total offered for the 3M, 6M, and 1Yr maturities, at Weighted Average Yield Rates (WAYRs) of 9.32% (-37bps), 9.65% (-30bps), and 9.95% (-5bps), respectively.

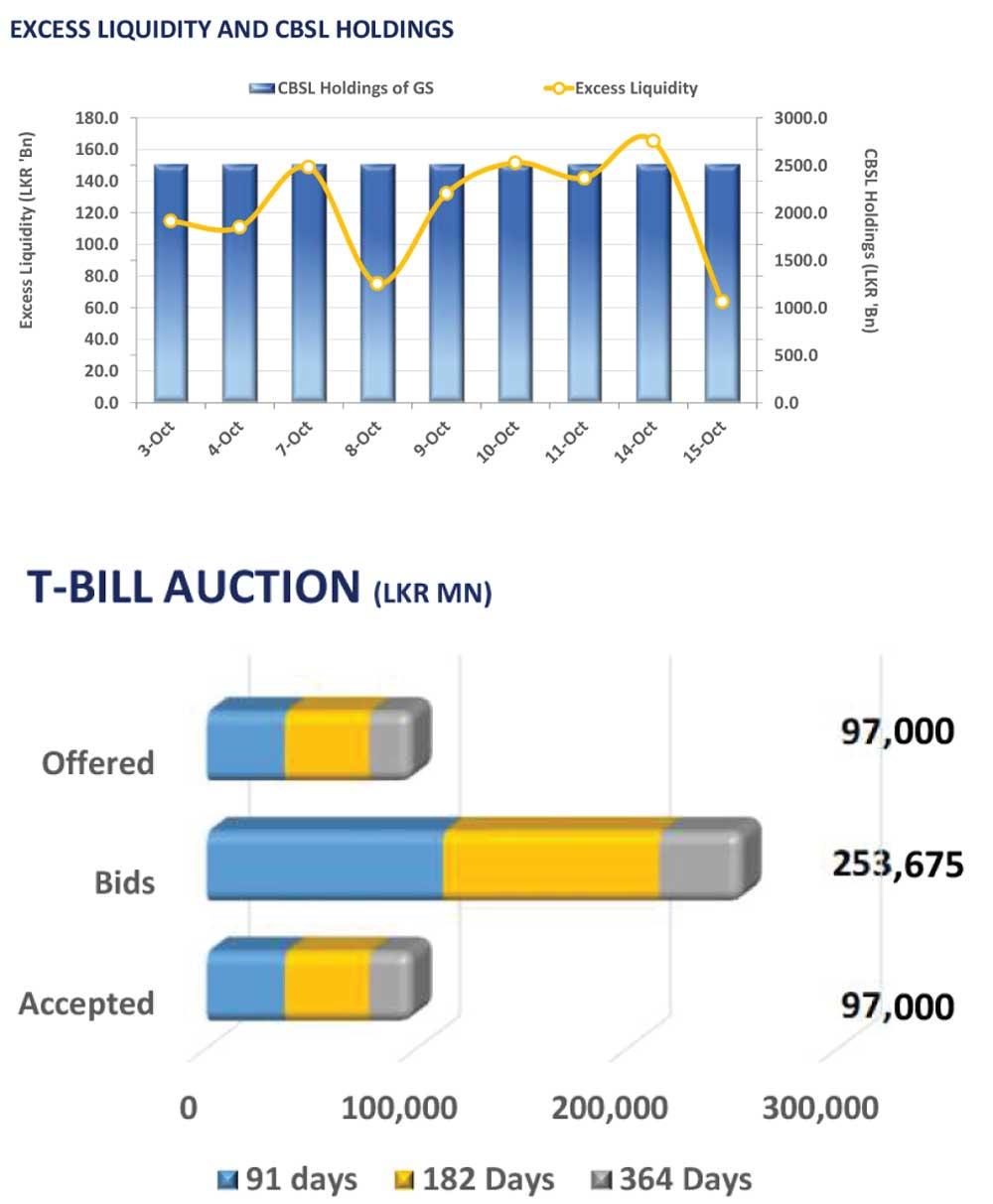

Notably, the overnight liquidity for the day significantly declined to Rs. 63.8bn, whilst CBSL holdings remained stagnant at Rs. 2,515.6bn.

Furthermore, in the forex market, the LKR marginally depreciated against the USD, closing at Rs. 292.9 for the day. However, the LKR has appreciated by 9.6%YTD against the USD, reflecting a strong overall performance for the year.

30 Dec 2024 36 minute ago

29 Dec 2024 2 hours ago

29 Dec 2024 4 hours ago

29 Dec 2024 4 hours ago

29 Dec 2024 6 hours ago