15 Feb 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market came to a standstill yesterday, as the investors opted for a wait-and-see approach, after experiencing a series of bullish sentiments fuelled by the expectations of a decline in yields over the past few sessions.

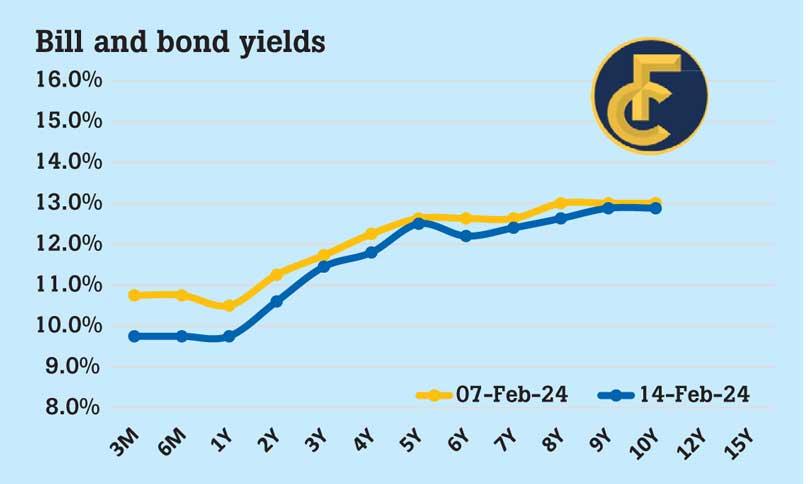

During the morning hours, the investor interest was centred on liquid maturities, including 2026, 2027 and 2028, which traded at 10.60 percent, 11.40 percent and 11.80 percent, respectively. Moreover, May 15, 2030 maturity was observed trading at 12.15 percent during the day.

Meanwhile, at the weekly Treasury bill auction held today, the Central Bank of Sri Lanka (CBSL) fully accepted the total offered of Rs.135.0 billion, whilst the auction yields significantly edged down across the board by over 70 basis points (bps). The 91-day and 182-day maturities experienced higher reception, with the CBSL accepting Rs.38.4 billion for the 91-day maturity (surpassing the total offered of Rs.30.0 billion), at 9.79 percent (-117bps) and Rs.48.4 billion for the 182-day maturity (above the total offered of Rs.45.0 billion), at 9.86 percent (-121bps).

Furthermore, Rs.48.3 billion was accepted from the 364-day maturity, at a weighted average yield of 10.02 percent (-71bps).

Moreover, market liquidity declined during the day and recorded a net liquidity surplus of Rs.50.2 billion, whilst the CBSL holdings remained stagnant at Rs.2,735.6 billion.

On the external side, the Sri Lankan rupee marginally depreciated against the US dollar, closing at Rs.313.4 at the end of the day.

27 Oct 2024 3 hours ago

27 Oct 2024 3 hours ago

27 Oct 2024 5 hours ago

27 Oct 2024 5 hours ago

27 Oct 2024 6 hours ago