01 Aug 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market exhibited subdued sentiment yesterday, marked by thin trading volumes following yesterday’s T-bond auction.

Despite this, a slight uptick in buying interest was noted for the T-bond maturing on 15.10.2030, which traded at 12.75 percent during the day.

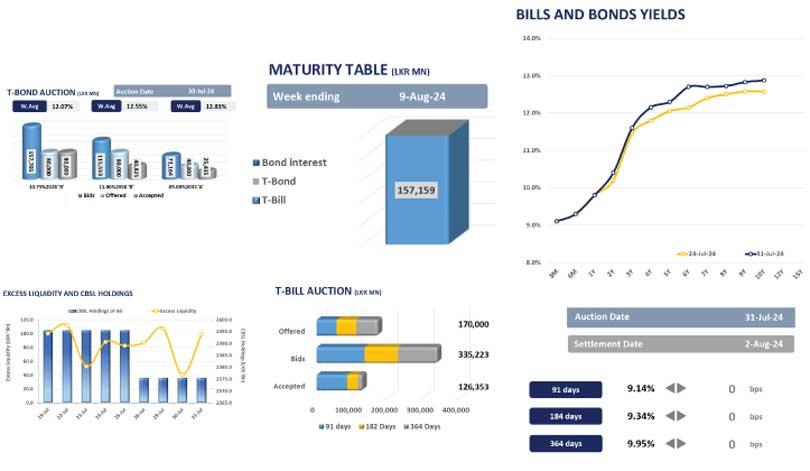

At the weekly T-bill auction held yesterday, the Central Bank partially accepted Rs.126.4 billion from the total offered of Rs.170.0 billion, whilst the auction yields remained stagnant, following a series of decline across the board in the previous three T-bill auctions.

The three-month maturity was oversubscribed with the Central Bank accepting Rs.85.3 billion (exceeding the total offered of Rs.55.0 billion) at a WAYR of 9.14 percent, whilst both the six-month and one-year maturities were undersubscribed. Accordingly, the Central Bank accepted Rs.29.4 billion for the six-month maturity at a WAYR of 9.34 percent and Rs.11.6 billion for the one-year bill at a WAYR of 9.95 percent.

Overnight liquidity improved to Rs.98.7 billion, whilst the Central Bank holdings remained unchanged at Rs.2,575.6 billion during the day. On the external front, the Sri Lankan rupee continued to appreciate against the US dollar for the third consecutive session, closing at Rs.302.4/US dollar for the day.

Furthermore, the headline inflation, as measured by the year-on-year change in the CCPI, accelerated to 2.4 percent in July 2024, up from 1.7 percent in June 2024.

26 Nov 2024 7 minute ago

26 Nov 2024 1 hours ago

26 Nov 2024 1 hours ago

26 Nov 2024 1 hours ago

26 Nov 2024 2 hours ago