30 Oct 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

By First Capital Research

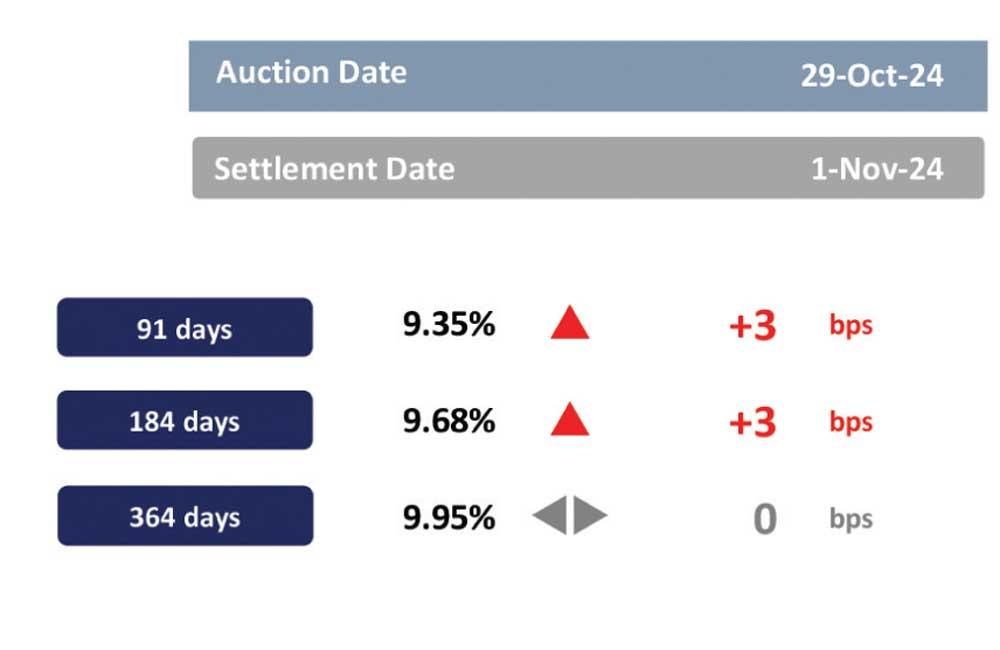

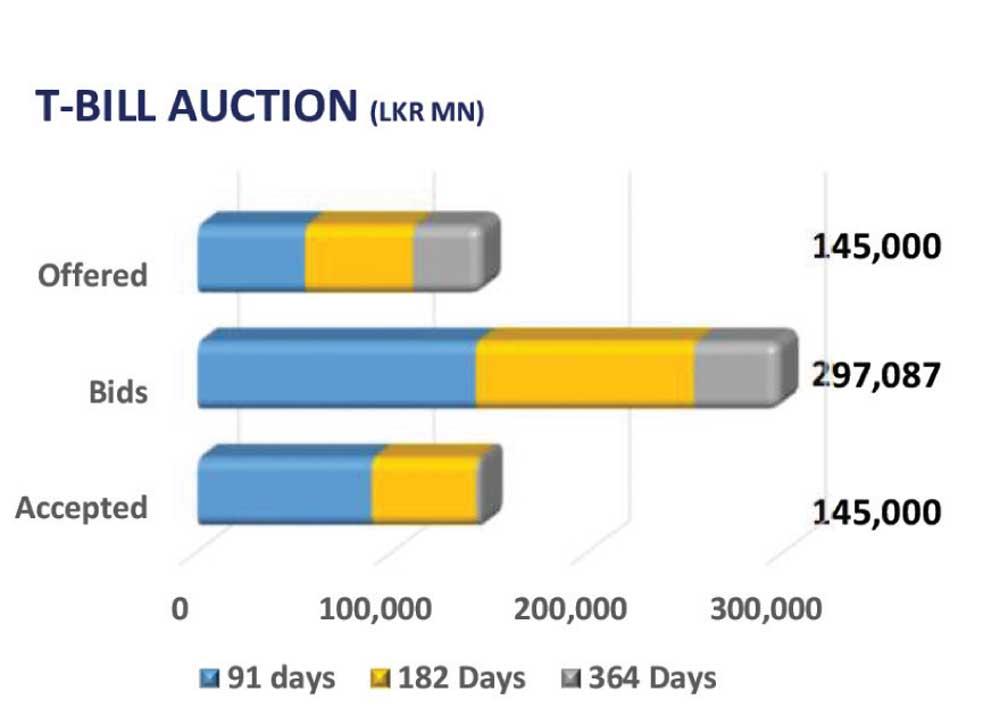

At the Rs. 145.0bn weekly T-Bill auction held yesterday, the CBSL fully subscribed to the entire offered amount.

The 3M T-Bill received the highest demand, leading to an oversubscription, while CBSL accepted Rs. 53.2bn of 6M T-Bill. In contrast, the 1Y T-Bill saw minimal interest, with only Rs. 2.7bn accepted.

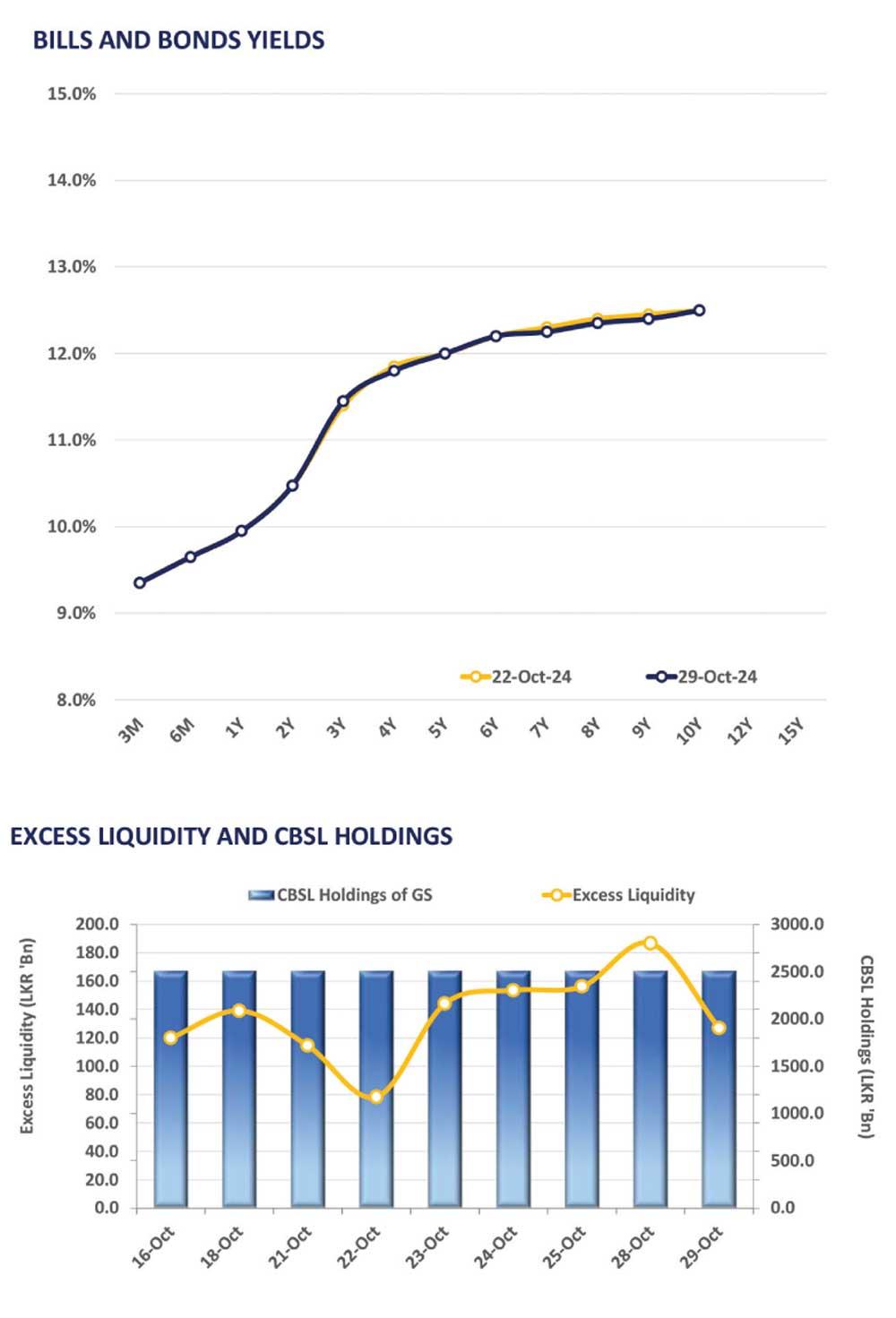

Meanwhile, weighted average yields edged higher after five weeks, with the 3M and 6M T-Bills closing at 9.35% (+3bps) and 9.68% (+3bps) respectively. However, the WAYR on the 1Yr T-Bill remained steady at 9.95%.

Meanwhile, in the secondary market, bond yields remained relatively stable amid limited investor activities and thin trading volumes. Amid mixed sentiment, mid-tenor bonds maturing on 01.07.28 and 15.12.28 traded at 11.80% and 11.95%, respectively.

On the longer end, bonds maturing on 15.09.29 and 15.05.30 changed hands at 12.00% and 12.20%, respectively.

On the external side, the LKR slightly appreciated against the greenback closing at Rs. 293.5. Meanwhile, overnight liquidity recorded at Rs. 126.9bn while CBSL Holdings remained unchanged at Rs. 2,515.6bn.

27 Dec 2024 3 hours ago

27 Dec 2024 3 hours ago

27 Dec 2024 4 hours ago

27 Dec 2024 5 hours ago

27 Dec 2024 5 hours ago