07 Nov 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market displayed a mild buying interest on mid-tenures during the day amidst limited activities and low trading volumes. Consequently, the 2027 maturities, including 01.05.27, 15.09.27 and 15.12.27, traded within a range of 11.50 percent-11.25 percent.

Meanwhile, the 2028 maturities, including those dated 15.02.28, 15.03.28, 15.10.28 and 15.12.28, saw trades within the range of 11.90 percent-11.67 percent.

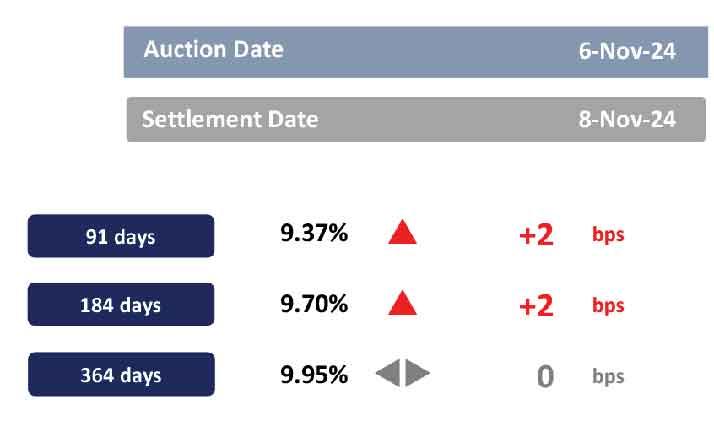

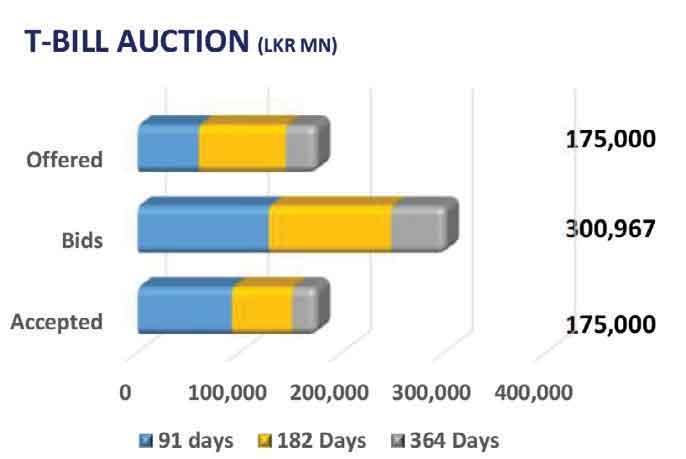

Furthermore, at the first weekly T-bill auction of the month, held yesterday, the Central Bank fully subscribed to the total offered amount of Rs.175.0 billion, with auction yields increasing across the board for the second consecutive auction. The three-month maturity was oversubscribed with the Central Bank accepting Rs.92.4 billion (exceeding the total offered of Rs.60.0 billion) at a WAYR of 9.37 percent, whilst both the six-month and one-year maturities were undersubscribed. Accordingly, the Central Bank accepted Rs.58.8 billion for the six-month maturity at a WAYR of 9.70 percent and Rs.23.9 billion for the one-year bill at a WAYR of 9.95 percent.

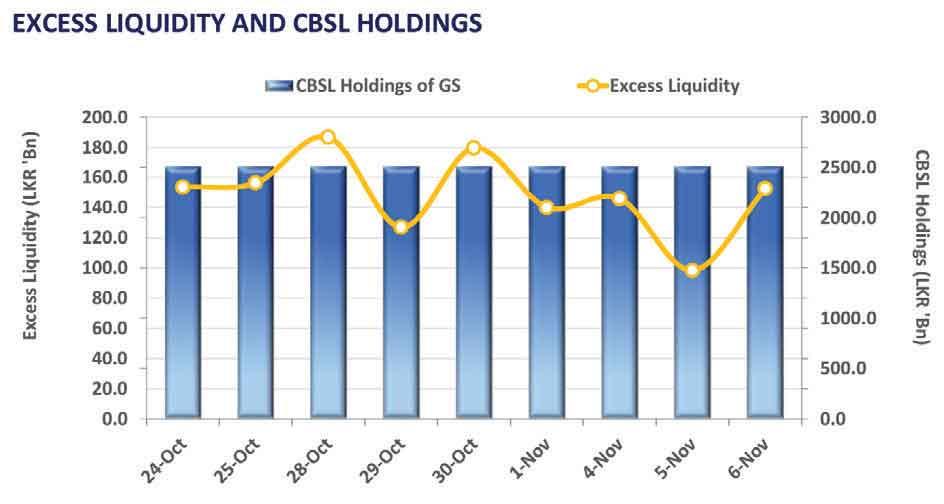

Notably, the overnight liquidity for the day increased to Rs.152.6 billion, whilst the Central Bank holdings remained stagnant at Rs.2,515.6 billion. Furthermore, in the forex market, the Sri Lankan rupee marginally depreciated against the US dollar, closing at Rs.293.1, whilst it appreciated against most of the major currencies, including the GBP, EUR, JPY, CNY and AUD for the day.

26 Dec 2024 5 minute ago

25 Dec 2024 25 Dec 2024

25 Dec 2024 25 Dec 2024

25 Dec 2024 25 Dec 2024