13 Sep 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

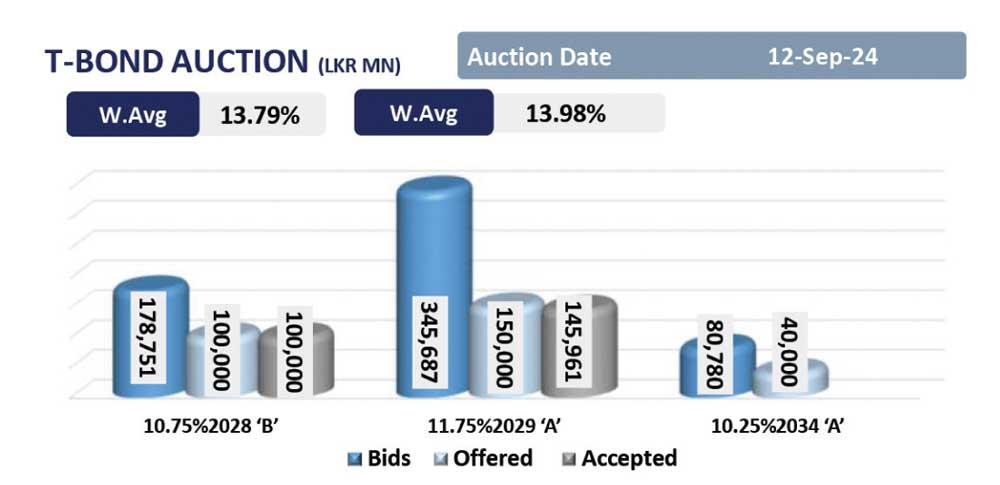

CBSL held its Rs. 290.0bn T-Bond auction yesterday where weighted average yield rates were accepted below the 14.0% mark.

Moreover, 15.02.28 tenor was accepted at a weighted average yield rate (WAYR) of 13.79%, 15.06.29 was accepted at a WAYR of 13.98% whilst 15.09.34 maturity was rejected during the day.

Notably, total offered of Rs.100.0bn was fully accepted from 15.02.28 whilst only Rs. 146.0bn was partially accepted from the 15.06.29 maturity during the 1st and the 2nd phases of the auction.

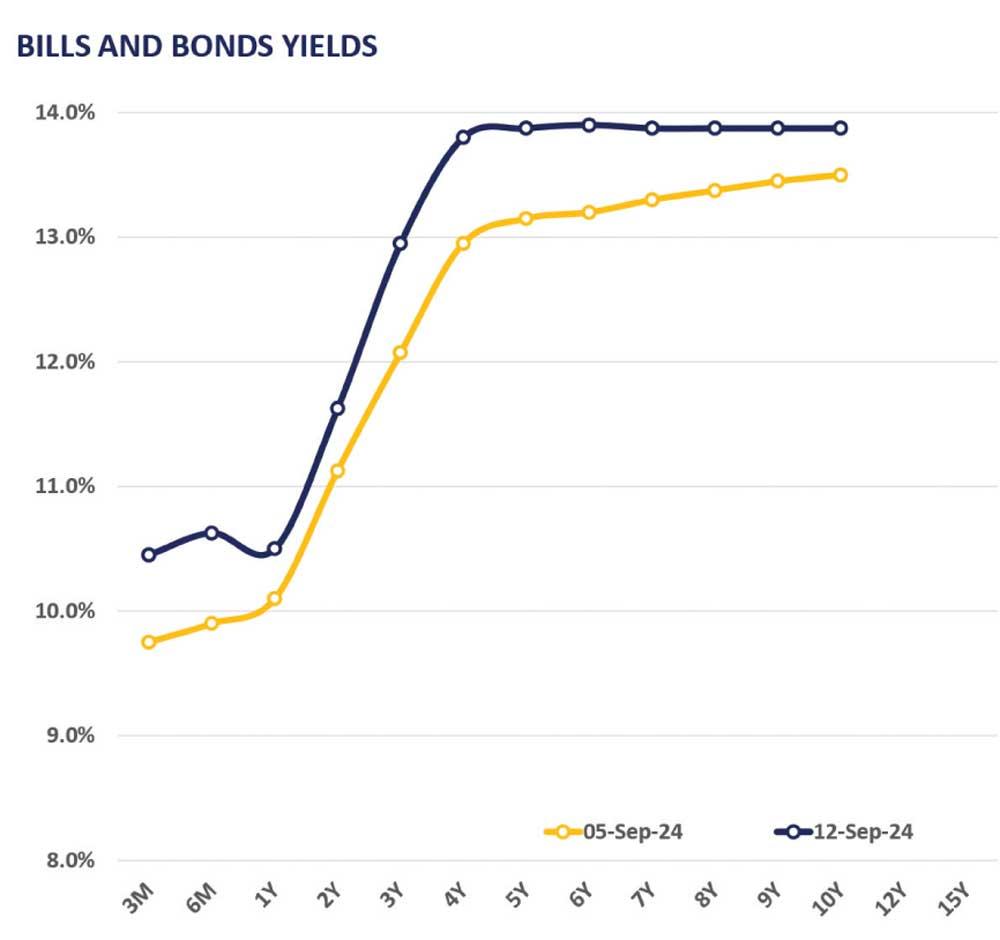

In the secondary market, mid tenor maturities 01.05.27 and 01.05.28 enticed trade at 13.00% and 13.75% prior to the auction, and auction maturity 15.02.28 enticed trades at 13.75% post T-Bond auction.

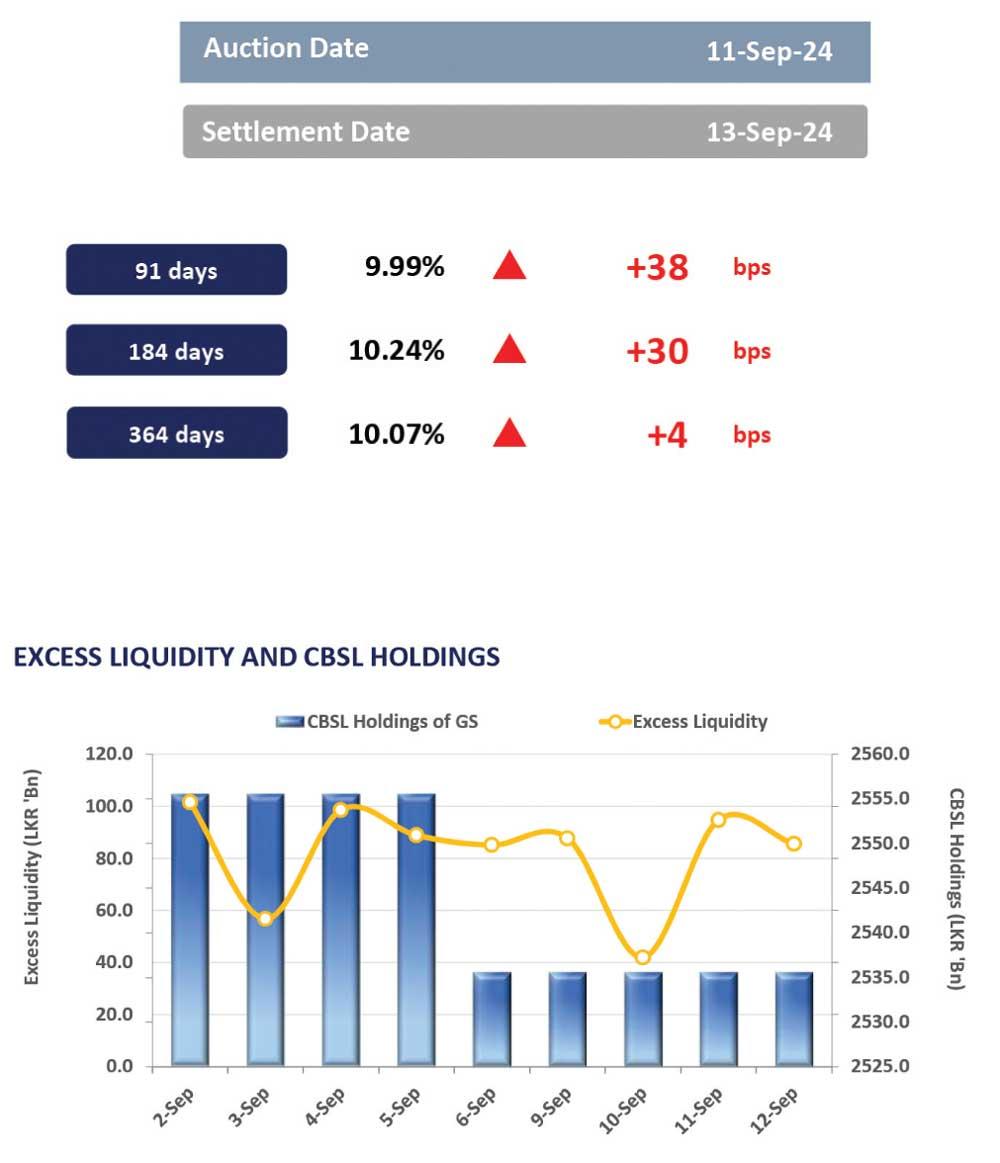

Overnight liquidity declined to LKR 85.5Bn from LKR 94.7Bn recorded during the previous day whilst CBSL holdings remained stagnant at Rs. 2,535.6bn.

On the external side LKR broadly remained stagnant against the USD recording at Rs. 300.8 during the day compared to the previous day’s closing. LKR appreciated amongst most of the major currencies namely, GBP, EUR, JPY and CNY.

25 Nov 2024 41 minute ago

25 Nov 2024 2 hours ago

25 Nov 2024 2 hours ago

25 Nov 2024 3 hours ago

25 Nov 2024 3 hours ago