13 Jun 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

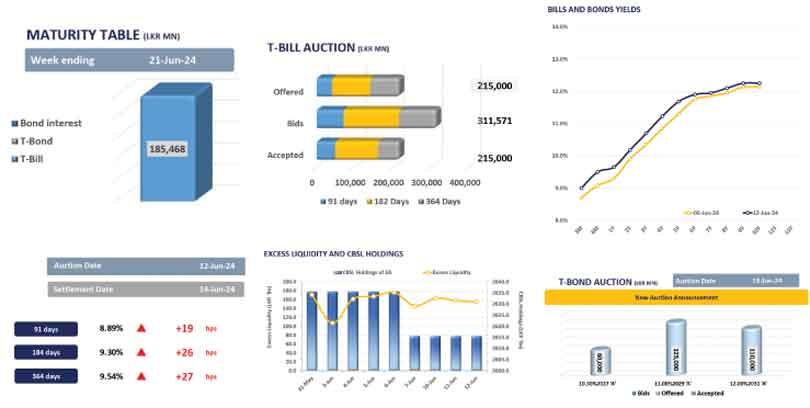

The Central Bank fully accepted the total offered of Rs.215.0 billion at yesterday’s weekly bill auction while the auction yields saw an uprise across the board for the second consecutive session.

Accordingly, the weighted average yield rate of three-month and six-month bills edged up to 8.89 percent (+19 basis points (bps)) and 9.30 percent (+26bps), respectively while the one-year bill closed higher at 9.54 percent (+27bps).

Meanwhile, in the secondary market, activities took a lacklustre sentiment as the investors cautiously awaited the upcoming bond auction scheduled for today. Following the auction, the investors adjusted their quoted prices upward, expressing surprise at the auction’s results; however, no trades were executed.

Moreover, amidst subdued activity, the 2028 maturity enticed slim interest during the session, with 15.01.2028 closing at 11.10 percent whilst 01.05.2028 and 01.07.2028 registered trades at 11.15 percent. Also, 15.05.2030 observed trades at 11.90 percent levels during the day.

The outcome of today’s significant Rs.295.0 billion T-bond auction, along with the developments from yesterday’s International Monetary Fund meeting, will be pivotal in shaping investor sentiment in the near term.

Meanwhile, on the external side, the Sri Lankan rupee depreciated against the greenback, closing at Rs.303.5.

27 Nov 2024 2 hours ago

27 Nov 2024 3 hours ago

27 Nov 2024 4 hours ago

27 Nov 2024 4 hours ago

27 Nov 2024 4 hours ago