11 Jul 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

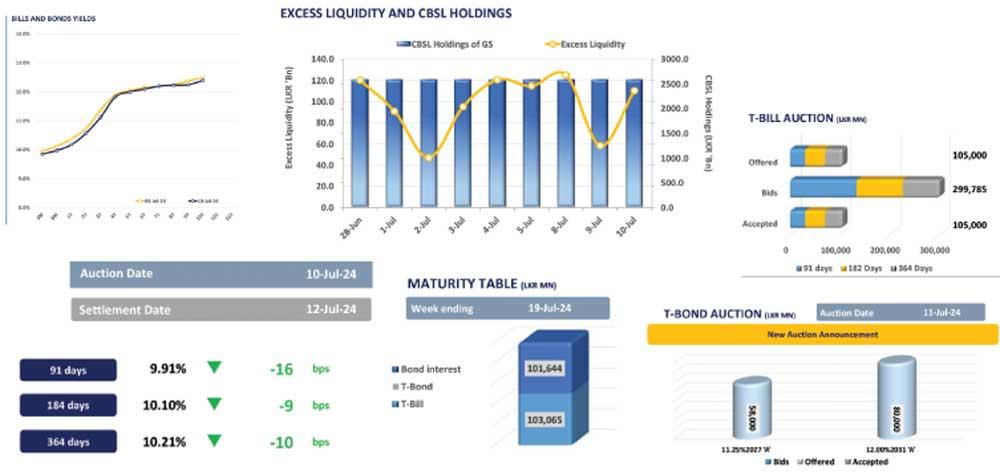

The secondary market exhibited selling interest during the morning hours as the investors geared up ahead of the Rs.138.0 billion T-bond auction slated for today.

The selling activity was predominantly centred on the 15.09.29 maturity, which traded within the range of 12.10 percent-12.16 percent.

In contrast, subsequent to yesterday’s weekly T-bill auction, there was a resurgence of buying interest due to a decline in auction yields across the board. The buying interest was predominantly focused on the mid-end of the yield curve, specifically the 15.02.28 and 01.05.28 maturities, which traded in the range of 11.90 percent-11.80 percent.

In the weekly T-bill auction held yesterday, the Central Bank fully subscribed to the total offered amount of Rs.105.0 billion. The auction yields experienced a decline of over nine basis points (bps) across the board, after remaining stagnant in the previous week’s auction. The Central Bank accepted the total offered for the 91-day, 182-day and 364-day maturities, at a WAYR of 9.91 percent (-16bps), 10.10 percent (-9bps) and 10.21 percent (-10bps), respectively.

Moreover, overnight liquidity rose to Rs.110.6 billion from the previous day’s Rs.58.6 billion, whilst CBSL Holdings remained unchanged at Rs.2,595.6 billion for the ninth consecutive day.

On the external front, the Sri Lankan rupee extended its appreciation against the US dollar for the second consecutive day, closing at Rs.304.2/US dollar.

26 Nov 2024 9 hours ago

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024