22 Aug 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

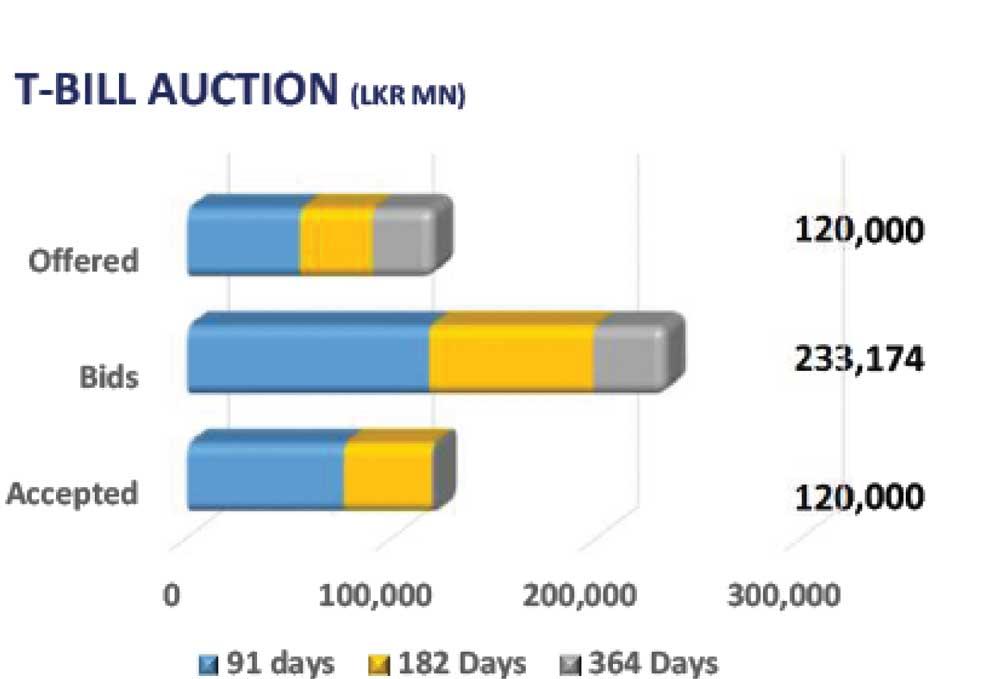

The Central Bank conducted the weekly T-bill auction yesterday raising Rs.120.0 billion and the total offered was fully accepted with higher reception on three-month and six-month tenures.

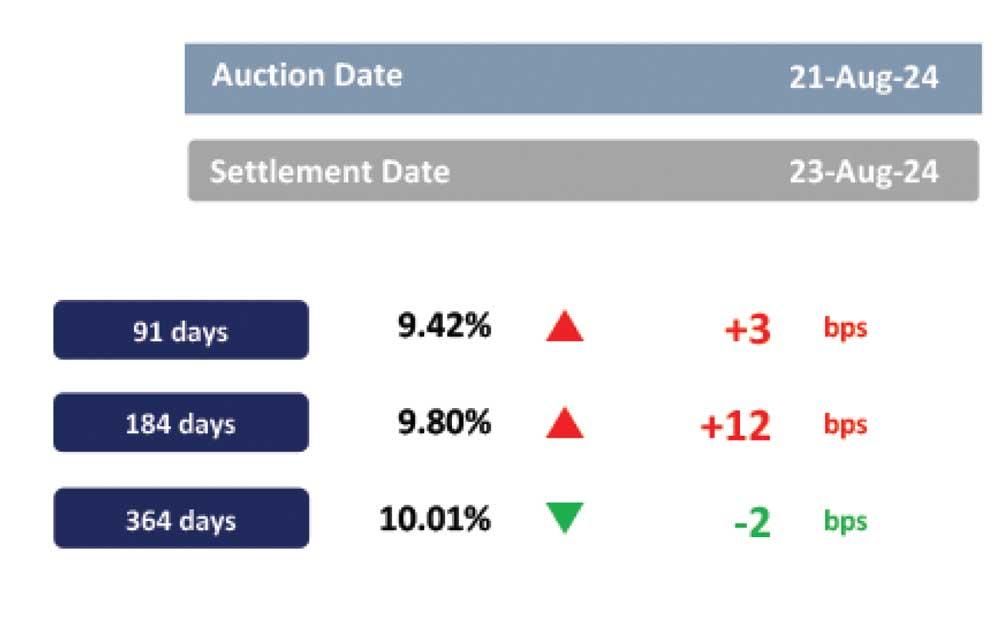

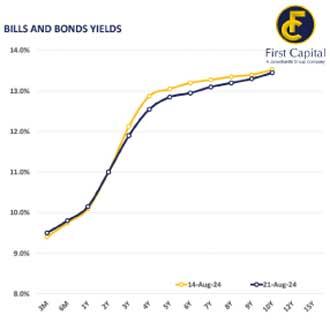

However, on a surprising note, the one-year bill saw only a very small level of acceptance amounting to Rs.740.0 million. Accordingly, the weighted average yield rate of the three-month bill edged up by three basis points (bps) to 9.42 percent whilst the six-month bill edged up by 12bps to 9.80 percent.

However, on the contrary, the one-year bill saw a marginal decline of two bps closing at 10.01 percent. Meanwhile, in the secondary market buying appetite continued to persist on mid-tenure, resulting in a downward shift in the belly of the curve. Accordingly, various maturities from the 2028 tenure traded during the day, such as 15.03.2028, 01.05.2028, 01.07.2028 and 15.12.2028, which hovered between 12.85 percent-12.50 percent.

Moreover, the 15.06.2029 maturity registered trades within the range of 12.95 percent-12.90 percent and 15.05.2030 changed hands between 13.10 percent-13.00 percent.

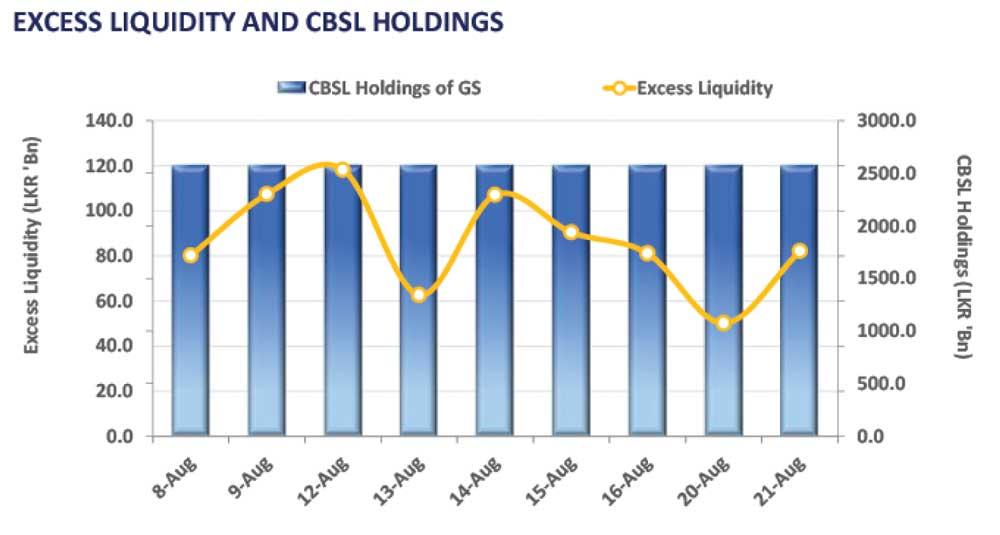

Despite the buying interest, market volumes were recorded at thin levels. Meanwhile, overnight liquidity saw an improvement yesterday, closing at Rs.82.2 billion compared to Tuesday’s level of Rs.50.2 billion.

However, the Central Bank holdings remained unchanged during the day. On the external side, the Sri Lankan rupee depreciated against the US dollar closing at Rs.299.3. Similarly, the Sri Lankan rupee depreciated against other major currencies including GBP, EUR, CNY and AUD.

25 Nov 2024 5 hours ago

25 Nov 2024 6 hours ago

25 Nov 2024 6 hours ago

25 Nov 2024 8 hours ago

25 Nov 2024 8 hours ago