24 Feb 2021 - {{hitsCtrl.values.hits}}

Individuals and organisations stockpiled cash during 2020 as they set aside large sums of money in bank accounts, most likely due to lack of spending opportunities and the inclination to hold on to the cash available during a time of crisis.

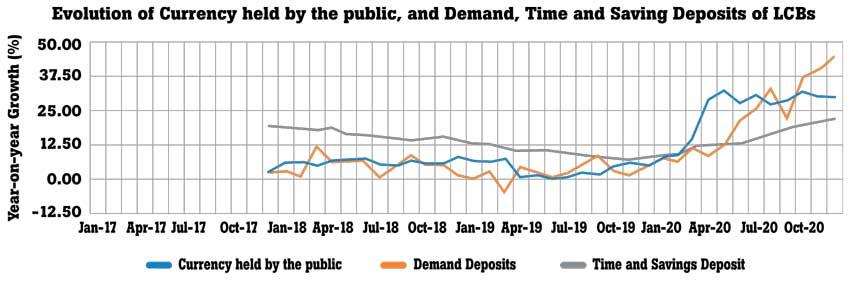

The data showed that both demand deposits and time & savings deposits began rising at record pace since March last year, while the build up of two deposit types accelerated from October through December as the second wave of COVID-19 lockdowns forced people again to shelter-in-place and economic activities to decelerate.

The demand deposits, which indicate how businesses manage their cash, started growing by as much as 37 percent, 40 percent and 44 percent during October, November and December from the same months in 2019.

This is an acceleration from 22 percent in September, a month prior to the October disruptions due to the second wave of COVID-19.

Data showed that the monthly growth in demand deposits have consistently remained below 10 percent, and mostly even below 5 percent until March last year.

Demand deposits in absolute terms grew by a massive Rs.174.7 billion from March through December, the most for a similar period in any year. During the whole of 2020, the demand deposits grew by Rs.164.9 billion.

Meanwhile, time & savings deposits, which demonstrate the money management of mostly the salaried population, recorded a similar trend, but on a higher scale. The growth in time & savings deposits, which remained relatively lacklustre till February 2020, started picking up from March by rising 11.5 percent year-on-year before gathering pace every month since then through December. During October, November and December moneys in such accounts grew by 19 percent, 21 percent and 22 percent respectively from the same months in 2019.

The data showed an inverse relationship between the piling up of time & savings deposits and restrictions on economic activities. The deposits rose when restrictions on economic activities were imposed and vice versa as people left most of their paychecks in bank accounts when they had only limited options to spend.

This is the beginning of a vicious economic cycle and that may be why the lockdowns are more damaging than the virus itself.

Time & savings deposits for the March-December period hit a whopping Rs.1.3 trillion and Rs.1.47 trillion for the full year.

In another interesting development, the currency held by the public also rose in tandem as the government spending accelerated starting from the beginning of the pandemic.

This can be seen from the sudden pick up in currency held by the public in March by 14.5 percent over the same period in 2019,which continued its ascent through the end of the year with December showing 29.7 percent growth over the same month in 2019.

The large increases in all three—currency in circulation, demand deposits and time & savings deposits—can also be understood by looking at the money supply in the economy as measured by the broad money or M2b, which rose to 23.4 percent in December 2020, from 7.0 percent a year ago.

20 Nov 2024 1 hours ago

20 Nov 2024 1 hours ago

20 Nov 2024 2 hours ago

20 Nov 2024 5 hours ago

19 Nov 2024 19 Nov 2024