30 Aug 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

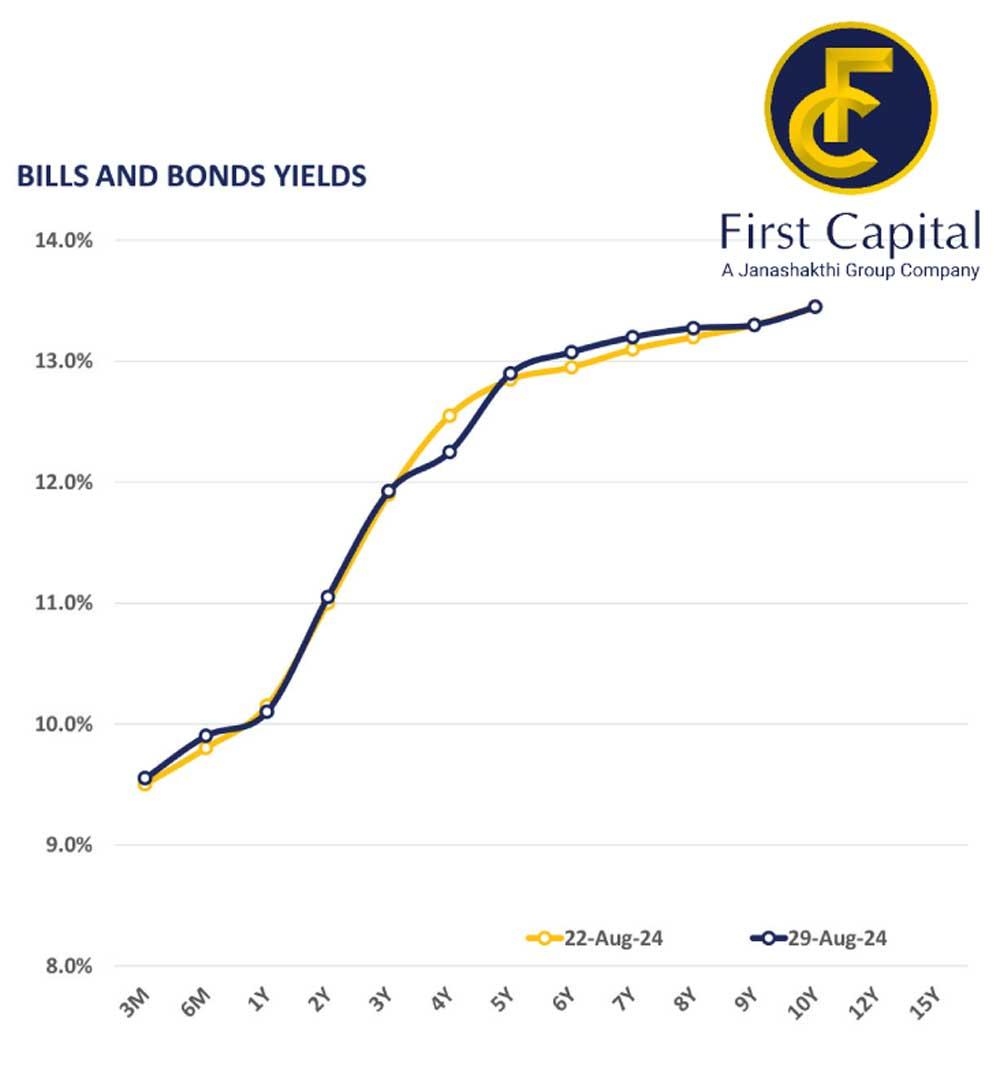

The secondary market yield curve experienced a modest increase yesterday compared to Wednesday’s closing levels, particularly on the short to mid tenors.

The uptick in yields was driven by persistent selling pressure as investors adopted a cautious approach in light of ongoing political uncertainties.

Amongst the traded maturities, short tenor bonds, such as the 01.06.26, traded at a yield of 11.00%. Mid-range tenors attracted notable investor interest, with 2028 maturities including 15.02.28, 15.03.28, and 01.07.28 trading at yields of 12.55%, 12.60%, and 12.80%-12.70%, respectively.

Limited trading activity was also observed in longer tenors, mainly 15.06.29 changed hands at a yield of 12.85%, 15.10.30 bond at 13.14%, and the 01.07.32 bond at 13.27%.

On the external side, LKR remained flat against the greenback closing strongly at Rs. 300.7. Meanwhile, on a YTD basis, LKR appreciated 7.2% against the USD, showcasing a robust overall performance despite recent fluctuations.

Also, the LKR experienced slight appreciation against other major currencies during the day, including AUD, GBP, and EUR. Notably, the overnight liquidity for the day recorded at Rs. 102.7bn, whilst CBSL holdings remained steady at Rs. 2,555.6bn.

25 Nov 2024 12 minute ago

25 Nov 2024 2 hours ago

25 Nov 2024 3 hours ago

25 Nov 2024 3 hours ago

25 Nov 2024 3 hours ago