29 Apr 2022 - {{hitsCtrl.values.hits}}

First Capital Research (FCR) this week said the bond yields might have found their peak by now and could stabilise from the next quarter, potentially leaving behind the worst of the economic crisis by the end of the first half of this year, which would restore debt and other foreign currency inflows.

Nevertheless, FCR analysts said any alleviation of stresses is highly contingent on the faster resolution of the political deadlock, which impedes progress on debt restructuring along with a potential International Monetary Fund (IMF)-backed rescue package, which would put the country back on a path towards macroeconomic stability.

The FCR outlook is the most soothing to the bond markets and broader economy, which came in at least since the second half of last year, when the current ascent in bond yields first began in tandem with the inflation and foreign currency crunch.

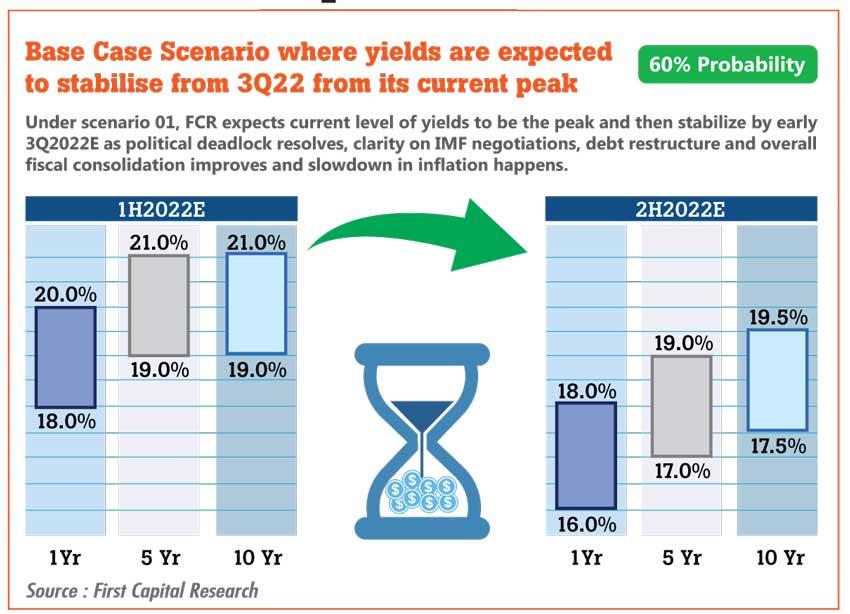

In its base-case scenario, where FCR assigns 60 percent probability, it says, “expect political deadlock to be resolved in 2Q2022E and the IMF negotiations and debt restructuring to be succeeded, thus improving the outlook for Sri Lanka, resulting in a dip in bond yields by 3Q2022E”.

After a sharp correction in the most immediate primary bill auction held following the 700-basis point hike in key policy rates by the Central Bank on April 8, the bill yields moderated in the following two weeks, likely signalling greater stability.

In fact, while the most favoured three-month bill yield budged only a very little at this week’s auction, the benchmark one-year bill yield and six-month yield retreated from their April 11 peaks.

However, it is too soon to be seen whether the bond yields have peaked or have more room to run their course, as the inflation is running hotter than ever Sri Lanka has seen, plunging the living standards of majority lower and middle-income-class families.

FCR doesn’t think that the Central Bank would strike again after an unprecedented hike earlier this month. Under its base-case scenario, it expects the current key policy rates to stay through the year.

As a result, it projected the one-year bill yield to peak in a range of 18.0 to 20.0 percent in 1H22 before easing further to between 16.0 to 18.0 percent in the 2H22.

“Considering the current conditions, we expect a base-case scenario to occur with a 60 percent probability, thus improving the outlook for Sri Lanka by 3Q2022E,” FCR said.

“Accordingly, yields are likely to fall faster, a trend that could continue towards 3Q2022, depending on the timing of developments that reduce uncertainty,” it added.

FCR typically has a very good track record of accurately predicting the monetary policy moves and behaviour in the fixed-income yields most of the times and its Head of Research Dimantha Mathews a few weeks ago predicted with higher accuracy the sharp policy rate hike on April 8.

However, despite some easing forecasted in the bond yields, the lending rates aren’t going to budge anytime soon and the interest rates cycle could run stronger before any moderation could be witnessed.

This is because FCR puts the Average Weighted Prime Lending Rate in a rage of 16.0 to 18.0 percent by the end of 1H 22, further rising to 18.0 to 22.0 percent by the year end, closely following the path of five-year bond yield.

Further, the dollar/rupee rate, which has been on a free fall since March 7 float, is forecasted to remain in a wide range between Rs.300.00 to 380.00 to a dollar by 1H22, before easing to a range of Rs.290.00 to Rs.320.00 by December 2022.

“Based on the clarity on the country’s economic progress in the midst of debt restructuring and the IMF negotiations, foreign inflows are gradually expected to flow into the country supporting a gradual appreciation by Dec-22,” FCR said.

Meanwhile, in its worst-case scenario, where FCR assigned a 40 percent probability, it expects the yields to continue rising through 2Q22, before stabilising in 3Q22. Under this scenario, FCR expects the Central Bank to further tighten monetary policy amid prolonged political standoff.

15 Nov 2024 23 minute ago

15 Nov 2024 52 minute ago

15 Nov 2024 53 minute ago

15 Nov 2024 1 hours ago

15 Nov 2024 1 hours ago