12 Jun 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

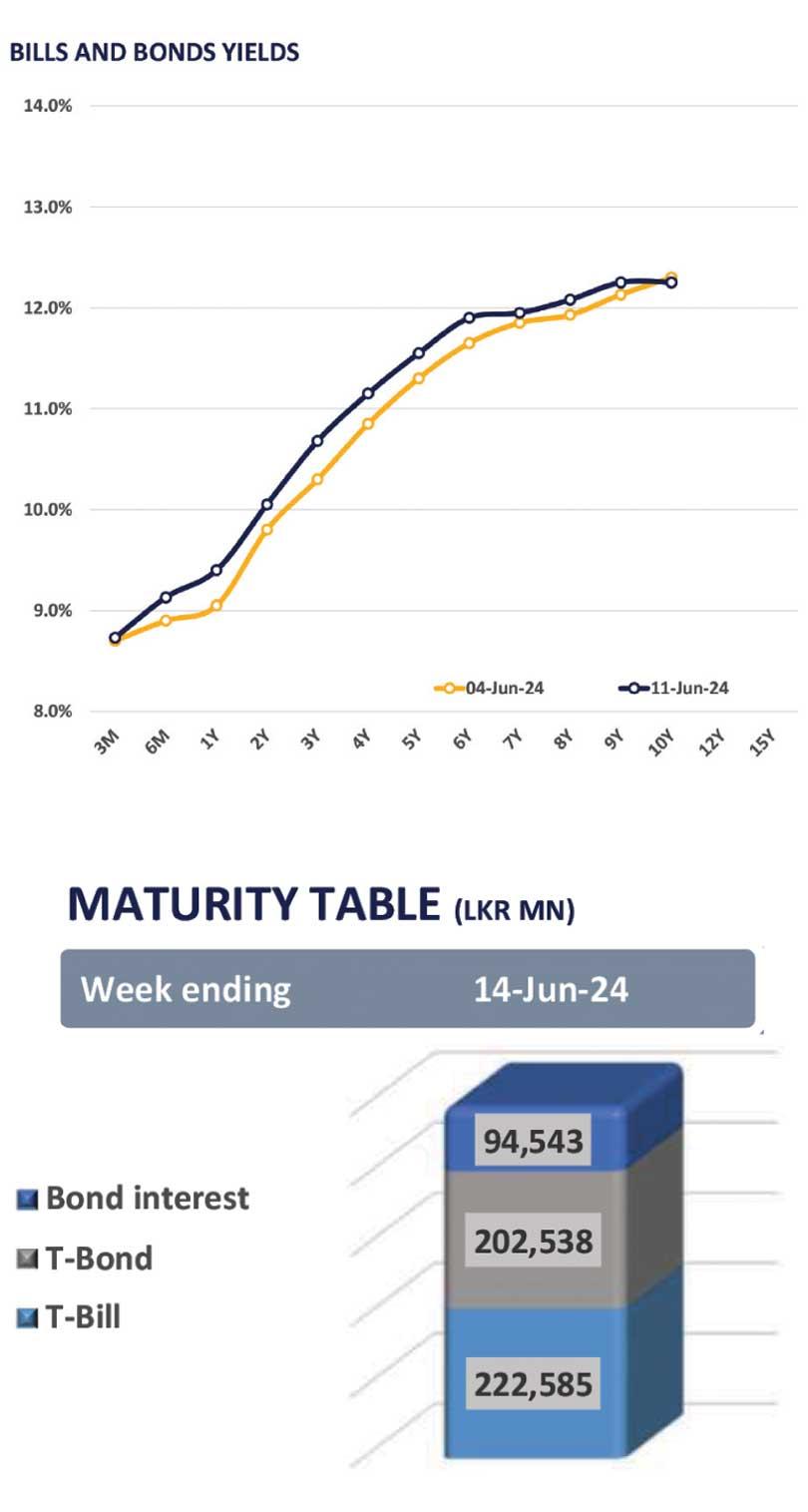

The secondary market witnessed moderate volumes resulting in bond yield across the board to surge during yesterday as a result of the Rs. 295.0 billion treasury bond announcement on Monday, pivoting from the wait and see approach displayed during the previous session due to the surrounding uncertainty regarding the IMF review which is scheduled for the 12th Jun-24.

Moreover, liquid maturities enticed trades during the day namely, 01.07.25 traded at 9.80%, 15.05.26 traded at 10.05%, 15.12.26 traded at 10.15% and 15.09.27 traded at 10.75%.

Furthermore, towards the mid end of the curve 15.01.28 along with 15.03.28 tenors traded at 11.00%, 01.05.28 traded at 11.10% while 01.09.28 traded at 11.25%.

Towards the long end of the curve 15.05.30 and 01.10.32 tenors changed hands at 11.90% and 12.12%, respectively. On the external side LKR slightly depreciated against the USD recording at Rs. 303.0.

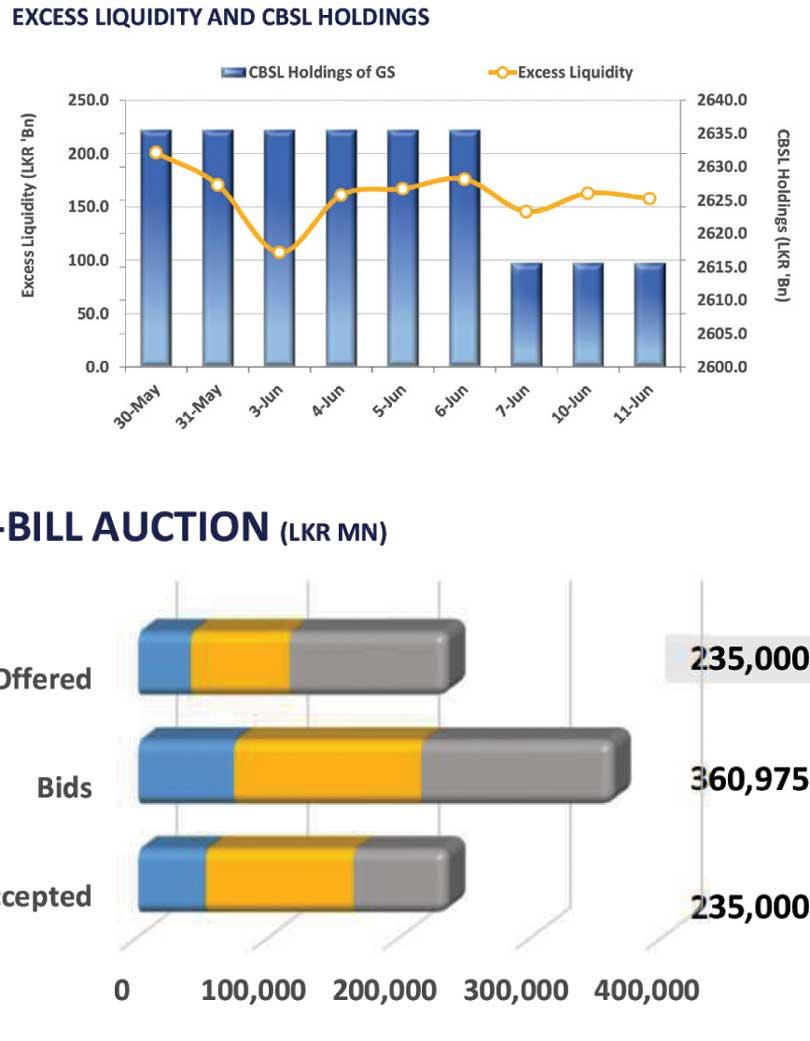

Overnight liquidity registered at Rs. 157.8 billion whilst CBSL Holdings remained stagnant at Rs. 2,615.6.

27 Nov 2024 4 hours ago

27 Nov 2024 5 hours ago

27 Nov 2024 5 hours ago

27 Nov 2024 6 hours ago

27 Nov 2024 6 hours ago