17 May 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

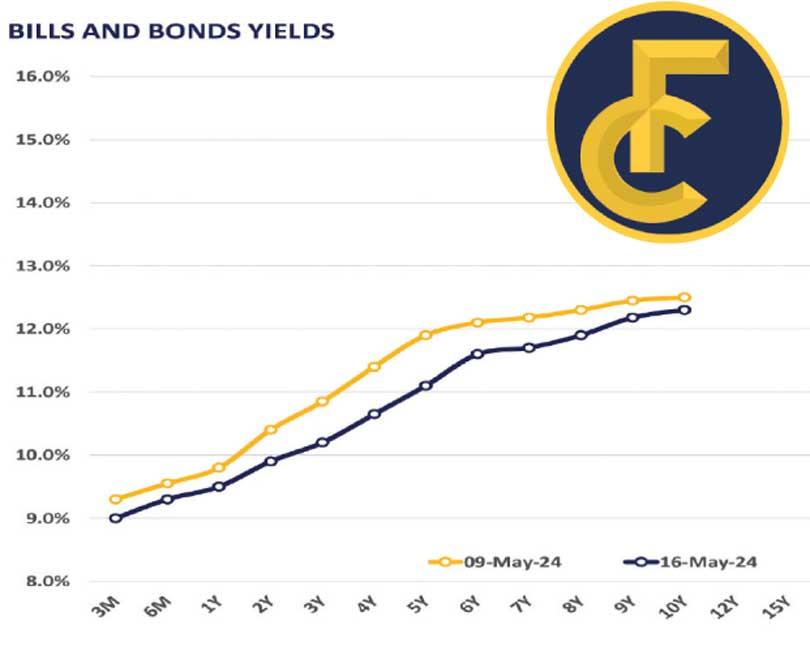

After a sustained bullish trend, profit-taking emerged in the secondary bond market, resulting in selling pressure across short to mid tenors.

As a result, yields closed slightly higher than the previous day. Notably, 2026 maturities such as 01.02.26 and 15.12.26 traded at 10.00% and 10.10% respectively, while 15.05.26 traded between 10.05%-10.00%.

Additionally, 15.09.27 changed hands between 10.40%-10.25%, and 2028 maturities including 15.03.28, 01.05.28, and 01.07.28 traded in the range of 10.75%-10.60%, 10.80%-10.70%, and 10.90%-10.70% respectively.

Meanwhile, on the mid-end of the curve, trades were witnessed on 01.10.32, with yields ranging between 11.90%-11.80%. On the external side, LKR depreciated against the greenback for the 4th consecutive day, closing at Rs. 302.25/USD.

28 Nov 2024 8 minute ago

28 Nov 2024 28 minute ago

28 Nov 2024 2 hours ago

28 Nov 2024 3 hours ago

28 Nov 2024 3 hours ago