09 Jul 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary bond market saw mixed activities during the day although the overall market witnessed limited activities with thin volumes.

The secondary bond market saw mixed activities during the day although the overall market witnessed limited activities with thin volumes.

The market participants adopted a cautious stance, awaiting clear signals regarding the interest rate movements in the wake of the recently concluded external debt restructuring agreement with the ISB holders.

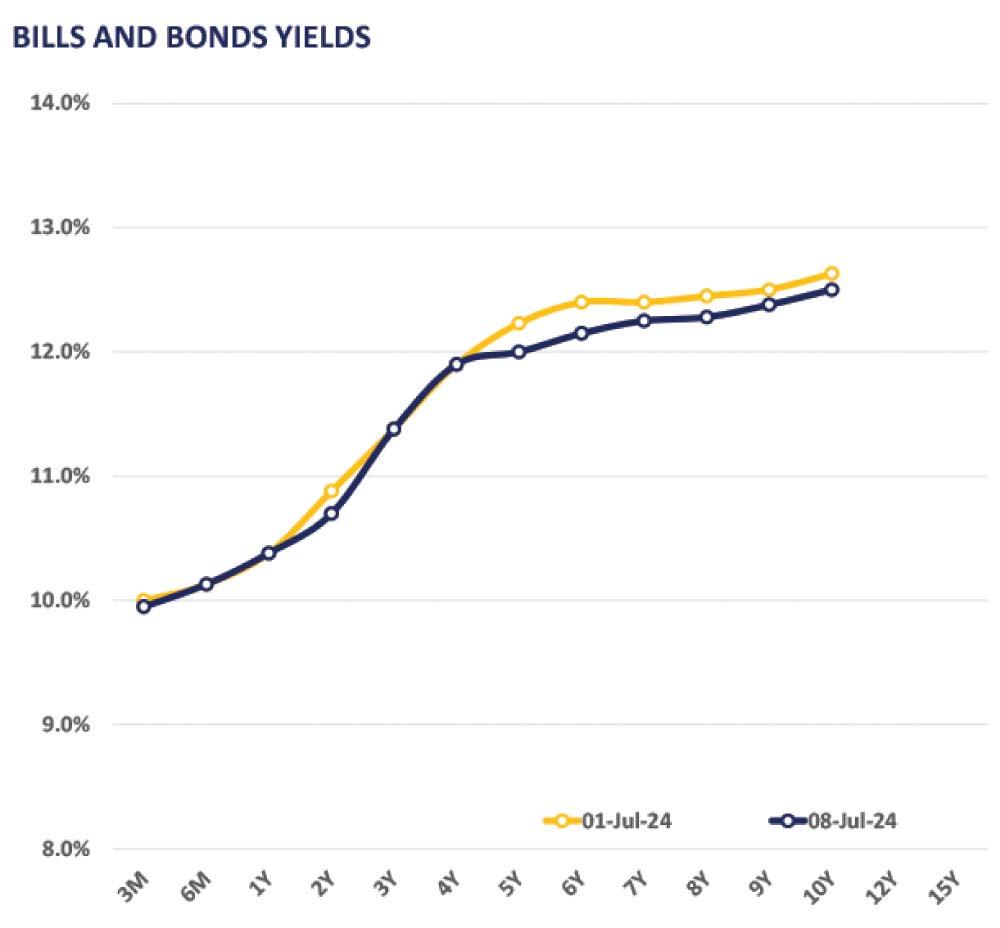

Among the traded maturities, the short-term bills maturing in less than three months were quoted between 9.70 percent and 9.91 percent while the mid tenure 15.09.29 traded between 12.00 percent and 12.03 percent.

Moreover, in the forex market, the Sri Lankan rupee experienced a slight depreciation against the US dollar, settling at Rs.304.9.

Moreover, overnight liquidity for the day was recorded at Rs.125.4 billion while the Central Bank holdings remained steady at Rs.2,595.6 billion.

During the week ending July 5, 2024, the AWPLR witnessed a surge of 26 basis points after five weeks of downturn and concluded the week at 9.04 percent.

Moreover, foreign holdings in government securities decreased by 14.5 percent week-on-week and registered at Rs.53.1 billion as of July 4, 2024.

Furthermore, foreign reserves inched up by US $ 232.0 million to US $ 5,642.0 million in June 2024, from US $ 5,410.0 million in May 2024. Notably, the aggregate reserves include proceeds from the swap with People’s Bank of China amounted to US $ 1,400 million.

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024