24 Jan 2020 - {{hitsCtrl.values.hits}}

The Colombo Stock Exchange (CSE) is among the worst performing frontier markets, but a leading equity research analyst said all indications favour a rebound and the forthcoming general election would stoke further upward momentum. First Capital Head of Research Dimantha Mathew said Sri Lankan stocks offer a once in a decade opportunity for buyers as valuations remain extremely attractive.

“I would say the attractiveness of the market is once in a decade opportunity,” Mathews said.

He said the easing interest rates would gradually drive the stocks to a bull run, which could receive a further tailwind from the forthcoming general election.

Nevertheless he is of the belief that interest rates could start rising from the second half of the year with fiscal loosening starting to bite government finances. CSE has seen net foreign outflow of Rs.1.4 billion worth of equities and the market witnessed nearly Rs.100 billion of its value being wiped out during the first 20 days of 2020.

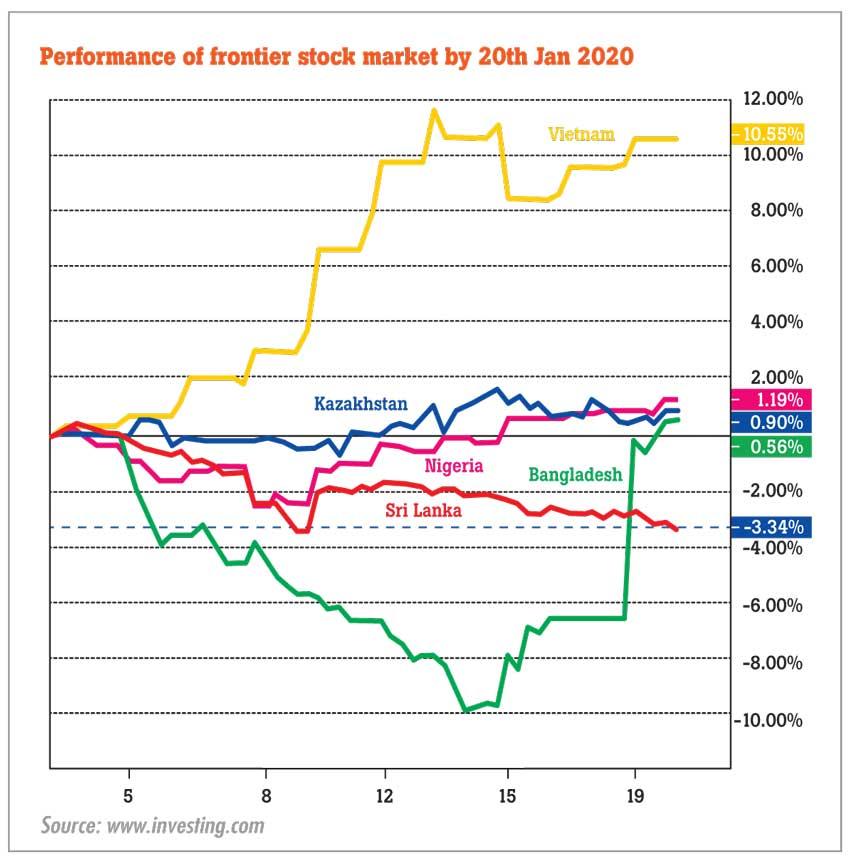

“Sri Lanka All Share Price Index (ASPI) slid more than 3 percent so far this year. Foreign investors continue to pull out from the stock market,” said Sanjeewa Dayaratne, a statistical data analyst, who closely watches daily stock index moves.

The performance during the first 20 days of the ASPI is also the worst among frontier markets— Vietnam, Kazakhstan, Nigeria, and Bangladesh.

On Monday, stockbrokers met Prime Minister Mahinda Rajapaksa in a bid to persuade the government to intervene in reversing the fortunes of the market, which has got into a tailspin.

The stockbrokers had asked for government captive funds such as Employees’ Provident Fund (EPF) and Employees’ Trust Fund (ETF) to return to market in a big way to uplift market sentiment and valuations of the stocks.

After a nearly four-year hiatus, EPF returned to the stock market last year buying Dialog Axiata PLC shares and has since accumulated shares of fundamentally

strong counters.

EPF’s stock market returns have been negative and were subject to frequent criticism by Opposition legislators prior to 2015.

However, EPF’s role in the bond scams that took place in 2015 and 2016 made the Central Bank to completely keep the pension fund away from the market for good three years.

According to Nishan De Mel, the Executive Director of Verite Research, an independent policy think tank, EPF had performed extremely poorly in the stock market since 2009 with returns lagging behind 5 percent when the general market returns were over 100 percent during the peak 2010-2011 period.

Speaking to the media early this week, De Mel charged that even at present, EPF’s marked-to-market losses are over Rs.23 billion and that’s after impairment or recognized losses of over Rs.8.0 billion as a result of equity investments which EPF had made without due process.

He also charged that EPF had routinely delayed its annual reports by at least two years. As a result, he said when the problems were discovered, the remedial actions were of little effect.

16 Nov 2024 15 minute ago

16 Nov 2024 47 minute ago

15 Nov 2024 15 Nov 2024

15 Nov 2024 15 Nov 2024

15 Nov 2024 15 Nov 2024