27 Sep 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

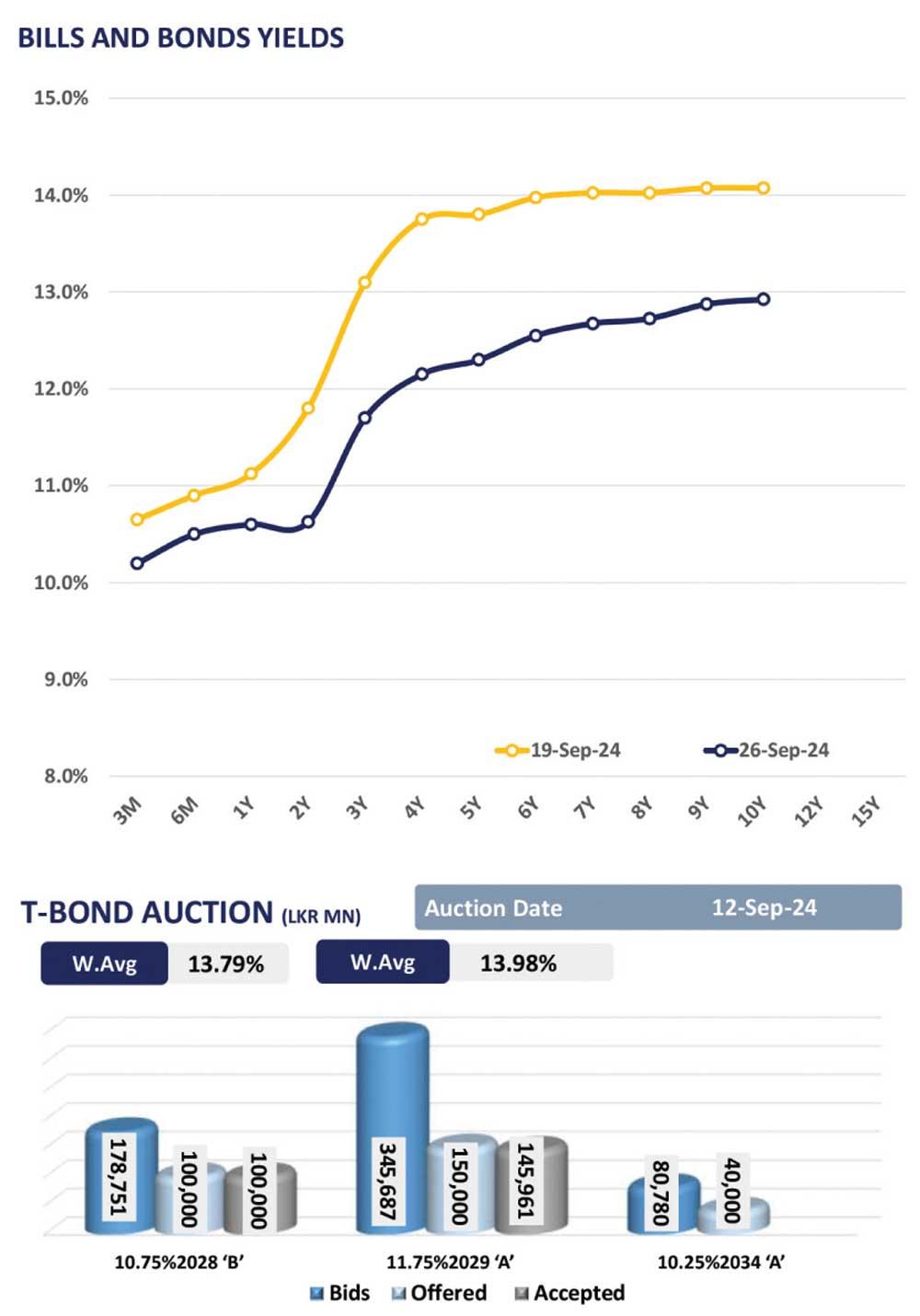

The secondary market continued its bullish buying trend from previous sessions yesterday, driven by high trading volumes ahead of the monetary policy review announcement set for today (27th Sep 2024). This surge in activity contributed to enhanced market sentiment, with significant volumes being traded throughout the day.

Among the traded maturities liquid tenors 2026, 2027, 2028 and 2029 enticed transactions during the day, namely, 01.02.26, 15.05.26, 01.06.26, 15.12.26 maturities traded between the range of 10.80% - 10.30%. 01.05.27, 15.09.27 and 15.12.27 traded between the range of 11.80%- 11.50%. 15.02.28, 15.03.28 and 01.07.28 traded between the range of 12.30% - 12.00%.

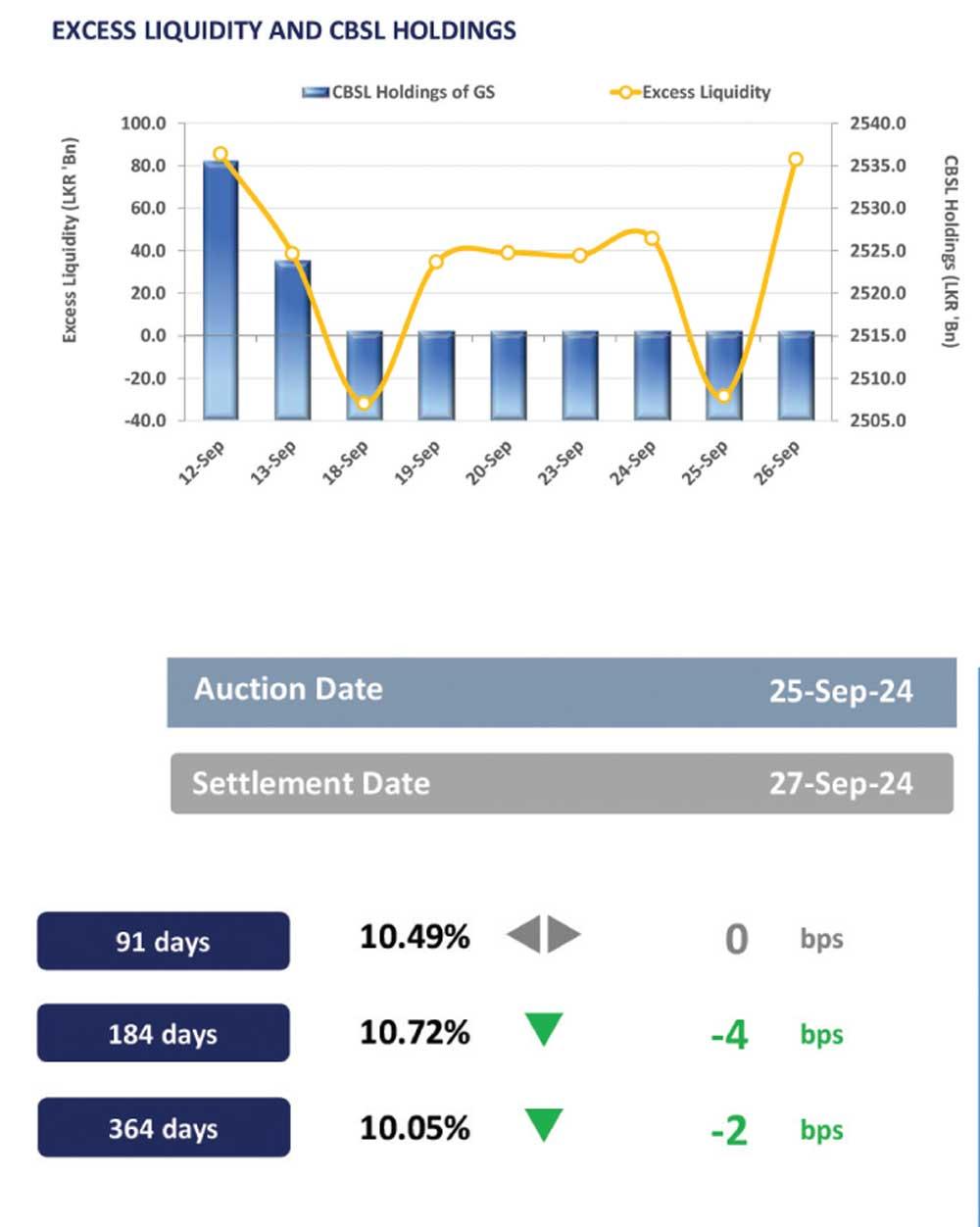

Furthermore, 15.06.29 and 15.09.29 traded at 12.50% - 12.15%. Towards the long end 15.05.30 and 15.10.30 maturities traded at 12.50%. Overnight liquidity increased during the day recording at Rs. 83.0bn whilst CBSL holdings remained stagnant at Rs. 2,515.6bn. On the external side LKR appreciated during the day as it was recorded at Rs. 301.76 compared to Rs. 303.91 recorded during the previous day.

10 Jan 2025 43 minute ago

10 Jan 2025 48 minute ago

10 Jan 2025 2 hours ago

10 Jan 2025 2 hours ago

10 Jan 2025 2 hours ago