03 May 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

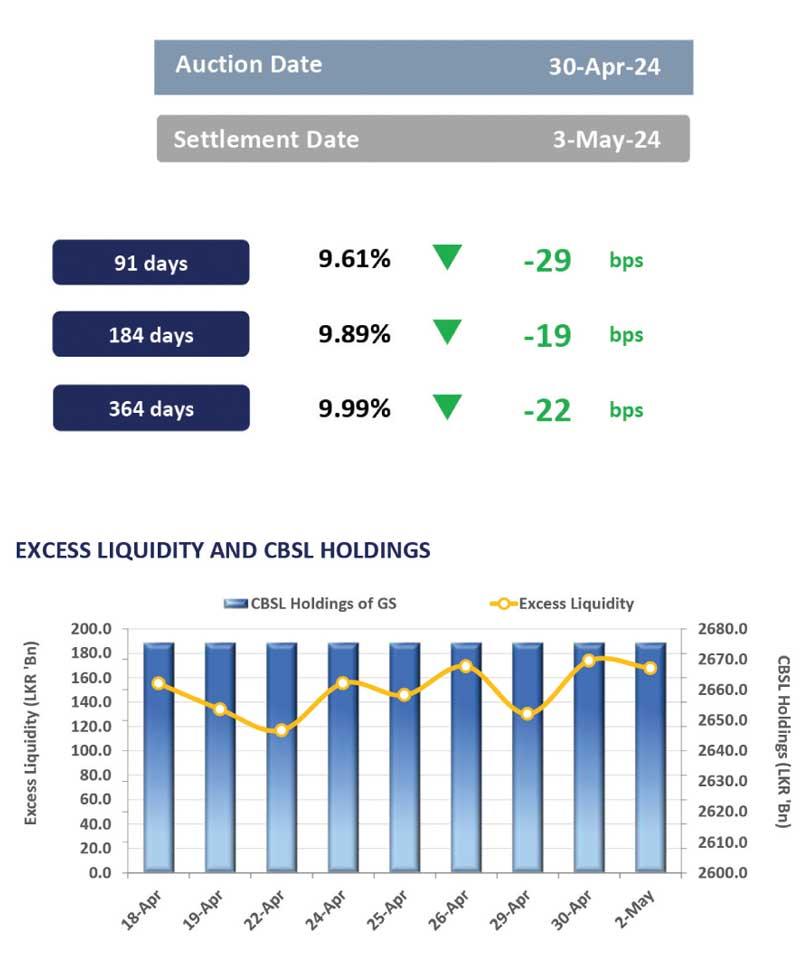

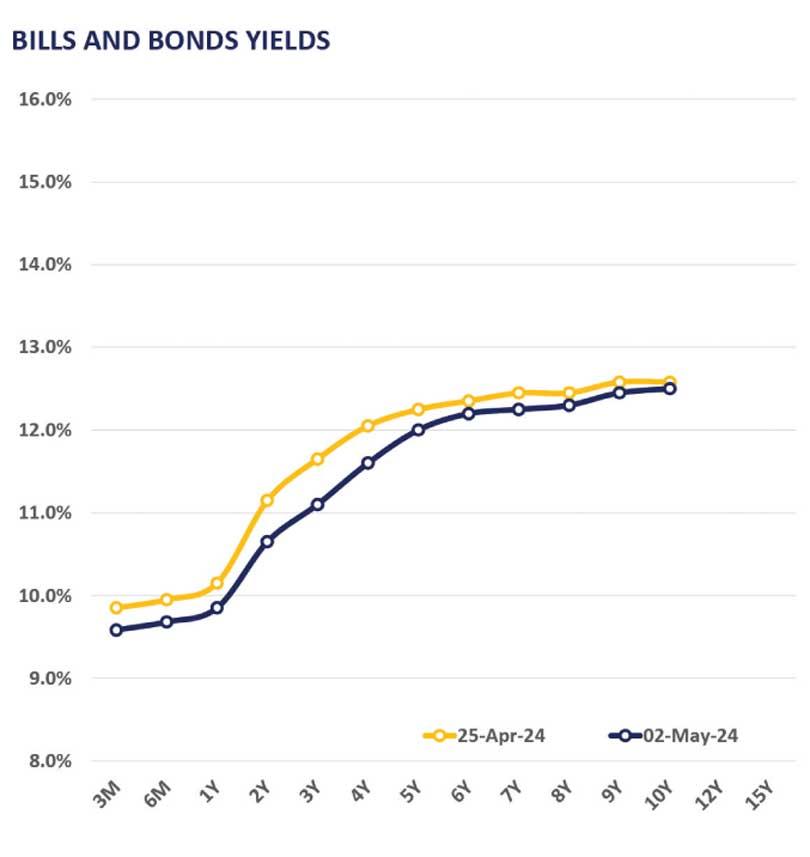

The yield curved nudged further down as the secondary market continued to see buying interest for the 5th consecutive session amidst positive investor sentiment while volumes were on moderate levels.

On the short end of the curve, 01.02.2026 closed transactions at 10.40 percent.

Further, 15.05.2026, 01.06.2026 and 15.12.2026 hovered between 10.85-10.70 percent.

Meanwhile, liquid maturities 2027 and 2028 too enticed interest at today’s session. Accordingly, 15.09.2027 and 01.05.2027 traded between 11.20-11.10 percent while on 2028 tenor; 15.01.2028, 15.03.2028, 01.07.2028 and 15.12.2028 hovered within a range of 11.70-11.50 percent.

On the long end, 15.05.2030 changed hands between 12.25-12.15 percent whilst 01.10.2032 traded between 12.35-12.30 percent.

In terms of forex movement, LKR depreciated against the greenback closing at R 297.6. On the macro environment, there was a slight increase in headline inflation for Apr-24, with YoY CCPI rising to 1.5 percent, up from 0.9 percent in Mar-24.

28 Nov 2024 4 hours ago

28 Nov 2024 5 hours ago

28 Nov 2024 6 hours ago

28 Nov 2024 7 hours ago

28 Nov 2024 8 hours ago