30 Apr 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

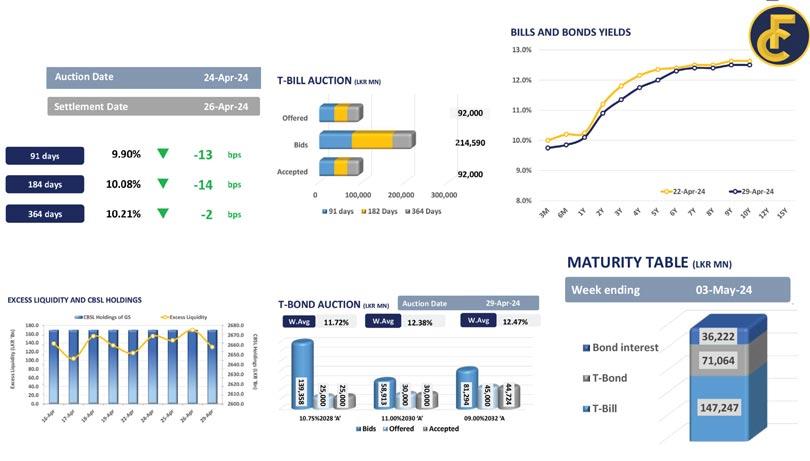

The secondary market witnessed heavy buying interest at yesterday’s session, resulting in a dip in the yield curve, following the T-bond auction held yesterday.

The buying appetite centred largely on the belly of the curve with liquid tenures 2026, 2027 and 2028 observing higher trades.

Accordingly, 15.05.2026, 01.06.2026, 01.08.2026 and 15.12.2026 hovered between 11.15 percent and 10.90 percent. Further, on the 2027 tenure, 01.05.2027 and 15.09.2027 traded between 11.60 percent and 11.30 percent.

Also, on the 2028 tenure, 15.01.2028, 15.03.2028, 01.05.2028, 01.07.2028 and lastly 15.12.2028 closed trades between 11.95 percent and 11.60 percent during the day amidst the heavy bullish sentiment.

Meanwhile, at yesterday’s T-bond auction, there was an acceptance rate of 99.7 percent out of the total offered of Rs.100.0 billion, with the total offered being fully accepted from 15.03.2028 and 15.05.2030 whilst 99.4 percent was accepted from the 01.10.2032 maturity.

Accordingly, 15.03.2028 and 15.05.2030 closed at a WAYR of 11.72 percent and 12.38 percent, respectively, whilst 01.10.2032 registered at a WAYR of 12.47 percent.

Meanwhile, on the external side, the Sri Lankan rupee appreciated against the greenback closing at Rs.296.2.

28 Nov 2024 6 hours ago

28 Nov 2024 7 hours ago

28 Nov 2024 8 hours ago

28 Nov 2024 9 hours ago

28 Nov 2024 28 Nov 2024