22 Oct 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

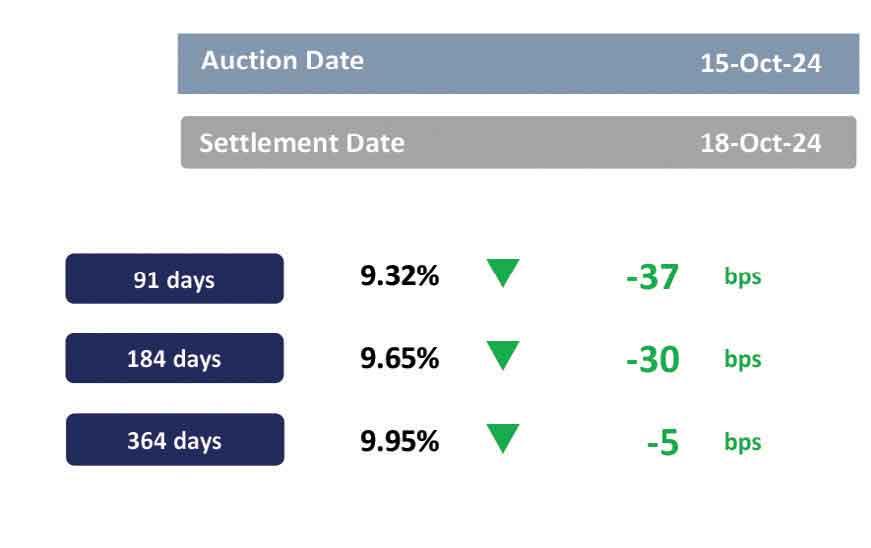

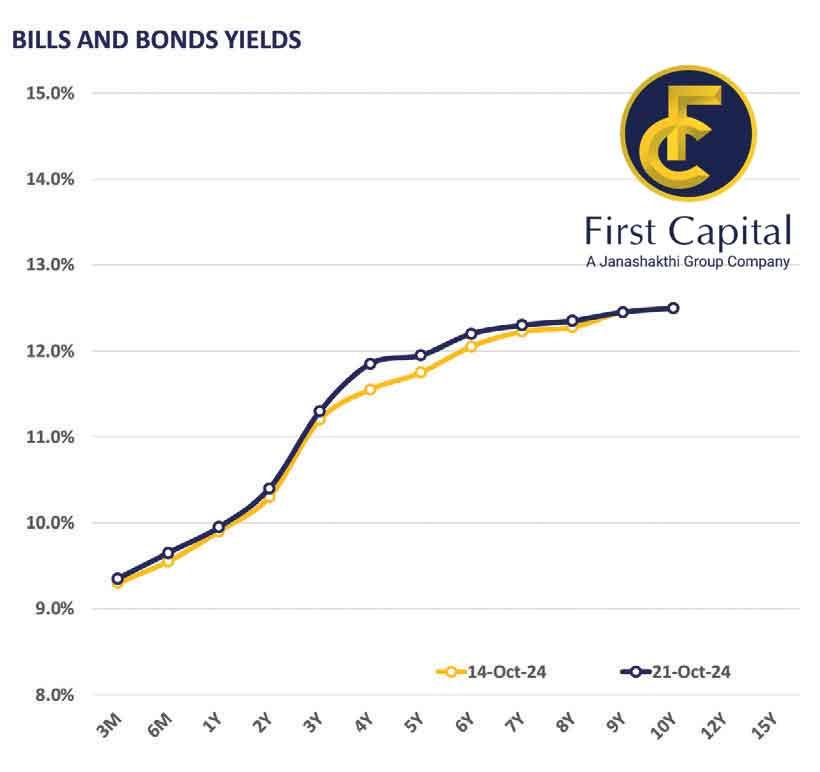

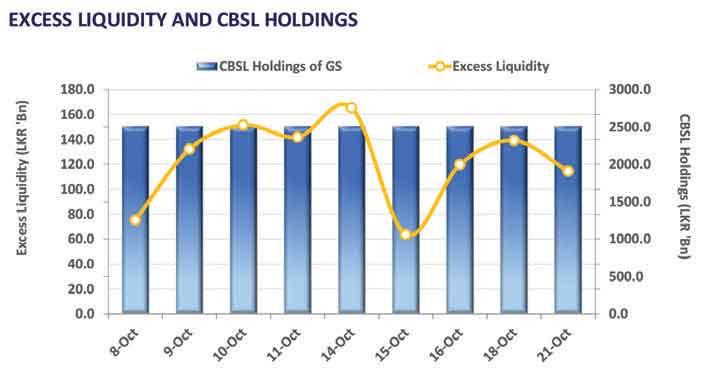

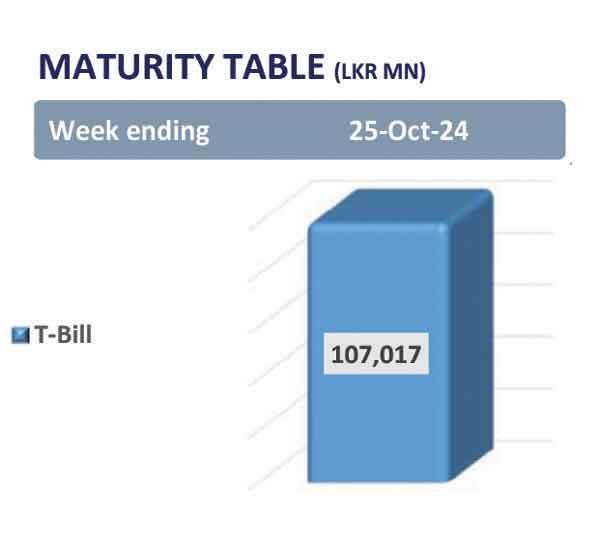

The bullish sentiment in the secondary market moderated slightly yesterday, marked by marginal profit-taking and notably thin trading volumes, in anticipation of the upcoming Rs.125.0 billion T-bill auction slated for October 23, 2024. Consequently, the three-year tenures, including 15.09.27 and 15.12.27, traded within the range of 11.35 percent-11.45 percent. Similarly, the four-year tenures such as 15.03.28, traded within the 11.73 percent-11.82 percent band, while the 01.07.28 tenure settled at 11.80 percent. Notably, the 01.10.32 maturity closed trades at 12.35 percent. The AWPR for the week ending October 18, 2024, declined by 15bps, registering at 9.10 percent, compared to the previous week’s closing of 9.25 percent. Moreover, the foreign holdings in government securities slightly increased by 1.0 percent week-on-week, registering at Rs.51.1 billion as of October 16, 2024. Consequently, the foreign holding percentage remained stagnant at 0.3 percent over the week. Meanwhile, the overnight liquidity for the day slightly declined to Rs.114.5 billion, whilst the Central Bank holdings remained stagnant at Rs.2,515.6 billion. Furthermore, in the forex market, the Sri Lankan rupee continued to slightly appreciate against the US dollar for the second consecutive session, closing at Rs.292.9 for the day. During the year up to October 18, 2024, the Sri Lankan rupee has appreciated by 10.6 percent against the US dollar, reflecting a strong overall performance for the year.

28 Dec 2024 8 hours ago

28 Dec 2024 9 hours ago

28 Dec 2024 28 Dec 2024

28 Dec 2024 28 Dec 2024

28 Dec 2024 28 Dec 2024