11 Dec 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market yesterday saw a pre-auction buzz with significant buying interest with moderate trading volumes in short to mid-term maturities, where 2027, 2028, 2029 and 2030 maturities took the center stage.

The secondary market yesterday saw a pre-auction buzz with significant buying interest with moderate trading volumes in short to mid-term maturities, where 2027, 2028, 2029 and 2030 maturities took the center stage.

On the short end of the curve, 15.10.27, 15.12.27traded between 10.10% to 9.95% whilst on the belly end of the curve, 15.02.28, and 15.03.28 traded between 10.45% to 10.38%, respectively.

However, 01.05. 28 and 01.07.28 traded between the range of 10.60% to 10.45% and 15.10.28 traded at a rate of 10.60%. On the belly end of the curve 15.09.29 traded between 10.90% to 10.85% and 15.05.30 traded between the range of 11.05% to 11.07%.

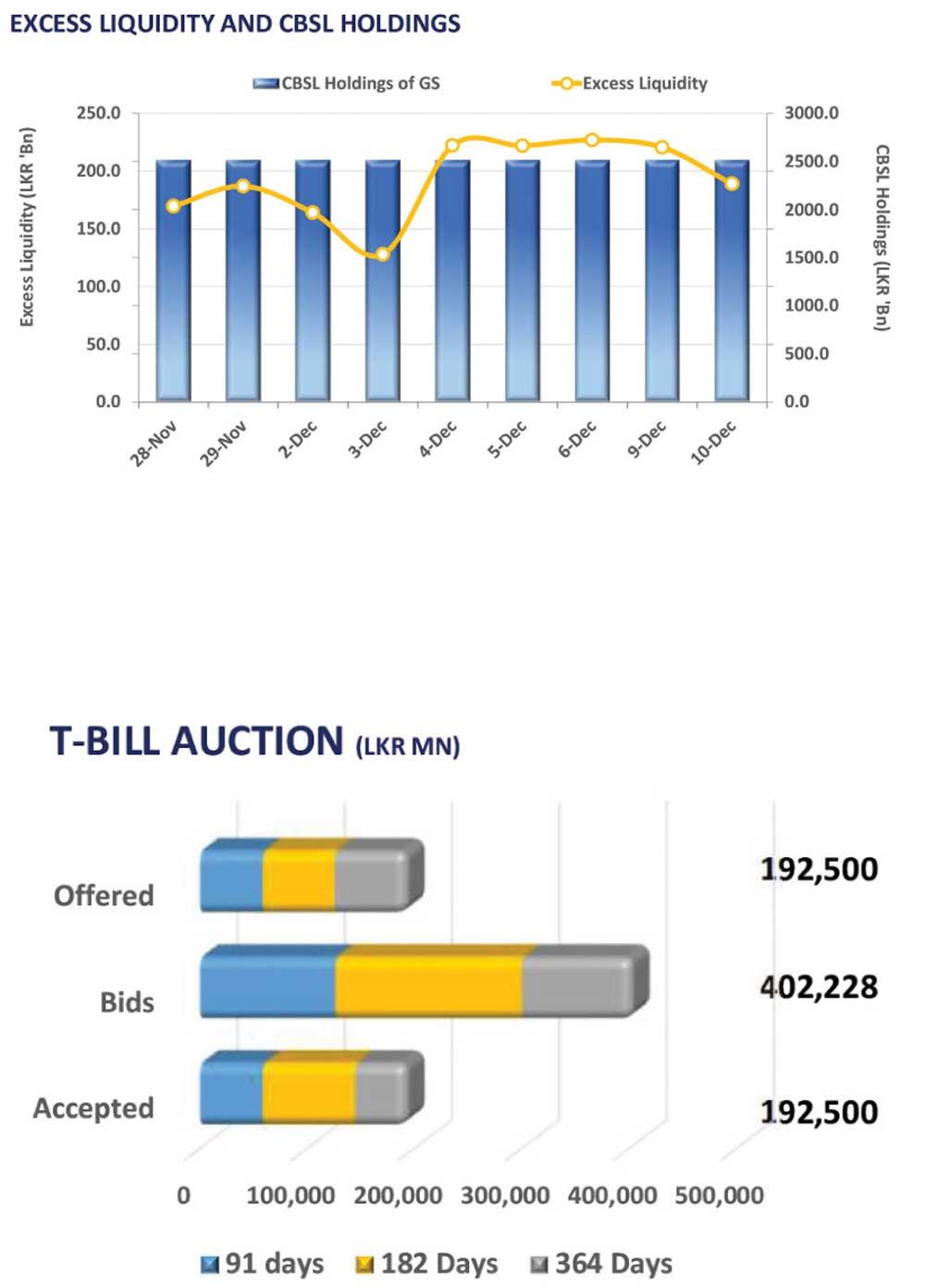

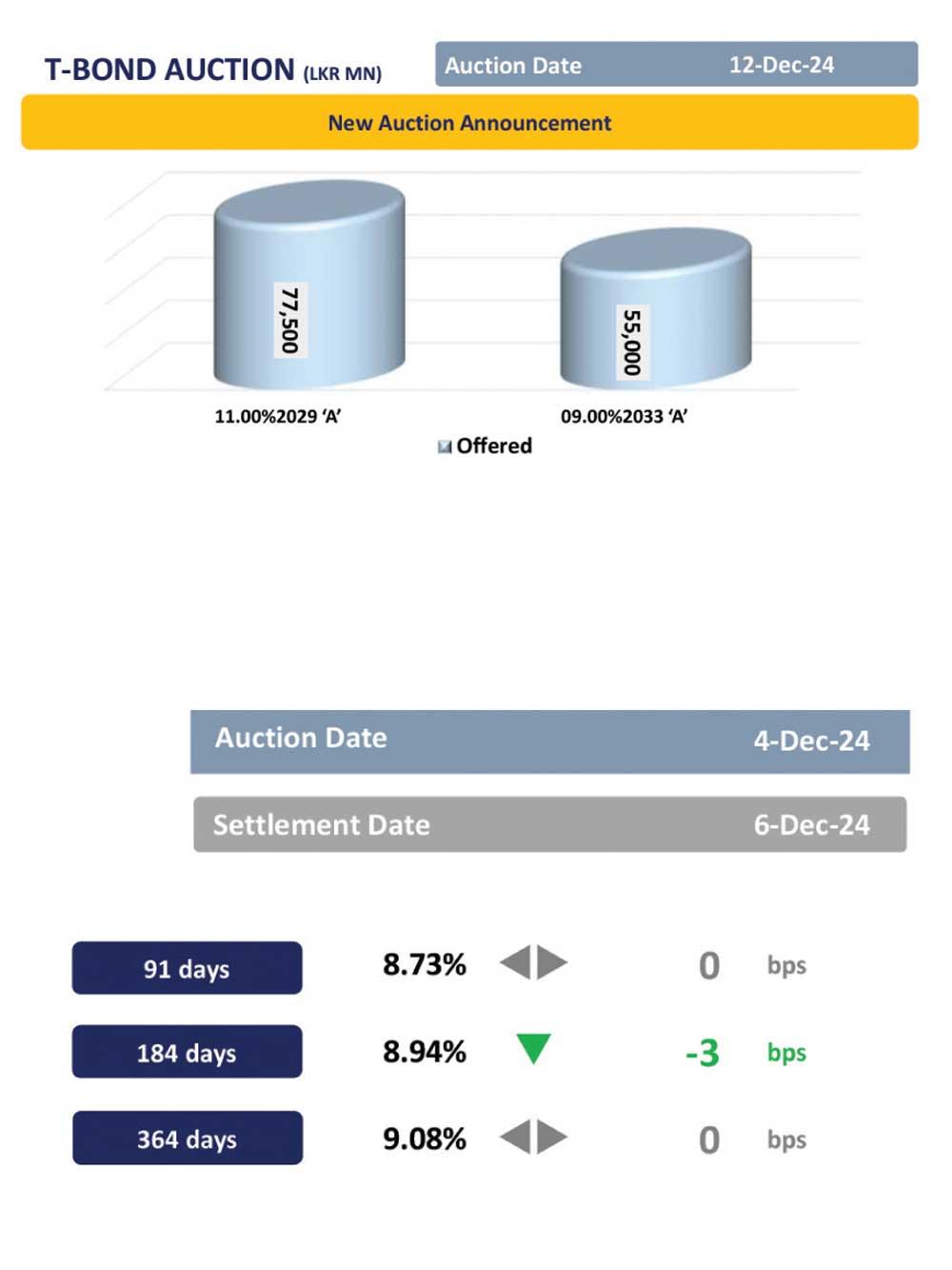

During the week ending 6th Dec-24, the AWPLR continued its downward trajectory, experiencing a decline of 1bps to 9.09%. Moreover, foreign holdings in government securities increased by 16.7% WoW and registered at Rs. 68.1bn as of 5th Nov-24.

Meanwhile, on the external front, the LKR depreciated slightly against the USD, closing at Rs. 290.36/USD, compared to Rs. 290.34/USD recorded the previous day.

Additionally, the LKR depreciated against other major currencies including the GBP, EUR, CNY, and AUD. CBSL holdings of government securities remained unchanged, closing at Rs. 2,515.62bn yesterday. Overnight liquidity in the banking system further contracted to Rs. 188.91bn from Rs. 220.43bn recorded the previous day.

22 Dec 2024 7 hours ago

22 Dec 2024 7 hours ago

22 Dec 2024 22 Dec 2024

22 Dec 2024 22 Dec 2024

22 Dec 2024 22 Dec 2024