29 Nov 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market yield curve experienced significant buying interest and heightened demand for traded maturities yesterday. Overall volumes remained moderate as buying sentiment persisted amidst the release of auction results.

The secondary market yield curve experienced significant buying interest and heightened demand for traded maturities yesterday. Overall volumes remained moderate as buying sentiment persisted amidst the release of auction results.

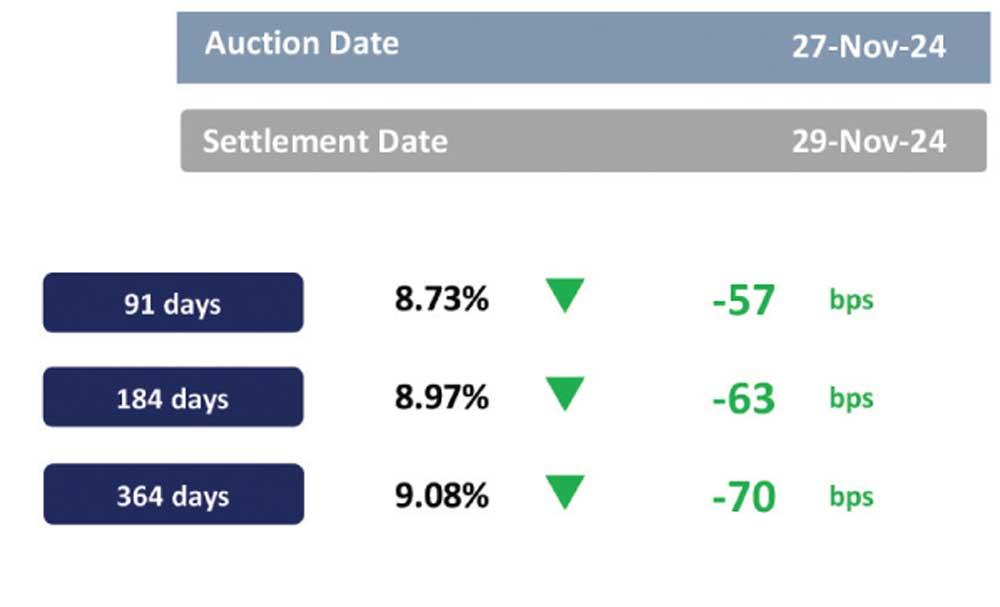

Yesterday’s bond auction saw increased levels of demand and buying interest as the CBSL raised Rs. 205.0bn, yielding full acceptance across all three maturities offered. The 15.10.2028 maturity closed at a weighted average yield rate of 10.62% with Rs. 80.0bn being fully accepted, whilst the 15.03.2031 maturity closed at a weighted average yield rate of 11.28% with Rs. 75.0bn being fully accepted.

Similarly, the 01.11.2033 maturity closed at a weighted average yield rate of 11.40%, with Rs. 50.0bn being fully accepted.

Additionally, the secondary market yield saw notable interest amongst traded maturities, primarily amongst the 2027, 2028, 2029, 2030, and 2033 maturities.

Following the auction results, on the short end of the curve, 15.12.27 traded at a rate of 10.30%. On the belly end of the curve, 15.03.28, 01.05.28, 15.10.28, and 15.12.28 were seen trading at rates of 10.40%, 10.45%, 10.55%, and 10.60%.

On the long end of the curve, 15.09.29 and 01.12.31 traded at rates 10.75% and 11.30%.

Meanwhile, on the external front, the LKR remained stable against the USD, closing at Rs. 291.09/USD, compared to LKR 291.15/USD recorded the previous day. CBSL holdings of government securities remained unchanged, closing at Rs. 2,515.62bn yesterday. Overnight liquidity in the banking system contracted to Rs. 169.56bn from Rs. 181.71bn recorded the previous day.

23 Dec 2024 44 minute ago

23 Dec 2024 2 hours ago

23 Dec 2024 5 hours ago

23 Dec 2024 6 hours ago