17 Dec 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

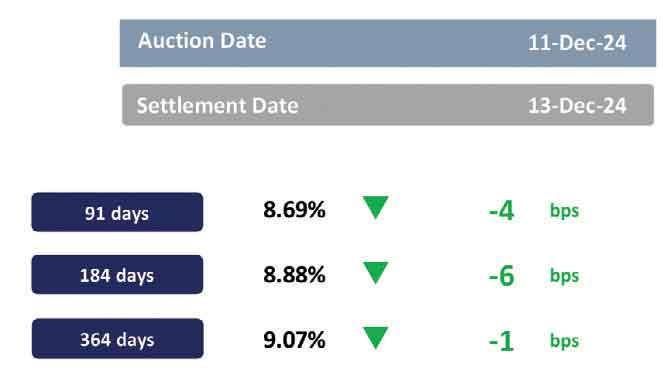

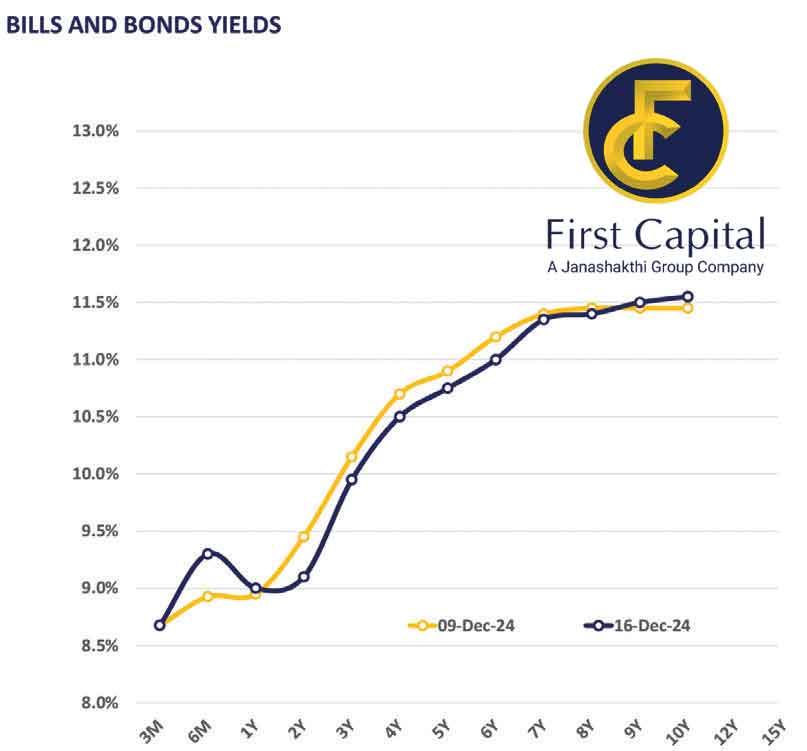

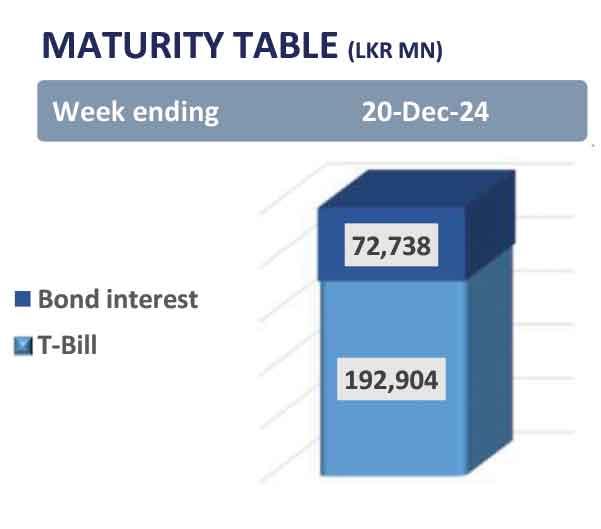

The secondary market yield curve witnessed thin trading volumes and limited activity. Buying interest was experienced primarily on the mid end of the curve, ahead of the upcoming T-bill auction scheduled to be held on December 18, 2024, which will offer Rs.185.0 billion, out of which Rs.65.0 billion is to be raised for the 91-day maturity, Rs.75.0 billion is to be raised for the 182-day maturity and Rs.45.0 billion is to be raised for the 364-day maturity. Notable trades were primarily amongst the 2028 maturities. On the belly end of the curve, 15.03.28, 01.05.28, and 01.07.28 were seen trading between rates of 10.25 percent and 10.20 percent and 10.30 percent and 10.40 percent, respectively.

Meanwhile, on the external front, the Sri Lankan rupee depreciated against the US dollar, closing at 290.32/US dollar, compared to Rs.290.26/US dollar recorded the previous day. Conversely the Sri Lankan rupee appreciated against the GBP, closing at Rs.366.78/GBP, compared to Rs.367.67/GBP recorded the previous day. The Sri Lankan rupee also depreciated against the other major currencies such as the EUR and AUD. The Central Bank holdings of government securities remained unchanged, closing at Rs.2,515.62 billion yesterday. Overnight liquidity in the banking system contracted to Rs.202.12 billion, from Rs.215.10 billion recorded the previous day.

22 Dec 2024 1 hours ago

22 Dec 2024 2 hours ago

22 Dec 2024 4 hours ago

22 Dec 2024 4 hours ago

21 Dec 2024 21 Dec 2024