25 Sep 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

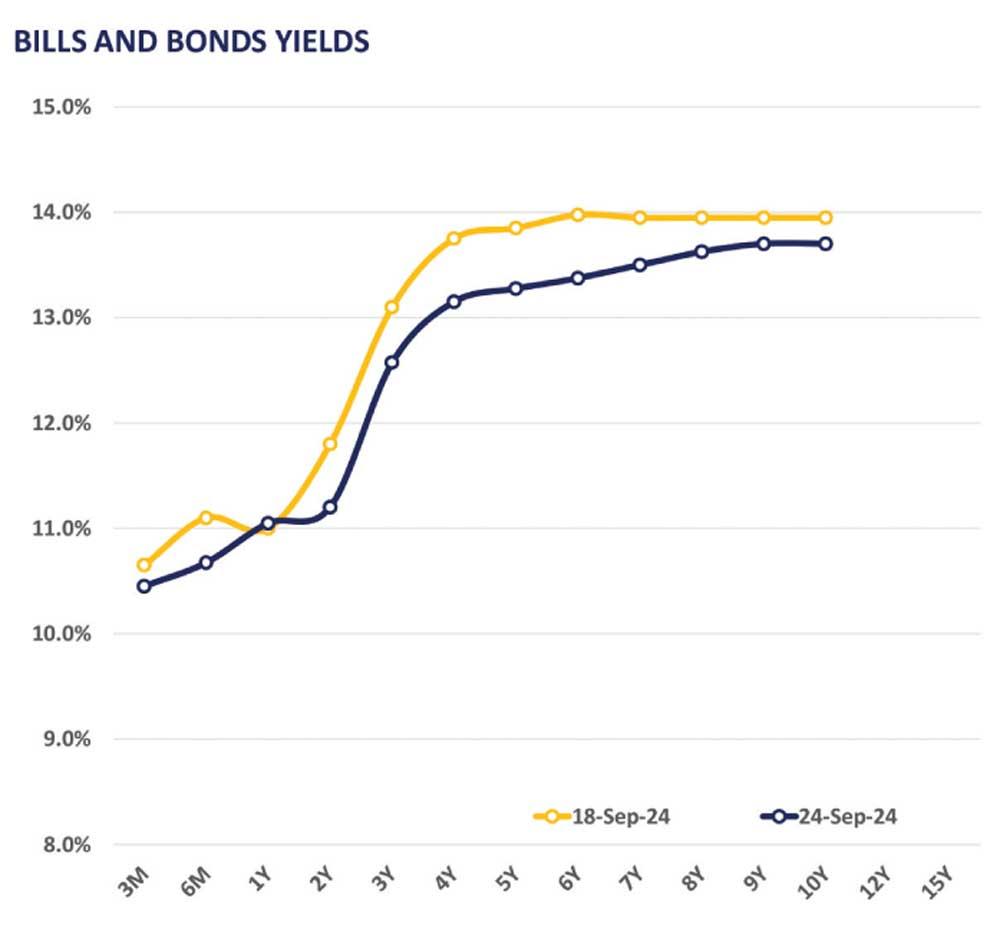

The secondary market yield curve experienced increased buying interest across the board, reflecting a resurgence in moderate levels of activity as uncertainty amongst investors diminished post-election.

Investors adopted an assertive approach, driving buying interest in the secondary market with expectations of a decline in future market rates. Notable trades were on the short to mid end of the curve, primarily amongst the 2028 and 2029 maturities.

On the short end of the curve, 01.06.26 traded between rates of 11.35% -11.15%. Similarly, 01.05.27 traded between rates of 12.50%-12.35%.

Meanwhile, on the belly end of the curve, 15.02.28, 01.05.28, and 01.07.28 traded at rates of 13.30%-13.05%, 13.20%-13.10%, and 13.25%-13.15%, respectively. Similarly, 15.06.29, and 15.09.29, traded at rates of 13.55%-13.20%, and 13.50%-13.30%, respectively. Additionally, 15.05.2030 traded between rates of 13.45%-13.40%.

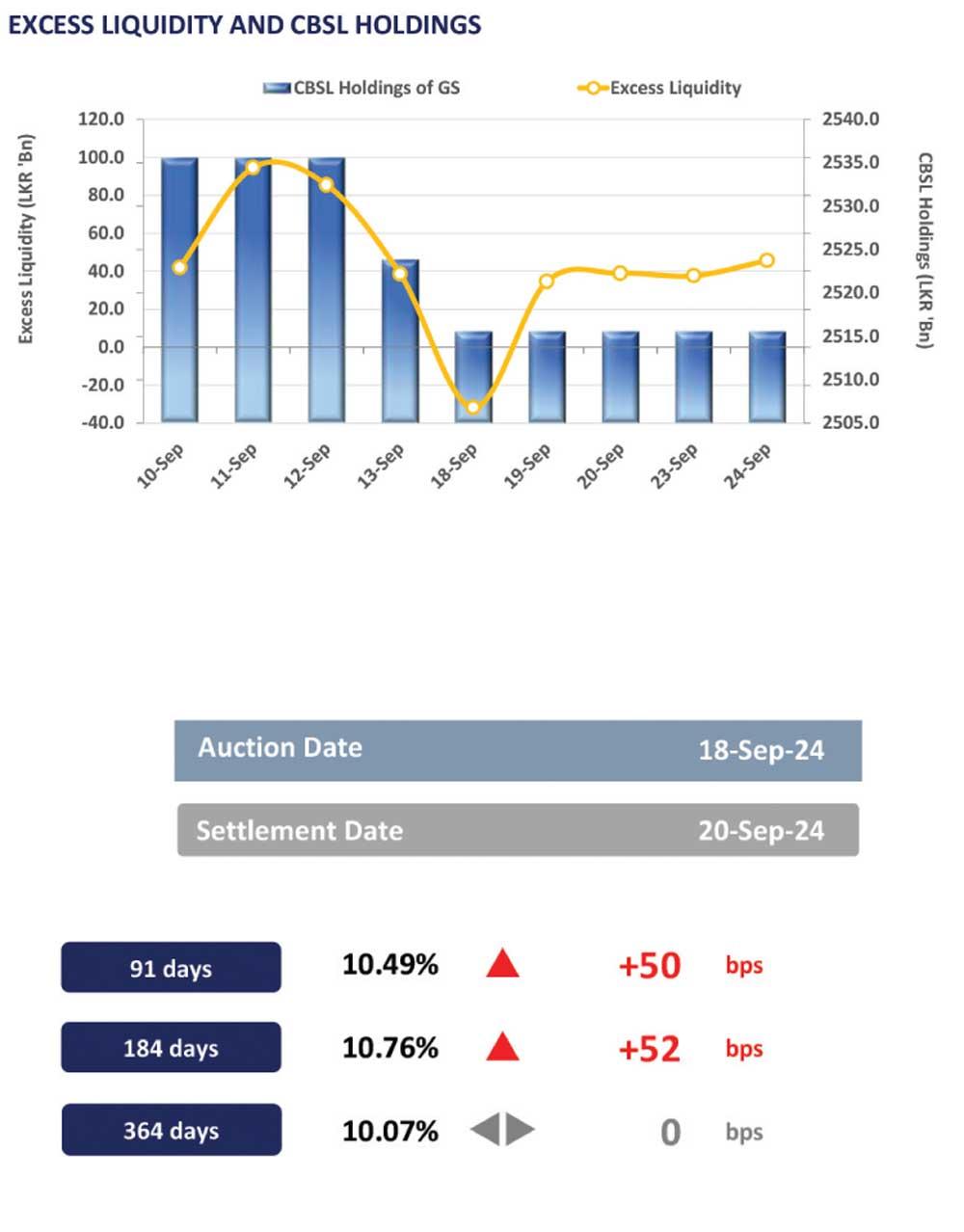

On the external front, the LKR appreciated slightly against the USD, closing at Rs. 304.42/USD compared to Rs. 304.88/USD recorded the previous day. Meanwhile, CBSL holdings of government securities remained unchanged, closing at Rs. 2,515.62bn yesterday. Overnight liquidity in the banking system expanded to Rs. 45.73bn from Rs. 37.69bn recorded the previous day.

10 Jan 2025 51 minute ago

10 Jan 2025 56 minute ago

10 Jan 2025 2 hours ago

10 Jan 2025 2 hours ago

10 Jan 2025 2 hours ago