26 Sep 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

Investor confidence surged in the secondary market, following the recent elections, alleviating political uncertainties.

The agreement reached with the Ad Hoc Bondholder Group last week further bolstered market sentiment, leading to a notable uptick in buying interest.

As a result, the secondary market yield curve experienced a significant decline of over 100 basis points (bps) across mid to long tenures. Short tenure mid-rates also saw a drop, shedding between 28 to 50 bps compared to last week. Notably, the highly liquid bonds, 2026 and 2027, attracted substantial trading activity across various maturities. Specifically, 15.05.2026, 01.06.2026 and 15.12.2026 recorded transactions between 11.20 percent-10.90 percent. Meanwhile, 15.09.2027 and 15.12.2027 traded at 12.00 percent.

On the mid-end of the curve, 2028 maturities: 15.01.2028, 15.02.2028 and 01.05.2028, hovered between 13.00 percent-12.35 percent. Meanwhile, 15.06.2029 and 15.09.2029 changed hands between 13.15 percent-12.45 percent. On the mid-end, 15.10.2030 closed trades at 12.67 percent whilst 01.10.2032 traded between 13.15 percent-12.85 percent.

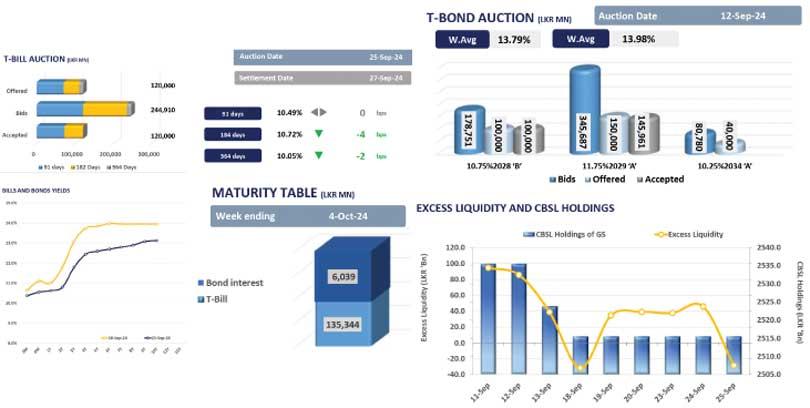

Meanwhile, the Central Bank conducted its final bill auction for the month, fully accepting the offered Rs.120.0 billion. The auction saw a high acceptance rate of 99.6 percent for the three-month and six-month maturities, while the one-year bill was undersubscribed, closing at Rs.463.0 million. The weighted average yield rates at the primary T-bill auction saw slight declines after a month, with reductions of four bps for the six-month bill (10.72 percent) and two bps for the one-year bill (10.05 percent). However, the three-month bill’s weighted average yield remained stable at 10.49 percent. Meanwhile, there was a notable and sharp decline in the cut-off rates of three-month and six-month bills.

10 Jan 2025 35 minute ago

10 Jan 2025 40 minute ago

10 Jan 2025 2 hours ago

10 Jan 2025 2 hours ago

10 Jan 2025 2 hours ago