19 Jan 2024 - {{hitsCtrl.values.hits}}

As the Central Bank of Sri Lanka prepares to announce the initial monetary policy review of 2024 next week, industry experts anticipate that the monetary authority will uphold current policy rates initially, with a subsequent shift towards a more accommodative stance. This adjustment is anticipated to facilitate the continued enhancement of vital economic indicators.

According to First Capital Research (FCR), there is an 80 percent probability the Central Bank keeps the policy rates at previous levels.

“With economic indicators stabilising and the economy projected to recover during 2H2023 with a drastic slowdown of inflation witnessed in 3Q2023, we believe a monetary relaxation may not be the need of the hour,” said FCR in its pre policy analysis.

However, it noted that considering both arguments for and against monetary easing, it also assigns a 20 percent probability for a relaxation in policy rates with a view to stimulate economic growth and accelerate the decline with interest rates.

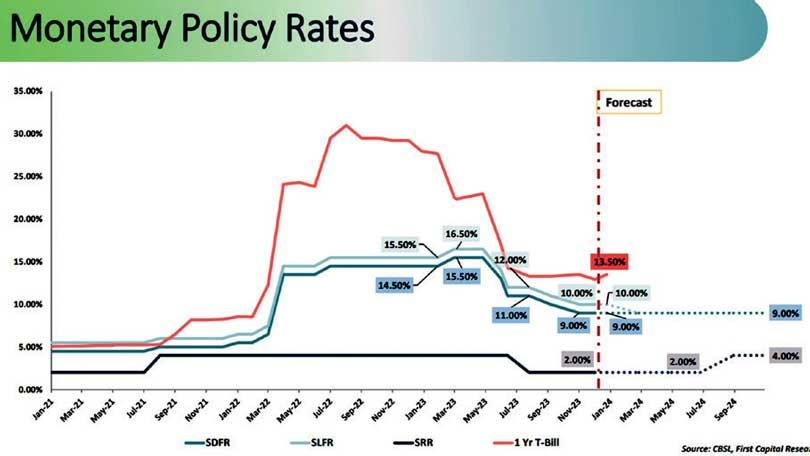

In the final Monetary Policy review for year 2023, the Monetary Board decided to reduce the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank by 100 basis points (bps) to 9.00 percent and 10.00 percent.

The decision was made after having analysed the current and expected developments in the domestic and global economy. It took into account the aim of achieving and maintaining inflation at 5 percent over the medium term, while enabling the economy to reach and stabilise at the potential level.

FCR noted there is a probability of 10 percent for a rate cut of 100bps, 5 percent for rate cut of 50bps and another 5 percent for 150bps rate cut to reduce rates and government security yields at a faster pace to facilitate the strengthening of the financial sector.

It went on to point out there is a 50 percent possibility for CBSL to maintain SLF rate at its current levels, while there is an equal probability of the CBSL adopting a singular monetary policy stance, potentially resulting in a 100bps reduction in the SLF rate.

Further, there is 85 percent possibility to keep SRR unchanged, while considering the risk associated with it there is a 15 percent possibility for a SRR hike of 50bps.

FCR shared that factors what argue against a relaxation in policy rates in the upcoming policy meeting are: the Central Bank’s intent to halt monetary easing to allow for market adjustments, yield movement temporarily paused by concerns over external debt restructuring, inflow of funds spurring liquidity in the financial system, the GDP turnaround in 3Q2023 and sustained credit growth on track, along with potential cost-push inflationary pressures.

Meanwhile, the factors that argue for a relaxation in policy rates are: demand constraints amidst tax hike, reserve position surge enhancing margin of safety, global policy rates peakhifting gradually to dovish stance, and the Central Bank adopting a single monetary policy stance.

28 Oct 2024 1 hours ago

28 Oct 2024 2 hours ago

28 Oct 2024 5 hours ago