28 Nov 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The Monetary Board of the Central Bank of Sri Lankan (CBSL), at the Monetary Policy meeting held on November 26, 2024, decided to further ease the monetary policy stance and implement the single policy rate mechanism while setting the newly introduced overnight policy rate (OPR) at 8.0 percent.

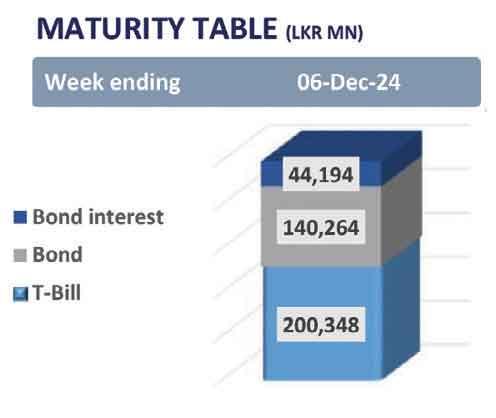

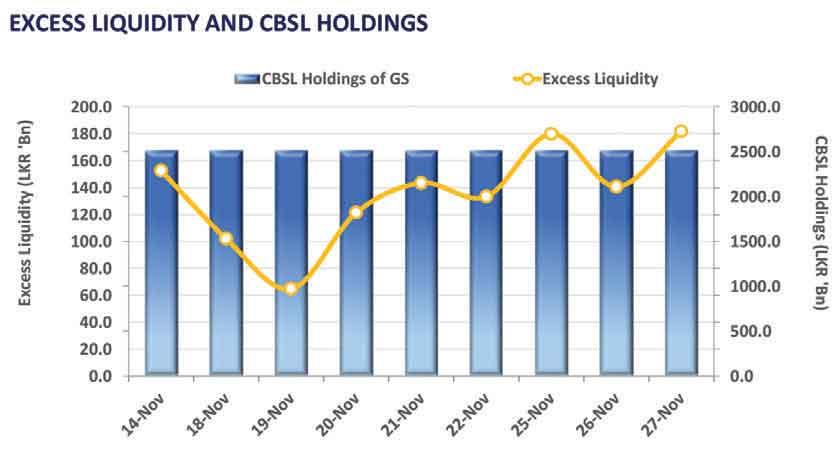

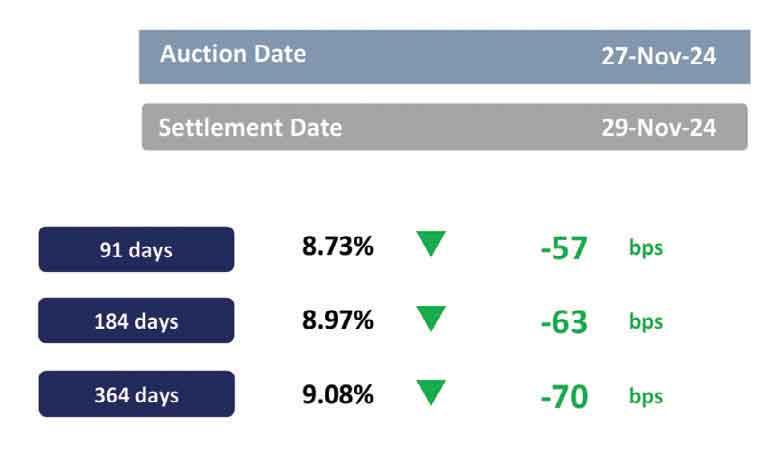

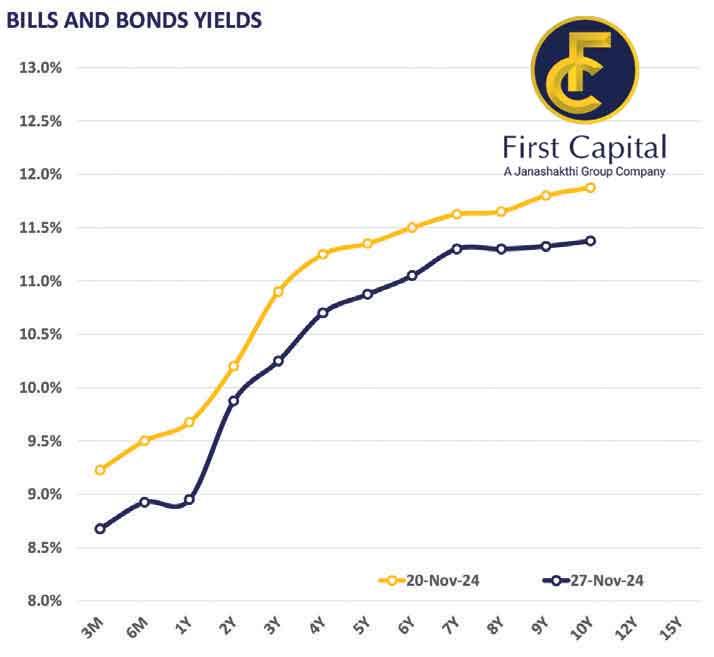

Moreover, with this transition, the SDFR and SLFR will no longer be considered policy interest rates of the CBSL. The SDFR and SLFR will continue to be available for participatory institutions for overnight transactions with the CBSL, are linked to the OPR with a margin of ± 50 basis points. Meanwhile, at yesterday’s T-bill auction, the weighted average yields continued to decline across the board for the third consecutive week and the total offered amount of Rs.125.0 billion was fully subscribed. Notably, total bids exceeded the total offered amount by nearly three times. Accordingly, the three-month T-bill declined by 57bps to close at 8.73 percent and the six-month T-bill dropped by 63bps to 8.97 percent whilst the one-year T-bill recorded the largest decline of 70bps to 9.08 percent. Following the single rate monetary policy announcement, the secondary market continued to display buying interest across short to mid tenures and the buying interest was centred in the 2027, 2028, 2029 and 2032 maturities. Accordingly, at the short end of the curve, 01.05.27, 15.09.27 and 15.12.27 traded in the range of 10.45 percent to 10.20 percent whilst the belly end of the curve 15.02.28, 15,03.28, 01.05.28 and 15.10.28 traded in the range of 10.65 percent to 10.43 percent and the 15.09.29 maturity traded in the range of 10.95 percent to 10.80 percent. Towards the long end of the curve, 01.10.32 traded at 11.30 percent. Furthermore, the CBSL is planning to raise Rs.205.0 billion worth treasury bonds through an auction scheduled for today.

23 Dec 2024 2 hours ago

23 Dec 2024 3 hours ago

23 Dec 2024 6 hours ago

23 Dec 2024 7 hours ago