29 May 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The CBSL maintained its monetary policy stance at the 3rd meeting for the year, maintaining the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) at 8.50% and 9.50%, respectively.

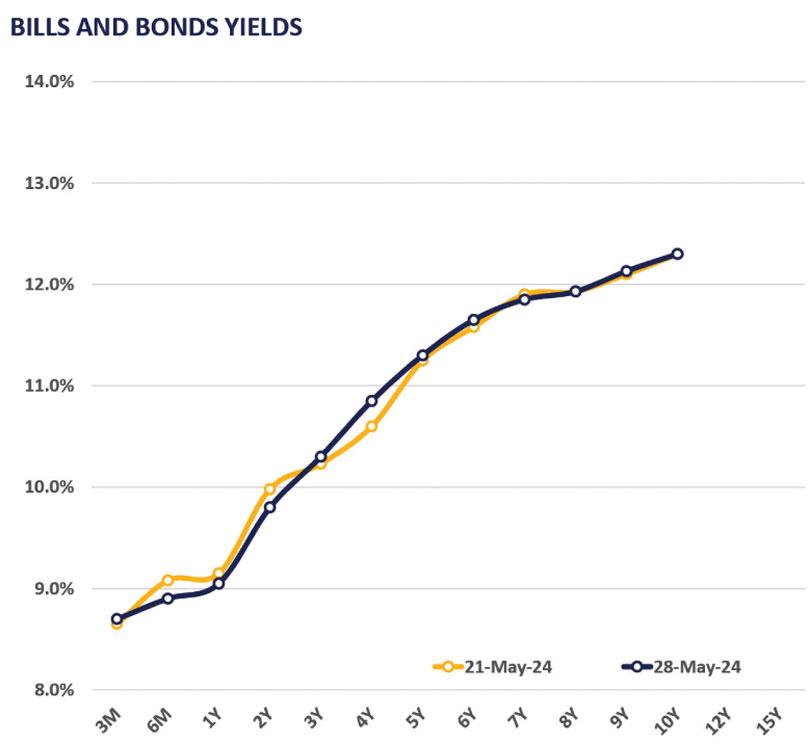

This decision led to a modest selling interest in the market, signalling a perception that rates have reached their lowest point. Consequently, liquid tenors including 01.08.26 and 15.12.26 saw trading in the range of 9.95%-10.05%, with 15.09.27 exchanging at 10.50%.

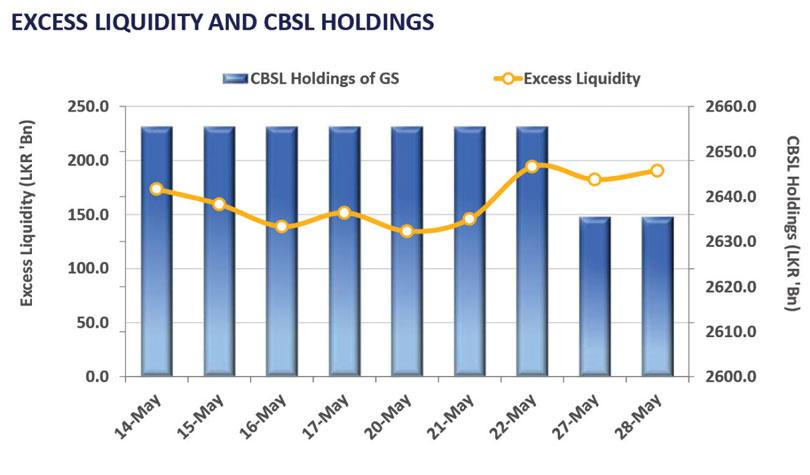

Meanwhile, 2028 tenors such as 15.01.28, 15.03.28, 01.07.28, and 15.12.28 traded between 10.80%-11.00%. On the external front, the LKR depreciated against the USD, closing at Rs. 300.42/USD. Moreover, overnight liquidity for the day was recorded at Rs. 190.7 billion while CBSL holdings remained steady at Rs. 2,635.6 billion.

28 Nov 2024 51 minute ago

28 Nov 2024 3 hours ago

28 Nov 2024 4 hours ago

28 Nov 2024 4 hours ago

28 Nov 2024 5 hours ago