09 Feb 2022 - {{hitsCtrl.values.hits}}

Following are the excerpts from an interview conducted with Ceylon Asset Management MD Dulindra Fernando, CFA.

|

Ceylon Asset Management MD Dulindra Fernando, CFA

|

What are your thoughts on the Finance Minister announcing reengagement with the International Monetary Fund (IMF)?

In my opinion, it is the best news we have had in months. As a result, it would open the door for other funding channels and most importantly, improve foreign investor confidence in Sri Lanka.

It was the IMF that came to Sri Lanka’s aid along with Templeton Funds under Mark Mobius during 2009, when Sri Lanka experienced the last currency crisis at the conclusion of the war. The IMF engagement has been a positive experience for Sri Lanka, while Sri Lanka has been a poster child of the IMF over the last several decades.

Why is there so much opposition to the IMF in some sections?

It’s possibly due to the restrictive conditions imposed by the IMF. For example, in 2016, the IMF engagement led to a significant increase in taxes and interest rates, which may have contributed towards slowing the economic growth to 3.3 percent in 2018.

Therefore, today’s policymakers wish to avoid the policy straight jacket imposed by the IMF.

What changes in policies can you expect this time with the IMF engagement?

Well, the most welcome change will be the depreciation of the currency, to make Sri Lanka investment and trade competitive again. You can also expect VAT and tax increases but interest rates may not rise since they have already increased significantly.

A welcome sale of unutilised state assets to foreign investors could also be

expected with an IMF programme.

Won’t the depreciation of the currency cause inflation?

The depreciation of the currency will contribute to inflation and budget deficit expansion but it would remedy the trade deficit and attract foreign remittances into Sri Lanka once again.

The non-sustainable exchange rate peg has increased unwarranted fear and kept away remittance and investment inflows. A managed depreciation in line with market forces could be the catalyst in attracting investments to Sri Lanka again.

The costs of a depreciation are greatly outweighed by the benefits to stabilise our reserves.

Some economists recommend that Sri Lanka should default sovereign bond repayments. What are your thoughts as a manager of a sovereign bond fund?

Our primary responsibility is to protect the capital of our investors.

We find such calls irresponsible and detrimental to our country.

We believe Sri Lanka has a great investment future that will attract foreign investors. We need to manage the few years where we experience a $ 5 billion deficit in tourism revenue and sovereign debt issues.

What are the consequences of default or restructure of sovereign bonds? Why not exploit the opportunity for Sri Lanka to save scarce dollars?

Of all of Sri Lanka’s foreign debts, the most painful will be a sovereign bond default. Sovereign bond holders are protected under the US law and empowered with a ‘cross-default’ clause. The cross-default clause enables all the US $ 12.5 billion sovereign bond holders to ‘call’ their investments immediately. In the unlikely event of the call option being exercised, Sri Lanka could face an immediate demand to pay US $ 12.5 billion and be compelled to declare bankruptcy.

A default or even a sovereign bond restructure would hit major international news headlines and destroy Sri Lanka’s reputation as a foreign investment destination. Sri Lanka has major plans to attract foreign capital to the country, including great projects such as Port City.

Sri Lanka has US $ 6.9 billion foreign debt to repay with only US $ 1 billion to pay in sovereign bonds. It is far less painful to restructure debts to Japan, China, the IMF and others.

In a worst-case scenario, what type of debt restructure would sovereign bond holders consider?

We take comfort from the statement by the Finance Minister that Sri Lanka will honour all of US $ 6.9 billion debt repayments due this year.

However, to answer your hypothetical question, the SriLankan Airlines’ dollar international corporate bond, guaranteed by the Government of Sri Lanka, matured in 2019 and was replaced with a new bond maturing in 2024. This appeared acceptable to the foreign bond holders, who only suffered a delay in the return of their capital.

In a worst-case scenario, a similar rollover of an ISB maturity with a new sovereign bond maybe acceptable to global investors, even if it extends maturity by 10 years. It would still hit global headlines but wouldn’t prove as damaging.

A ‘haircut’ of capital would prove a lot more damaging and painful for both bond holders and Sri Lanka. I would not recommend it for Sri Lanka today, with such great investment potential.

Some economists state that it’s acceptable to default since some ‘local’ investors have bought US $ 100 sovereign bonds at US $ 50?

The same economists admit they are unable to verify any ownership of local bond holders. Accordingly, such unsubstantiated claims are made without responsibility. Such action to spite a few recent discounted bond buyers neglects the far-reaching damage to Sri Lanka’s international credibility as a borrower.

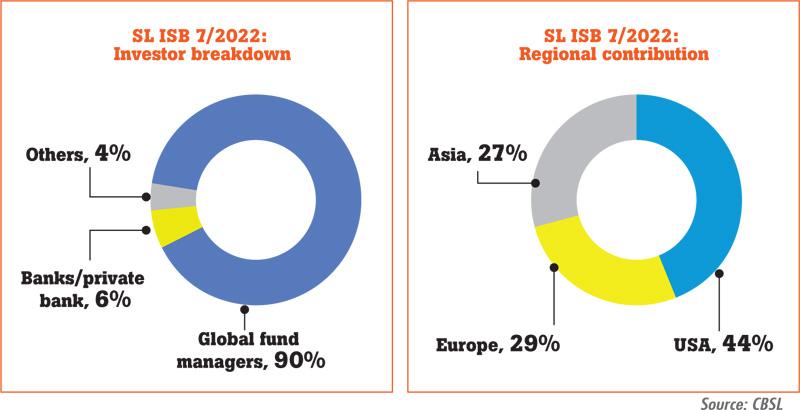

Around 44 percent of the 2022 maturity bond was invested by the US investors, while the EU investors represented 29 percent. The investors were mainly frontier market bond funds and private wealth managers. Pension funds consider only investment grade investments rated BBB or better. Sri Lanka never reached investment grade and would not have attracted pension fund managers.

A ‘haircut’ of capital would prove a lot more damaging and painful for both bond holders and Sri Lanka. I would not recommend it for Sri Lanka today, with such great investment potential.

Most foreign investors as well as Sri Lankan banks and our own fund have bought bonds at around par value. To recommend default, on the basis of some local investors buying at a discount, is disappointing.

With Sri Lanka’s rating at ‘CC’, is there anymore damage we could inflict on Sri Lanka’s reputation?

Rating agencies have downgraded around 60 percent of African nations, compelling many to default. The rating agencies have been criticised for acting in self-interest to protect their own reputational capital and overreacting to pandemic risks that are global. As some foreign investors exited from downgraded African bonds, it became a painful self-fulfilling prophecy of rating calls.

Sri Lanka also suffered a similar fate although we could have helped ourselves in managing the trade deficit and defending our foreign reserves better. A default would complete the predictions of rating agencies.

The US $ 1 billion sovereign bond repayment in July is a manageable quantum and hardly warrants the vast cost of default. Unfortunately, some economists may recommend such negative publicity for political reasons.

Do you think Sri Lanka can emerge out of the current foreign currency crisis?

Yes, we can. Sri Lanka has options of gaining credit from Japan, the IMF, India and others to bridge the US $ 5 billion gap we have experienced in the absence of tourism and annual sovereign bond issues since the past two years.

Tourism is gradually returning to the island while exports are strong. If the IMF comes on board or Sri Lanka adopts measures such as market-driven currency depreciation, even without the IMF assistance, the remittance inflows and exporter dollar inflows could suffice to pay some external debt. The government could also consider ending the mandatory currency conversion rules, which discourages forex inflows to the country.

What is the great investment potential of Sri Lanka?

Sri Lanka has several great projects that exploit Sri Lanka’s geographic location and regional competitive advantages. They include the construction of the WCT and ECT terminals in the Colombo Port, Hambantota Port, opening for container business as well as the exciting Port City development and Cinnamon Life project, etc. The Central Freeway to Kurunegala would accelerate GDP growth, while LNG energy projects (instead of ‘coal’) would help resolve the present crisis in energy. The proposed IT parks would help build capacity in the fast-growing IT export industry. The proposed yacht marina in Galle can truly propel high-end tourism at Galle Fort.

Sri Lanka can reach out to global investors and promote the unique investment opportunities we offer. I remain optimistic that we can emerge out of the current crisis.

16 Nov 2024 30 minute ago

15 Nov 2024 15 Nov 2024

15 Nov 2024 15 Nov 2024

15 Nov 2024 15 Nov 2024

15 Nov 2024 15 Nov 2024