14 May 2024 - {{hitsCtrl.values.hits}}

The Central Bank (CB) in a recent article attributed the recent inflation escapade nearly, largely and almost entirely to supply side factors, two years after its occurance and also explained how it should have been dealt with.

The Central Bank (CB) in a recent article attributed the recent inflation escapade nearly, largely and almost entirely to supply side factors, two years after its occurance and also explained how it should have been dealt with.

Here is how it goes;

“Given the transitory nature of supply side inflation in general, central banks may adopt a cautious approach in using monetary policy actions to address it. Moreover, supply side disturbances move output and prices in opposite directions and the Central Bank may not be able to maintain both output and price stability

(Amarasekara, 2009)”.

They further went to say that, “in such circumstances, extreme policies aimed purely at price stability aggravate the effect of the supply disturbance on the real economy. Certain supply side shocks may be better left to correct themselves over time without the need for immediate and aggressive policy responses”.

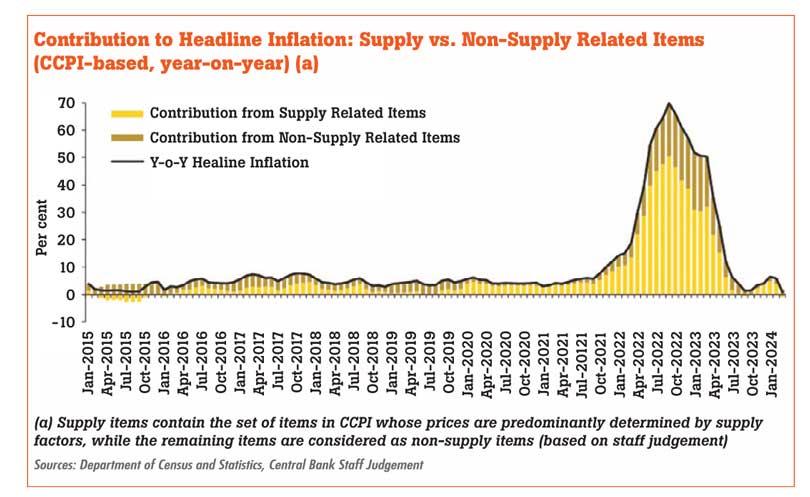

They even went on to illustrate it graphically to make it clearer. (see graph)

Did the Central Bank of Sri Lanka just say that they got massively wrong about the inflation spiral that they saw in 2022 and most part of 2023?

Was that a tacit admission of the mistake they made back in 2022 by raising the interest rates by a phenomenal amount no sooner the current Governor took over the reins citing to rein in that inflation?

Vis-à-vis their above statement in quote, they did neither back in 2022; they neither adopted a cautious approach in applying monetary policy nor left the inflation to work out by itself.

The statement above proves that either they got it wrong in the first place about what was truly behind the inflation at the time or they applied wrong tools or a combination of both.

The folly

Back in April 2022, because they misread the inflation, the Central Bank raised interest rates by a jumbo 700 basis points and thereafter too by another 100 basis points in July 2022 citing that those increases were badly needed to tame that runaway inflation at the time which peaked near 70 percent before the fall.

But the question remains if they massively overdid it and by so doing it they exacerbated what looked like a short term spike in prices, largely and almost entirely caused by the supply side squeeze led by the global energy prices, food and other commodities prices which were compounded by the War in Ukraine.

The central banks around the world are well aware that their tools are less effective in dealing with supply side shocks which cause inflation. By applying their tools, it could in fact turn a bad situation worse.

“Central banks usually do not respond to supply side shocks as their primary control lies with affecting demand side inflationary pressures”, the Central Bank of Sri Lanka said.

“Supply side issues can have an immediate effect on prices and inflation. In addition, many supply side factors are essentially structural and weather related, and not simply a consequence of the business cycle. Addressing these may necessitate longer term policy measures or structural reforms, such as supply side policies of the government aimed at improving the productive capacity and efficiency of the economy.

Central banks, which aim at addressing business cycle fluctuations through demand driven policies, may not be able to tackle underlying structural issues”.

And they went to say, “Therefore, attempting to address supply side price pressures through monetary policy may result in adverse consequences. Raising interest rates to ease inflation could slow down economic activity, thereby further worsening supply side pressures”.

Wasn’t this exactly what the Central Bank did by raising interest rates which as a result drove hundreds of thousands of small businesses out of business causing at least a similar number to lose their jobs and thereby inflicting more pain on a larger swaths of the economy just to snuff out what could have been a short lived inflation which could have come down on its own as supply chains unclogged and the effects of war became less pronounced as it in fact did few months later.

In any case, it is no surprise that in any cycle, many Sri Lankans including the so-called economists and analysts do not get the inflation narrative right.

The problem with economists especially with those with no skin-in-the game is that they get often troubled with things that move, and, are unable to comprehend that things that move have different attributes from the things that don’t.

Dipping into true causes of inflation

Though too late, it is pertinent to dip back into what caused the global inflationary spiral during the recent past for the benefit of large swaths of people who were either misled or think otherwise about inflation.

The inflation started to lift its ugly head globally from around the end of the first quarter of 2021 as rising demand coming mainly from the developed economies for goods (not services) collided with less supply because of the prolonged disruptions to the supply chains caused by the lingering pandemic at the time.

This was the reason why the East-West shipping lanes were mostly clogged up, driving the shipping and other logistics costs to exponential levels. Let us also not forget the additional shipping costs which may have been encapsulated into the products from the Suez Canal blockade in March 2021 which by then carried approximately 12 percent of global trade, and around one million barrels of oil and roughly 8 percent of liquefied natural gas each day.

As the economies were beginning to ease their pandemic related restrictions starting from 2022, helping to potentially bring the supply and demand conditions into balance and thereby the prices, the world was met with yet another unprecedented geo-political event with the breaking out of the Ukraine war in February 2022 sending global energy prices well above US$ 100 a barrel.

The trade disruptions caused by the war and the exponentially higher energy prices then caused the rest of the global food and other commodities prices to drift higher to the point of threatening even the access to continuous power by the developed countries in Europe, including Germany and France as they were overly dependent on natural gas from Russia.

This sent shockwaves across the world, including Sri Lanka which anyway had a fragile economy, weakened further by the two years of pandemic induced border closures and other economic disruptions which took toll on the country’s external sector and thereby its foreign currency reserves.

Sri Lanka’s problems weren’t systemic as it always had higher debt levels but could have had a safe sailing in an uninterrupted global and a local economy.

In fact it was during the 5 years from 2015 to 2019 the total foreign currency debt stock and thereby the total-outstanding debt-to-GDP rose to just shy of 100 percent from a little above 70 percent when the country was handed over to the good governance government.

Those who say that Sri Lanka’s debt is unsustainable are the ones who know nothing about debt.

In fact, the narrative what many either slips or intentionally leave out is the fact that during its sixteenth International Monetary Fund (IMF) programme, Sri Lanka’s debt-to-GDP ratio rose from a little over 70 percent to little under 100 percent.

It wasn’t the tax cuts, lower interest rates or money printing which many so-called intellectuals and think-tanks try to portray, that brought the economy into its knees during that period. And it wasn’t the alleged corruption either.

It was the systemic weakening of the economy during 2015 through 2019 and the back-to-back shocks from the Easter Attacks in 2019 to the pandemic in 2020 and 2021 to the social chaos in 2022 which caused the economy to come to a grinding halt.

However, what further exacerbated Sri Lanka’s inflation back in 2022 was the sudden floating of the rupee due to the country running out of the foreign currency reserves and the resulting shortage of other commodities.

But the impact that came from the currency collapse did not have second round effects as prices were re-priced to reflect the devalued currency and the prices did the opposite when the currency appreciated as seen at present, contributing to the disinflation cycle the country has been seeing subsequent to inflation peaking in September 2022.

And the repeated and massive taxes slapped on incomes, goods and services for the sake of satisfying the International Monetary Fund (IMF) alongside the market pricing of administered priced sent the already elevated inflation through the roof.

All these moves led to further demand destruction as many people were forced to cut down consumption or business spending. For an instance, following the unconscionable power tariff hike, many users either completely lost access to electricity or were forced to significantly cut down their use weighing down on the demand.

Costs of conquering inflation massively outweighs benefits

The Central Bank has been taking a victory lap after conquering the inflation as it claims it brought the inflation down to single digits from July 2023 onwards. But how they did it is through large scale demand destruction.

“Inflation reverted to single-digit levels from July 2023 onwards, from historically highest levels in September 2022, mainly owing to the tight monetary policy stance that led to subdued demand”, the Central Bank reiterated in a recent note.

If the Central Bank said the inflation was caused not by demand but by supply constraints, why that they so keenly killed the demand to bring inflation down?

In the process, they put hundreds of thousands of people out of jobs and companies out of business and drove swaths of households into poverty.

From what they did, the Central Bank made production further constrained and thereby the supplies difficult, ultimately causing the economy to plunge into recession.

Instead what they should have done was to help those who manufacture various things from food to many other things which people need for their day-to-day living to be produced more and thereby help bring prices down.

This could have brought inflation down too, couldn’t it?

But instead what they did was bringing demand into parity with the available supply.

Yes, they conquered the inflation but the cost of doing that was enormous both to the real economy as well as to the capital markets whose three trillion rupees worth of net worth got wiped out when the stock market nosedived with the bumper policy rate hike in April 2022.

Conclusion

While there might be extremely rare occasions where the Central Bank might respond to some supply side shocks which prove to be persistent, it also acknowledges that supply side inflations could be managed well by messaging or through “clear and proactive communication”, by managing the inflation expectations.

Hence, it has become increasingly clear that in 2022 the Central Bank applied their only tool, which is the interest rates for the wrong reason and thereby prolonged and made more pronounced an otherwise short lived pain on the economy and its actors.

As the Central Bank itself has accepted that the inflation back then was largely and almost entirely caused by the supply side factors and also it should have been better left to solve by itself over time, it begs the question as to why they erred then, causing a massive damage to the economy which in retrospection is unwarranted.

(The writer can be reached at:

[email protected])

28 Nov 2024 25 minute ago

28 Nov 2024 2 hours ago

28 Nov 2024 2 hours ago

28 Nov 2024 3 hours ago

28 Nov 2024 3 hours ago