06 Oct 2021 - {{hitsCtrl.values.hits}}

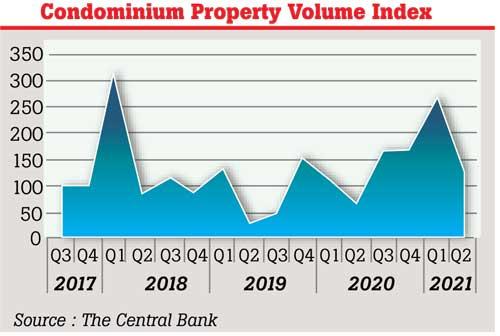

Sri Lanka’s condominium market which got off to a robust start in the first three months of 2021 slowed in the second quarter, though activity was higher than from a year ago levels as the pandemic induced restrictions appeared to have had a bearing on the pace at which the uptakes of apartment units took place.

According to the ‘Condominium Property Volume Index compiled by the Central Bank for the second quarter, condominium sales had slumped to between 100 and 150 levels of the index readings from over 250 levels reached in the first quarter.

According to the ‘Condominium Property Volume Index compiled by the Central Bank for the second quarter, condominium sales had slumped to between 100 and 150 levels of the index readings from over 250 levels reached in the first quarter.

While the single condominium project category and units below Rs.25 million have continued to remain the most preferred category of buyers, there was a shift observed towards the higher priced categories with units priced between Rs.25 to Rs.50 million.

For instance condominium units priced below Rs.25 million comprised of 62 percent of the total sales in the 2Q21, down from 70 percent in 1Q21 while the units priced at between Rs.25 and Rs.50 million rose to a share of 24 percent from 20 percent in 1Q’21 and 8 percent a year ago. “The majority of condominium buyers were Sri Lankan residents and only a few condominiums were purchased by dual citizens and foreigners,” the Central Bank said.

Meanwhile, the majority of the purchases or 47 percent have been for immediate living while the purchases for investment purpose also rose, supported by the low interest rates in the market, specially for housing. The government has capped the housing loan interest rates at 7 percent, fixed for five years with the objective of enhancing housing ownership as well as to revitalise the construction sector which remained lacklustre for over 5 years before it further weakened by the pandemic. The quarterly survey also indicates the growing preference for vertical living in the urban and suburban settings by a growing majority seeking higher convenience for work, education and other recreational activities in the city. Although the pandemic made possible remote working for a large majority, it failed to become a strong incentive for people to abandon city dwelling.

Meanwhile, the quarterly Central Bank survey also found that major buyers had used their own funds as their primary source of funds while those who financed the purchases through bank loans have also seen an increase in the 2Q21. The majority funding requirement of developers have been through pre-sale deposits followed by bank loans and developer equity. “It could be observed that the proportions of pre-sale deposits and bank loans in the developers’ funding portfolio were increased during 2Q, 2021,” the survey results found.

Despite the initial setbacks suffered from the pandemic, Sri Lanka’s construction and real estate activities expanded by robust 18.2 percent and 5.5 percent respectively in the 2Q21 from a year ago levels, predominantly supported by the incentives provided by the government and low interest rates.

17 Nov 2024 7 hours ago

17 Nov 2024 9 hours ago

17 Nov 2024 17 Nov 2024

17 Nov 2024 17 Nov 2024

17 Nov 2024 17 Nov 2024