01 Aug 2024 - {{hitsCtrl.values.hits}}

The construction sector activity continues to gather momentum with the index measuring its heft, touching the highest in 30 months.

The construction sector activity continues to gather momentum with the index measuring its heft, touching the highest in 30 months.

This gives hope that the sector is finally on a fast ascent, as the stalled and new projects are coming back.

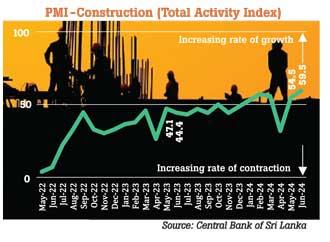

Accordingly, the Purchasing Managers’ Index (PMI) for construction recorded an index value of 59.5 in June, up from 54.5 index points in May, reflecting a faster expansion in the activity.

The index has now been in expansionary territory for months, with the exception of April, which took a dip, due to the extended holidays.

In the PMI, an activity is split between a contraction and an expansion at an index value of 50.0, while 50.0 indicates a neutral level.

The respondents to the survey cited that the construction sector is mainly driven by the projects funded by the multilateral agencies, particularly related to road rehabilitation and water distribution.

As the country was making progress on its economy, the multilateral agencies such as the World Bank and Asian Development Bank raised their funding support for critical infrastructure development projects, which were mostly stalled during the height of the foreign exchange crisis.

Meanwhile, as the country successfully concluded its bilateral debt restructuring in late June, the bilateral lenders have also resumed their funding support for infrastructure projects.

Last week, Japan announced it would unlock its bilateral funding to Sri Lanka while this week the Export Import Bank of Korea decided to resume its concessional funding support aimed at restarting construction projects, which are already underway.

This included the Ruwanwella water supply project.

The availability of new projects has become plenty at a higher pace in June, emboldening hopes about the industry’s future.

This followed the quantity of purchases with the accelerated demand for input materials.

The prices of the construction sector materials have continued their easing path, providing further incentive for building activity.

The declining interest rates also appear to be adding a tailwind for the industry’s continuous ascent after about a two-year decline.

However, the employment in the sector has continued to decline, although at a slower pace than a month ago, in a sign that the contractors are still taking a cautious approach for new hiring.

Meanwhile, the sector gave a positive outlook for the industry, given the increasing availability of projects but many expressed cautiousness about the potential uncertainty, which could stem from the upcoming presidential election.

26 Nov 2024 9 minute ago

26 Nov 2024 1 hours ago

26 Nov 2024 1 hours ago

26 Nov 2024 1 hours ago

26 Nov 2024 2 hours ago