24 Aug 2021 - {{hitsCtrl.values.hits}}

The authorities appear to have largely contented with the pace of credit growth into the key sectors of the economy through the first half of this year, since they set forth an ultra-accommodative monetary policy stance along with targeted measures to direct lending into these segments.

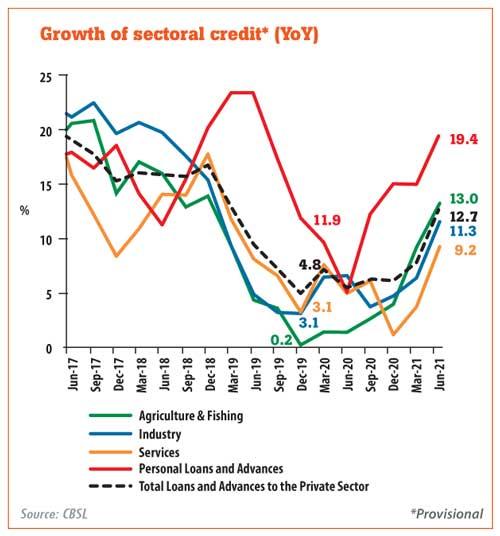

The data showed that almost every key economic sector—agriculture and fishing, industry, services and personal loans—has seen increased credit flows accelerating to double digits during the first half of 2021, from a year ago and particularly from dismal low levels in 2019.

The data showed that almost every key economic sector—agriculture and fishing, industry, services and personal loans—has seen increased credit flows accelerating to double digits during the first half of 2021, from a year ago and particularly from dismal low levels in 2019.

For instance, the banking sector credit flows to agriculture and fisheries had accelerated to 13.0 percent YoY by June-end, from the 3.9 percent growth in December 2020, when credit began to respond to lowering interest rates, other targeted loan schemes introduced by the banks and subsequent priority sector lending targets imposed by the Central Bank early this year.

As at 2019-end, credit to the agriculture and fishing sectors grew at a dismal 0.2 percent, when the economy plunged into its worst economic collapse before the pandemic, due to the business and growth-killing policies pursued.

The Central Bank, which last week raised its key policy rates by 50 basis points and banks’ reserve ration by 200 basis points, effective September 1, is confident over the continued momentum in credit expansion into the productive and needy sectors of the economy.

Although the statutory reserve hike could drain part of the banking sector liquidity back into the Central Bank, the Central Bank is of the view that the banks could make use of the policy rate hike as a tool to attract part of the massive amount of currency in circulation into the banking sector via deposits, which they can give back to people as loans.

Banks are anyway operating with very high levels of rupee liquidity and would continue to look for lending avenues to increase their interest yields, which now generate a nominal return from the government securities.

Meanwhile, loans to the industry sector saw loans flowing at a robust 11.3 percent in the first six months of the year, compared to a year ago, accelerating from 4.7 percent in December 2020 and 3.1 percent in 2019.

Acceleration in credit also signals an expanding industrial base in the country, which predominately powers exports even amid a pandemic.

Echoing what Mirror Business had stood for throughout the pandemic, billionaire businessman Dhammika Perera in a televised interview in the weekend said while a few days of lockdown may be needed to bring down the number of fatalities, a country-wide lockdown, lasting for a long time, could prove lethal to its ultra-fragile economy, as it disturbs the export industries which hitherto have largely survived the pandemic, when tourism and direct inflows have stopped. While adding that the country needs a functioning economy to generate incomes for the government and its people, even to buy the crucial medicines of which a large majority comes from abroad, he pointed out that all elements in an economy are intertwined and a stoppage in one element would stop the entire cycle.

Meanwhile, the services sector of the economy saw credit being channelled at a pace of 9.2 percent in June 2021, from a year ago, accelerating from 1.4 percent six months ago.

Services are the most battered segment of the economy, as the lingering pandemic has made it extremely hard for in-person activities to run smoothly.

Meanwhile, personal loans and advances grew the most by 19.4 percent in the year to June 2021, from 15.1 percent in December 2020.

These segmental credit growths add up to the overall private sector credit growth in the economy, which logged a 12.7 percent growth by June-end, accelerating from 6.1 percent in December 2020.

18 Nov 2024 30 minute ago

18 Nov 2024 1 hours ago

18 Nov 2024 1 hours ago

18 Nov 2024 1 hours ago

18 Nov 2024 1 hours ago