10 Jul 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

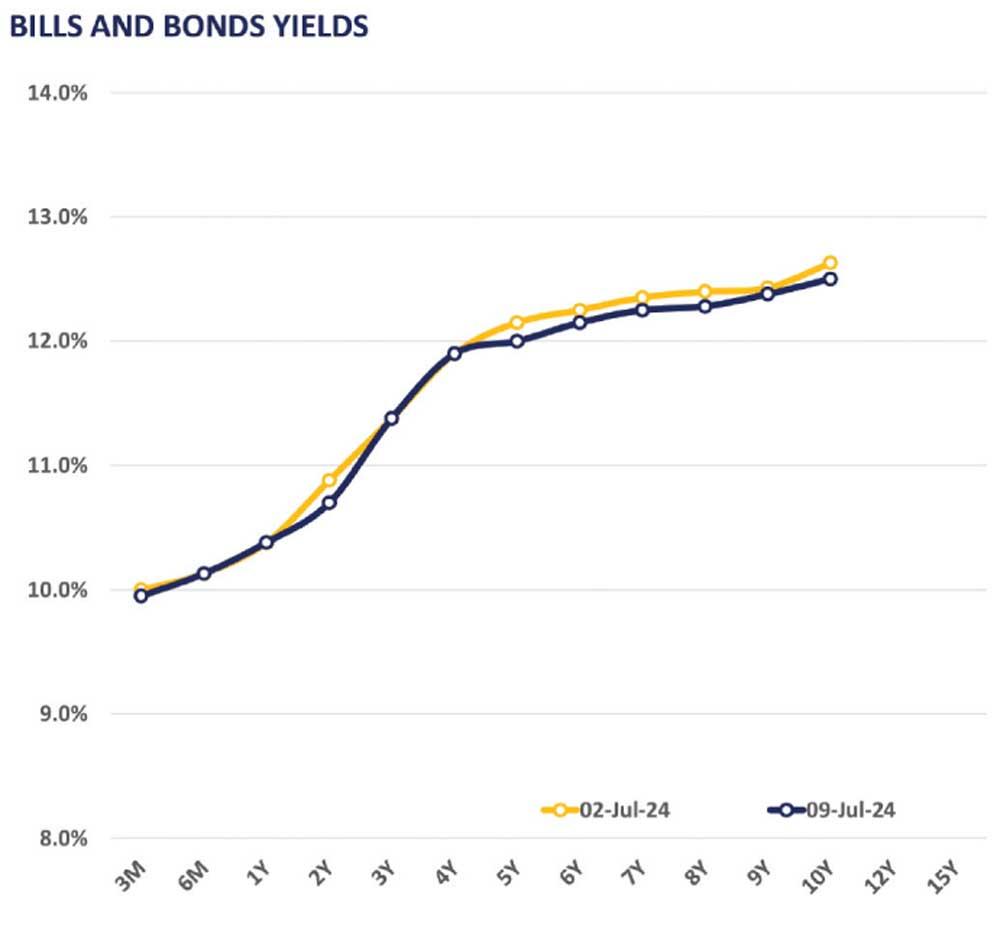

The secondary market yield curve remained broadly unchanged yesterday, reflecting dull activity and thin trading volumes across the market. Market participants were on a wait and see approach ahead of the treasury bond auction scheduled to be held on 11th for Rs. 58.0bn from 15 Dec 2027 maturity and Rs. 80.0bn from the 01 Dec 2031 maturity.

Among the maturities traded, notable trades were observed amongst mid tenors, where 15.09.29 was seen trading between rates of 12.05% - 12.08%, and 15.03.30 was seen trading at a rate of 12.15%.

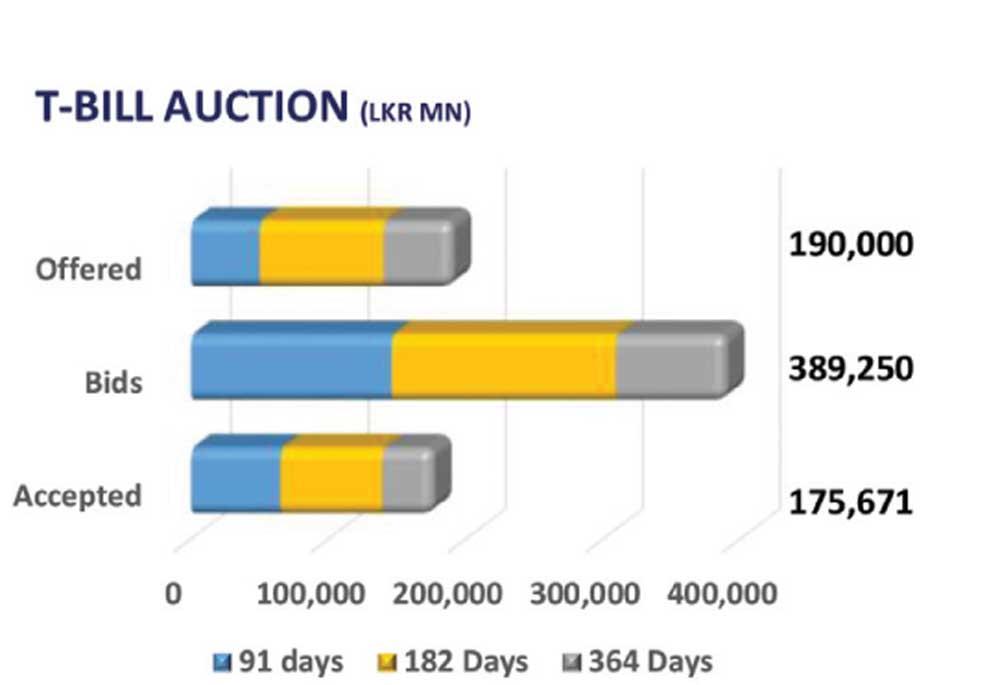

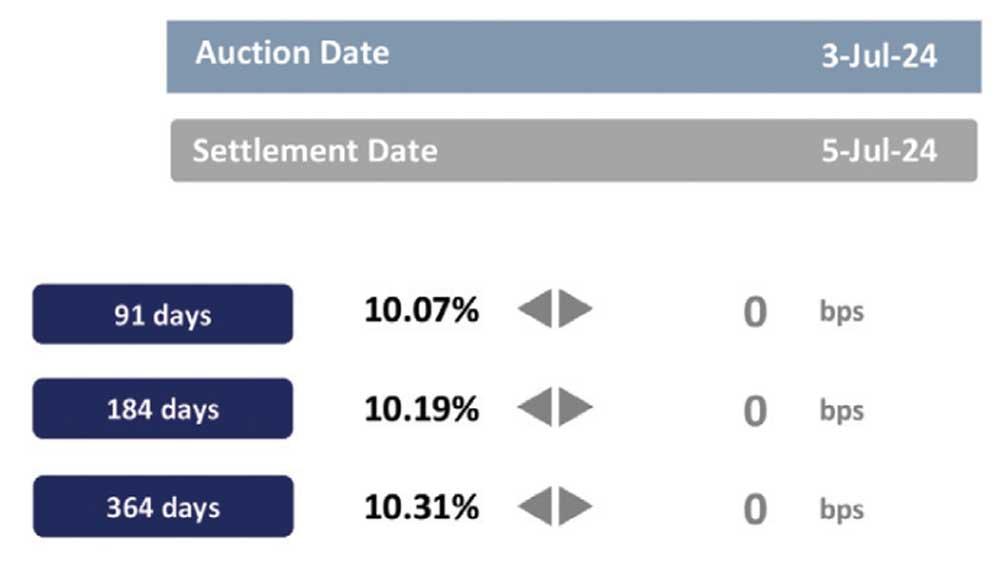

At the today’s weekly Treasury bill auction, CBSL announced to issue, Rs. 30.0bn from 91-day maturity, Rs. 40.0bn is expected to be raised from 182-day maturity, while Rs. 35.0bn is to be raised from 364-day maturity.

On the external front, LKR slightly appreciated against the USD, closing at 304.5/USD. Meanwhile, CBSL Holdings of Government securities remained at Rs. 2,595.6bn yesterday. Overnight liquidity in the banking system contracted to Rs. 58.6bn from Rs. 125.4bn recorded the previous day.

26 Nov 2024 9 hours ago

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024

26 Nov 2024 26 Nov 2024