19 Jun 2020 - {{hitsCtrl.values.hits}}

Sri Lankan exporters are cautiously optimistic on business continuity as a large number of firms have identified new business opportunities arising from the needs combating the COVID-19 pandemic, a survey carried out by USAID revealed.

Although the sentiment from the sector is upbeat, exporters expressed concerns on the impact on operations, cash flow, and productivity.

“They pressed for tax and financial relief, and digitisation of government services - particularly at border agencies - in order to recover losses caused by the lengthy halt to business activity in the country,” the USAID supported COVID-19 impact survey stated.

The survey was designed by the Economic Intelligence Unit of the Ceylon Chamber of Commerce (CCC) and the USAID ‘Partnership for Accelerating Results in Trade, National Expenditure and Revenue (PARTNER)’ project.

While majority of the businesses responded they were prepared to manage the impact of COVID-19, and 70 percent of the firms stated they already had a ‘Business Continuity Plan’ in place.

“Most had already begun automating their business processes prior to COVID-19, indicating they are fairly well-placed to manage the challenges of work from home,” the survey said.

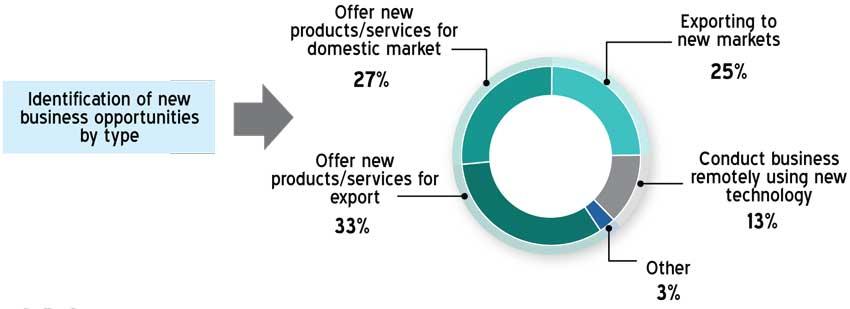

Further, 63 percent of respondent firms had identified new opportunities to cater to increases in global demand arising from the pandemic. Large businesses were most likely to have identified new opportunities (67 percent) compared to SMEs (58 percent).

However, half of the respondents expected a decline in export revenues by 40 percent or more in 2020 thus most planned to apply for financial relief.

“Here, the prominence of female owned businesses planning to request for relief (80 percent) was apparent. Majority of the companies have applied for financial relief to meet working capital requirements, relative to debt moratoriums,” the survey stated.

With regard to outlook in the short term, in the area of employment, 26 percent of businesses anticipated a decline in full-time employees; 57 percent a dip in part-time employees, whereas 51 percent expected a drop in contractual employees.

On the outlook for export business, nearly half of the businesses expect a “severe” or “moderate” contraction in export business over the next three months, while over a 12-month period 36 percent expect high or moderate growth.

On the outlook of the overall economy, the survey revealed that businesses are less optimistic, with 83 percent perceiving severe or moderate contraction over the next three months and only 21 percent expecting high or moderate growth over a 12-month period.

The survey also highlighted that although export businesses were ready to bounce back, they had some key requests from the government.

Tax relief, financial assistance, and digitisation of border agencies were among the top three interventions requested from the government by large firms, SMEs and women-owned/led firms.

The COVID-19 Impact Survey was conducted over two weeks starting on May 4, 2020, and received responses from a representative mix of large firms and SMEs, including firms owned or led by women in 26 export segments.

The responses were primarily from senior-level executives, providing key strategic insights on the trade and labour market impacts of COVID-19.

17 Nov 2024 3 hours ago

17 Nov 2024 5 hours ago

17 Nov 2024 7 hours ago

17 Nov 2024 7 hours ago

17 Nov 2024 7 hours ago