09 Apr 2018 - {{hitsCtrl.values.hits}}

By Chandeepa Wettasinghe

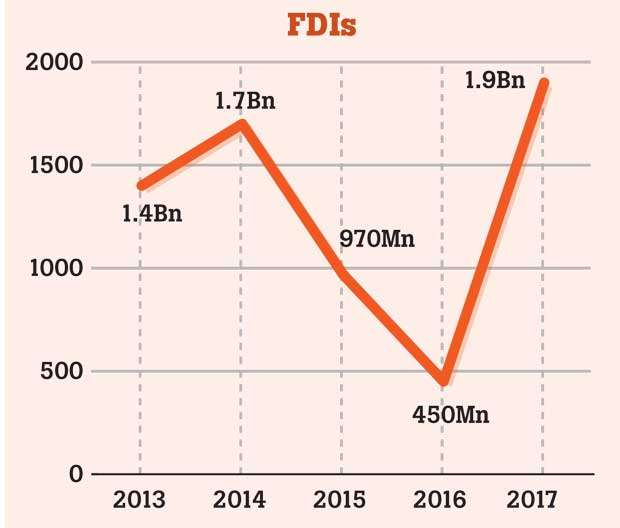

Foreign Direct Investments (FDIs) to Sri Lanka reached an all-time high of US $ 1.9 billion in 2017, Central Bank data released last week indicated.

This was an over four fold increase compared to the US $ 450 million in FDI inflows recorded in 2016. According to the Board of Investment (BOI), a majority of the investments in 2017 were from existing foreign investors re-investing profits or injecting more capital into the country.

However, nearly US$ 300 million came from the first tranche of the Hambantota Port lease to China by the government last December.

The BOI said that the highest FDI inflows came from China, followed by Hong Kong, India and Singapore. The FDIs in 2017 broke the previous high of US$ 1.7 billion set in 2014, when large inflows came in from China for the mega project, the Colombo Port City, and the Colombo International Container Terminal.

A year earlier in 2013, US$ 1.4 billion in FDIs were recorded, maintaining an upward trend in investments following the end of the civil war in 2009.

The dip in FDis to US$ 970 million in 2015 and US$ 450 million in 2016 resulted from political and policy uncertainty arising from a change in government, and the inability of the new government to maintain policy consistency. However, 2016 and 2017 saw the government implement better fiscal and monetary policies, which along with an International Monetary Fund sponsored reform programme, saw foreign investor confidence increase in 2017.

The government has further pledged to ease the doing business environment in Sri Lanka, and has taken steps towards its promise, with the implementation of a simpler tax law, and making the registration of a company, a one-day affair.

More action is being taken by eight task forces assigned by the government to improve doing business, in order to attract FDIs, particularly to export industries, in order to take advantage of Sri Lanka’s geographic location and trade agreements.

The current government is also viewing FDIs and boosting exports as the more sustainable solution to solve Sri Lanka’s balance of payment woes.

The higher FDIs and an improved export performance had contributed to Sri Lanka’s foreign reserves increasing to US$ 8 billion at the end of 2017 compared to US$ 6 billion 12 months earlier.

The government has set an FDI target of US$ 2.5 billion for 2018, and is attempting to reach an annual FDI target of US$ 5 billion by 2020.

18 Nov 2024 4 hours ago

18 Nov 2024 5 hours ago

18 Nov 2024 5 hours ago

18 Nov 2024 6 hours ago

18 Nov 2024 18 Nov 2024