02 May 2022 - {{hitsCtrl.values.hits}}

The Finance Ministry last week admitted that the sweeping tax cuts introduced by President Gotabaya Rajapaksa’s government was the main reason for the State coffers to go dry and the biggest contributor to current economic malaise the country is faced with.

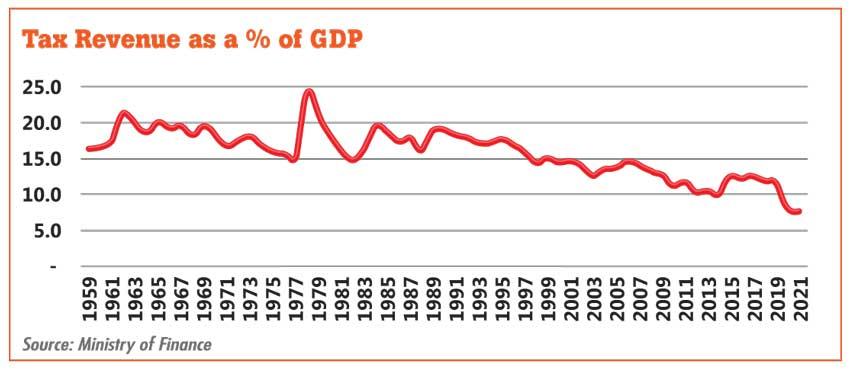

“Government revenue declined sharply in the last two years due to various reasons including the economic downturn caused by the COVID-19 pandemic, import restrictions imposed to ease the external sector pressure, but most importantly, due to the ultra-low tax regime introduced in late 2019 and the COVID-19 related easing measures in early 2020,” the Finance Ministry said in an information note.

“Even before these tax cuts, Sri Lanka was a country with one of the lowest revenue- to-GDP ratios in the world, and the tax cuts drove Sri Lanka closer to the bottom of this list,” it added.

The revenue- to-GDP in 2021 was estimated to have declined to 8.7 percent from 9.1 percent in 2020. However, the country’s fiscal deficit as a percentage of the GDP widened to 11.1 percent in 2020 and 12.2 percent in 2021, which resulted in significant macroeconomic imbalances.

With the deterioration of fiscal and macroeconomic conditions, Sri Lanka’s credit ratings were successively downgraded resulting in the country’s access to international financial markets being severely constrained.

This led the government to depend on domestic borrowings to finance the increased budget deficit. Domestic financing has been largely from the banking system.

Within the banking system, financing from the Central Bank, which is loosely referred to as money printing rose to an alarmingly high level, leading to an unprecedented deterioration of the Central Bank’s balance sheet and causing inflationary and balance of payments pressures.

To put the strayed economy back on track, the Finance Ministry said Sri Lanka needs revenue-based fiscal consolidation, and identified the government’s decision to seek the International Monetary Fund (IMF) assistance as a starting point and a catalyst to implement the hard economic reforms Sri Lanka has been delaying for decades. “Cost-based pricing for public utilities and the energy sector will have to be implemented, with social safety nets to support vulnerable segments of society. Persistent losses of related State-owned business enterprises (SOBEs) add to the burden of the fiscal sector through contingent liabilities and loss of revenue while also creating significant financial pressures on the financial sector.

Given the financial situation of the country, divestment of underutilised and non- strategic State assets, including unproductive SOEs, will also be required,” the information note said.

The Finance Ministry cautioned that failure to implement required policy reforms at this critical juncture would be very costly.

Finance Ministry Ali Sabry has already said that all taxes will soon be raised at least to the prior 2019 levels, but has indicated that increase in Value Added Tax (VAT) may be delayed. However, when implementing these hard reforms Finance Ministry noted that the country and its citizens will have to go through a period of difficulty.

“Given the tighter fiscal and monetary conditions, along with more market-based pricing, robust social safety nets must be designed and implemented,” the information note said.

15 Nov 2024 31 minute ago

15 Nov 2024 33 minute ago

15 Nov 2024 45 minute ago

15 Nov 2024 1 hours ago

15 Nov 2024 2 hours ago