15 Jun 2018 - {{hitsCtrl.values.hits}}

If there was any leniency enjoyed by the Sri Lanka’s finance companies on their capital and disclosure requirements thus far, such will end soon as the sector is set to come under a BASEL-like regulatory framework.

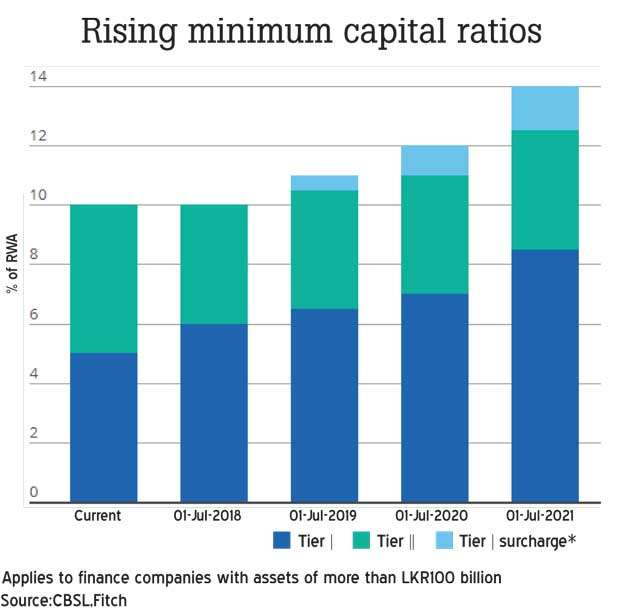

The new capital regulations on licensed finance companies, which will take the form of BASEL rules on banks, will require the finance companies to gradually increase their capital ratios from 2018 through 2021, said Fitch Ratings on a special note on the sector ahead of the new rules coming into effect from July 1.

Accordingly, the tier I and tier II ratios of licensed finance companies will increase to 8.5 percent and 12.5 percent from the current 5 percent and 10 percent respectively, effective from next month.

Further, the finance companies with assets over Rs.100 billion – termed as systematically-important licensed finance companies – will be required to build an additional capital surcharge of 150 basis points starting from July 1, 2019 to July 1, 2021.

This effectively takes the total capital ratio up to 14 percent by 2021 for such larger finance companies.

However, the most immediate hurdle for all finance companies will be to up their tier I ratio to 6.0 percent by next month.

“New capital-adequacy regulations for Sri Lankan finance companies are likely to improve the resilience of the sector to economic shocks, but will add to capitalization pressures— particularly for the country’s numerous small-scale finance companies,” Fitch Rating said.

Fitch noted the finance companies that they rate already stay on top of the capital thresholds coming into effect next month even after taking into account the potential risk-weighted asset changes based on the current asset mix.

While most of them already comply with the 2021 thresholds with some requiring external capital to stay in line, the rating agency said the small finance companies are struggling to raise capital to comply with an earlier requirement, which asked them to hold a minimum core capital of Rs. 2.5 billion by January 1, 2021.

“The new minimum capital ratios are likely to add to those difficulties”, Fitch said.

Sri Lanka’s licensed finance company sector has long been subjected to less stringent checks and balances compared to the banks on their capital adequacy, measurement of risks and disclosure requirements.

The lax regulatory framework on the sector resulted in many finance companies filing for bankruptcy due to mismanagement of funds with the taxpayers having to rescue the hapless depositors.

Meanwhile, capital ratios of the finance companies will come under downward pressure due to substantial increase in risk weighted assets/loans in the sector stemming from additional risk weighting made on ‘operational risks’ and the changes in the computation of risks weighted assets for credit risk.

Therefore Fitch said those finance companies exposed to uncollateralized lending such as micro-financing, “may see the sharpest increases in RWAs, as this lending will be risk-weighted at 125 percent instead of 100 percent as previously”.

However, the sector does not consider the ‘market risk’ in their trading book when computing the risk weighted assets in a finance company’s balance sheet because the regulator still views such a risk is low in the sector.

The staggered capital ratio increments for the licensed finance sector in Sri Lanka is coming into effect precisely one year after the country’s banking sector was made subjected to BASEL III regulations on capital requirements.

18 Nov 2024 11 minute ago

18 Nov 2024 1 hours ago

18 Nov 2024 1 hours ago

18 Nov 2024 1 hours ago

18 Nov 2024 1 hours ago