26 Nov 2019 - {{hitsCtrl.values.hits}}

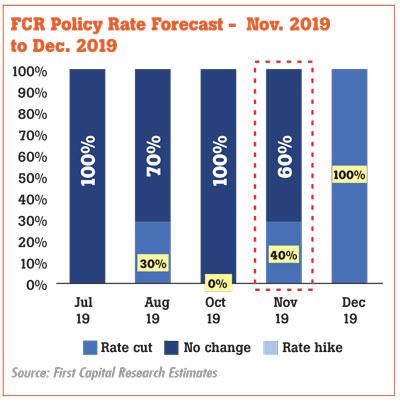

A third rate cut for this year, despite forecasting to the contrary prior to the recently concluded presidential election, was not ruled out by First Capital Research, the research arm of a leading Colombo-based investment bank.

The Monetary Board of the Central Bank is set to announce the seventh monetary policy review for this year on Friday. The Central Bank has slashed policy rates twice so far this year, in May and August—50 basis points each.

Although in their October pre-policy analysis, First Capital Research maintained that there would be no more rate cuts this year, in its latest pre-policy analysis released yesterday, the research firm said it was revising its previous stance “considering the recent changes in the political and economical landscape of the country and external outlook for Sri Lanka”.

“Despite the 50bps rate cuts each in May and August, First Capital Research believes that door is open for a rate cut considering the need to address the sluggishness in economic activity,” the pre-policy analysis said.

“Accordingly, we do not rule out a possibility of a rate cut though at a lower probability of 40 percent. We are more biased towards a rate cut in December 2019, considering the risk in lower liquidity position,” it added.

Explaining the rationale behind their forecast, First Capital Research said strengthening macroeconomic indicators and the current high yields have been slowly attracting foreign inflows, which is likely to further accelerate post-presidential election amid easing political uncertainty to a certain extent.

However, last week, Fitch Ratings in a report said the election outcome increases the policy uncertainty in Sri Lanka.

First Capital Research also believes more supportive economic policies will be implemented by the new administration amid the overly sluggish economic growth.

Sri Lanka’s GDP grew 1.6 percent in the second quarter of 2019, impacted by the Easter attacks in April. Private sector credit growth remains negligible with January-September growth at 2.13 percent.

Despite the Central Bank cutting rates, the decline in market interest rates has been slow amid high level of non-performing loans in the system, which compelled the Central Bank to slap lending interest caps on banks.

Following the completion of the presidential election, business activity and credit growth have shown slow progress but continue to remain below expectations calling for further monetary easing.

Meanwhile, First Capital Research also pointed out that the Sri Lankan rupee has been strengthening over the past couple of weeks.

“We believe a significantly undervalued rupee and lower credit growth, provides room for the CBSL to buy dollars, strengthening the reserves and increasing liquidity in the system.”

Talking about the external developments that may lead the Central Bank to cut rates again, the research firm cited the benchmark overnight lending rate cut by the US Federal Reserve in late October by a quarter a point.

“The global move towards easing monetary policy creates a supportive environment for Sri Lanka to provide further easing in the domestic economy,” First Capital Research said.

The Monetary Board of the Central Bank currently maintains Standing Deposit Facility Rates at 7 percent and Standing lending Facility Rate at 8 percent. The Statutory Reserve Ratio is maintained at 5 percent.

15 Nov 2024 20 minute ago

15 Nov 2024 1 hours ago

15 Nov 2024 3 hours ago

15 Nov 2024 4 hours ago

15 Nov 2024 4 hours ago