01 Aug 2022 - {{hitsCtrl.values.hits}}

REUTERS: Foreign mutual funds which have exposure to Sri Lankan equities have posted steep losses in their net asset values this year, prompting their fund managers to look for ways to trim their holdings and switch to alternative markets.

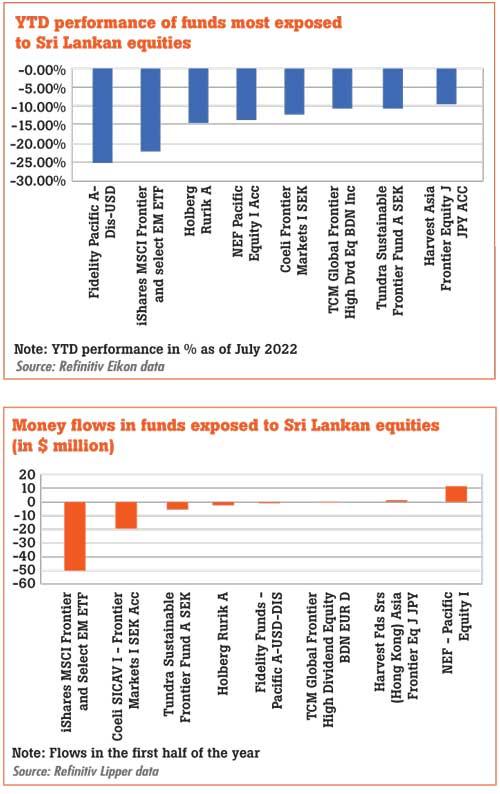

According to Refinitiv Lipper, the top eight overseas funds that have exposure to Sri Lanka have dropped 14.8 percent this

According to Refinitiv Lipper, the top eight overseas funds that have exposure to Sri Lanka have dropped 14.8 percent this

year on average.

That’s a lot better than the Sri Lanka’s CSE All-Share index’s decline of 38 percent so far in 2022.

The Tundra Sustainable Frontier Fund A SEK, which had about 3.14 percent exposure to Srilanka, has lost 10.52 percent this year, while Harvest Asia Frontier Equity J JPY Acc and Holberg Rurik A declined 9.6 percent and 14.5 percent, respectively.

“During 2022, it(Sri Lankan exposure) has negatively impacted our performance by ca 3 percent (US$),” said Mattias Martinsson, chief investment officer at the Swedish fund manager Tundra Fonder AB. “Our stock-selection in Vietnam and Indonesia has helped us to outperform our benchmark (MSCI FMxGCC Net TR) despite the negative impact from Sri Lanka,” he said.

Overseas funds that have holdings in Sri Lankan equities have also faced sharp outflows in the past few months.

The iShares MSCI Frontier and Select EM ETF witnessed US50.12 million worth of net selling in first half of the year, while Coeli Frontier Markets I SEK had outflows worth US$19.6 million.

Sri Lanka is facing its worst economic crisis in seven decades, unable to pay for essential imports such as fuel and medicine due to a severe shortage of foreign exchange.

08 Nov 2024 47 minute ago

08 Nov 2024 3 hours ago

07 Nov 2024 7 hours ago

07 Nov 2024 7 hours ago

07 Nov 2024 8 hours ago