26 Dec 2019 - {{hitsCtrl.values.hits}}

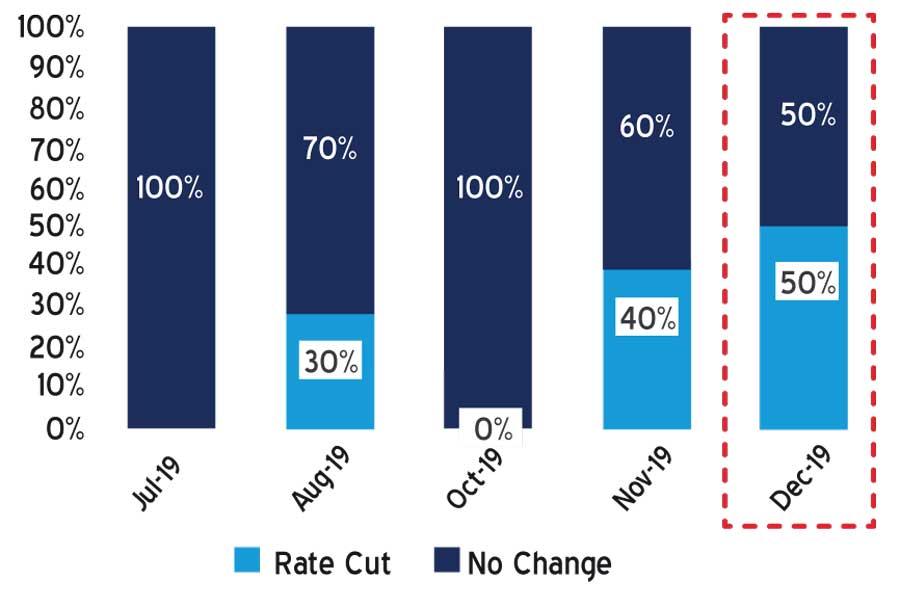

The research arm of an investment banking unit has lowered the probability of a policy rate cut to 50 percent, from the previously projected 100 percent, amid the sweeping tax cuts and loan moratorium announced for small and medium-sized enterprise (SME) loans.

First Capital Research on November 26 said the door was wide open for a further policy easing in December 2019.

“We are maintaining the same stance; however lowering the easing probability to 50 percent in December, considering the recent hefty tax benefits, moratorium to SMEs and relaxation of capital adequacy requirements declared by the government and CBSL,” First Capital Research said in its pre-policy analysis.

“We believe that the benefits given may partly compensate an expectation of a rate cut to address the prevailing sluggish economic growth.

However, we are of the view that a 50 percent probability exists for a “No Change” in the Monetary Policy as well due to the major benefits,” it added.

First Capital Research believes the Statutory Reserve Ratio (SRR) will be maintained at the current levels.

The Central Bank is scheduled to announce its final monetary policy review for this year, tomorrow.

The government on November 27 announced sweeping tax reforms, including a considerable reduction in the Value-Added Tax (VAT) and abolishing of taxes such as Nation Building Tax (NBT). Also, the thresholds applicable for several taxes such as Pay-As-You-Earn (PAYE) were increased.

The tax cuts have raised concerns on the government revenue side, signalling higher fiscal deficits than earlier projected. Moody’s has estimated the revenue loss due to tax cuts to be around 1.5 percent of GDP while Fitch, which lowered Sri Lanka’s sovereign rating outlook over the tax cuts last week, estimates the impact from VAT change and scrapping of NBT alone to be 2 percent of GDP.

However, the government has strongly defended its position saying that the tax cuts would augment the aggregate demand in the economy and thereby boost economic growth, offsetting most of the revenue-side impacts.

On top of that, the government last week directed all banks to suspend the recovery of SME loans up to Rs.300 million for a 12-month period, starting from January next year, to support the lagging SMEs. Sri Lanka’s economic growth and private sector credit have shown signs for recovery, albeit below par the potential, leaving space for aggressive monetary policy easing. Sri Lanka grew 2.7 percent in the third quarter and private credit recorded an increase of Rs.26 billion in October, recording a positive credit growth for the third consecutive month. The credit growth during January-October was 2.6 percent.

Meanwhile, First Capital Research said although the government delaying the US $ 500 million Samurai bond issuance, given the country’s higher foreign loan payments and modest foreign reserves, it added that foreign outflows is not considered a major concern, given the lower level of foreign holding in the government securities market. The government bond market witnessed an outflow of Rs.16.9 billion since November 27, resulting in foreign holding in government securities declining below 2.0 percent.

“Though policy easing in the current scenario enhances foreign outflows, the historical low level of foreign holding significantly reduces the risk of further outflows,” First Capital Research said.

15 Nov 2024 6 hours ago

15 Nov 2024 8 hours ago

15 Nov 2024 8 hours ago

15 Nov 2024 9 hours ago

15 Nov 2024 9 hours ago