03 Sep 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

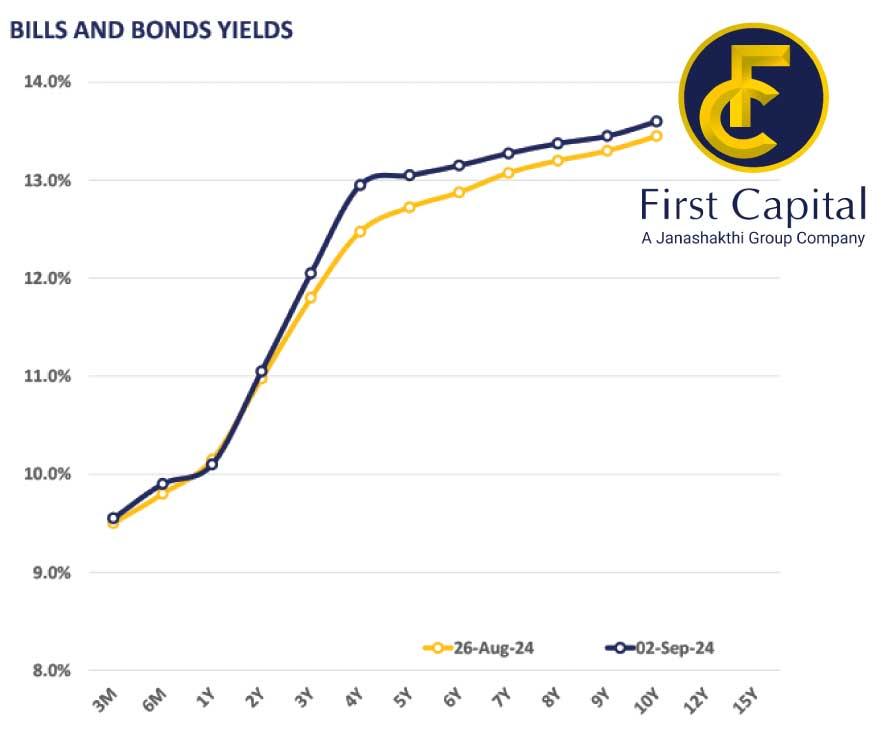

The secondary market yield curve saw a slight uptick on the belly of the curve as selling pressure emerged on the mid tenures.

Broadly, the sentiment during the day was mixed with buying interest observed in short tenures. However, selling pressure emerged on the mid tenures, predominantly on the 2028 maturity. On the short end of the curve, 01.06.2026 and 01.08.2026 enticed trades at 11.00 percent while 15.02.2026 closed at 11.15 percent. On the 2027 maturities, 15.01.2027 and 15.12.2027 closed transactions at 11.10 percent and 12.00 percent, respectively.Amidst strong selling interest, the 2028 maturities, 15.02.2028 recorded trades at 12.60 percent while 01.07.2028 inched up to 13.00 percent during the day. Uncertainty continues to impact market sentiment, owing to concerns on the outcome of the upcoming election. However, volumes improved to moderate levels amidst limited participation. Meanwhile, the Central Bank has announced to raise Rs.152.0 billion at the weekly T-bill auction scheduled for September 4, 2024. On the external side, the Sri Lankan rupee appreciated slightly against the US dollar, closing at Rs.299.6/US dollar while reflecting a similar appreciation against other major currencies as well. Meanwhile, the AWPLR closed at 9.13 percent as at end of August while remaining unchanged compared to the previous week.

25 Nov 2024 15 minute ago

25 Nov 2024 36 minute ago

25 Nov 2024 50 minute ago

25 Nov 2024 1 hours ago

25 Nov 2024 2 hours ago