30 Jan 2024 - {{hitsCtrl.values.hits}}

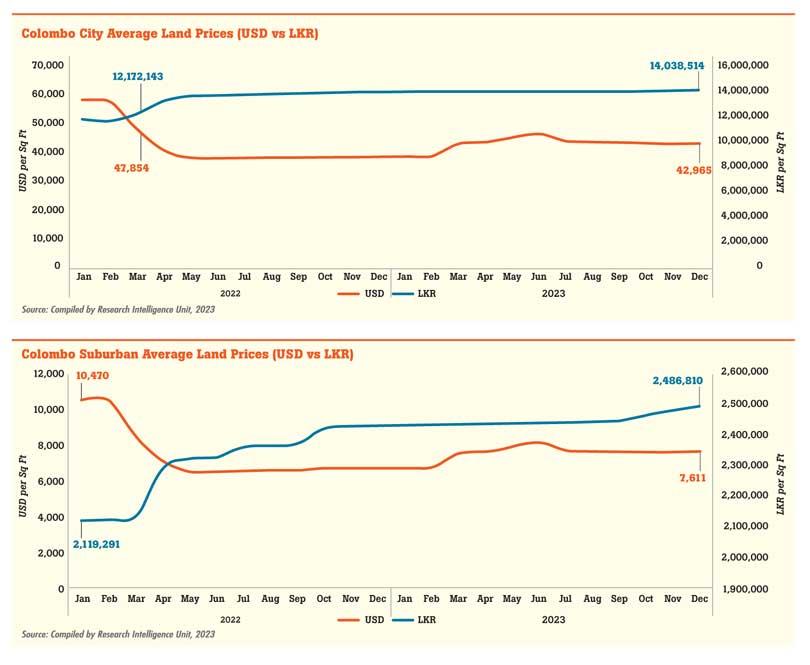

During the firm’s extensive 21 years of tracking land prices in Sri Lanka, the current period stands out as the flattest so far, an analysis by Research Intelligence Unit (RIU) showed.

In the aftermath of the economic crisis, it said it noted that the anticipated rebound in land prices has proven to be a more sluggish than first expected.

The research firm that specializes in the Sri Lankan real estate market said that the average land prices in Colombo city, denominated in LKR, experienced a marginal increase from Rs. 14.024 million per perch in November to Rs. 14.038 million per perch in December. Similarly, when assessed in USD terms, the prices rose from US$ 42,725 per perch in November to US$ 42,965 per perch in December.

The monthly real estate market surveillance update flagged Colombo 05 as having the highest growth rate of average land price per perch within the Colombo city land market. It has increased nearly by 3 percent (Y-o-Y) during the time period from December 2022 – December 2023.

In the suburban areas of Colombo, the trend continued with average land prices in LKR terms rising from Rs. 2.474 million per perch in November to Rs. 2.486 million per perch in December 2023. In USD terms, this equated to an increase from US$ 7,538 per perch to US$ 7,611 per perch over the same period. RIUNIT ongoing research captured Rajagiriya as having the highest growth rate of average land price per perch in the Colombo suburban land market. It has increased nearly by 6 percent (Y-o-Y) during the time period from December 2022 – December 2023.

Whilst the land market is still on a positive incline, the rate of increase is extremely sluggish at present. Moreover, the RIUNIT said high growth rates were seen even during the civil conflict before 2009. However, it expects the market to pick up toward the latter part of 2024.

27 Oct 2024 8 hours ago

27 Oct 2024 27 Oct 2024

27 Oct 2024 27 Oct 2024

27 Oct 2024 27 Oct 2024

27 Oct 2024 27 Oct 2024