23 Aug 2022 - {{hitsCtrl.values.hits}}

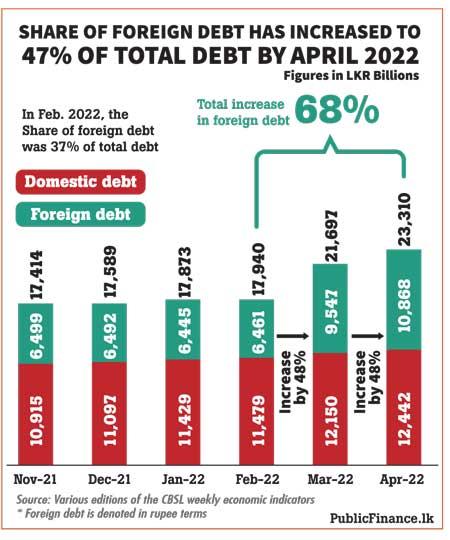

Fuelled by the sharp depreciation of the rupee, Sri Lanka’s foreign debt portion has gone up to 47 percent of the total outstanding government debt by end-April this year, from 37 percent at the end of last year, according to PublicFinance.lk, a platform for public finance-related information in Sri Lanka.

The rupee value of the government’s foreign debt stock rose by 68 percent to Rs.10.86 trillion from the February to April period of this year, following the sharp devaluation of the rupee in mid-March. This was despite a sizeable decline in foreign debt in US dollar terms.

The rupee value of the government’s foreign debt stock rose by 68 percent to Rs.10.86 trillion from the February to April period of this year, following the sharp devaluation of the rupee in mid-March. This was despite a sizeable decline in foreign debt in US dollar terms.

Over the past decade, on average, foreign debt accounted for 44 percent of the total outstanding government debt while domestic debt made up of the remaining 56 percent. Subsequently, the total outstanding government debt also increased to Rs.21.69 trillion at the end of the first quarter this year, from Rs.17.83 trillion or 105 percent of the GDP at end-last year.

As per the debt sustainability analysis conducted by the International Monetary Fund (IMF), Sri Lanka’s public debt, including the sovereign-guaranteed SOE debt and Central Bank’s debt, reached 114.4 percent of the GDP last year, with the foreign currency-denominated debt making up 47.3 percent of the public

debt stock.

The central government and guaranteed SOEs’ external public deb accounted for 11.3 percent of the public debt and China held 44 percent of this bilateral credit, followed by Japan and India. On April 12 of this year, the government announced a pre-emptive default on external debt, pending an orderly and consensual restructuring of those obligations in a manner consistent with an economic adjustment programme supported by the IMF.

Under the programme, the government’s external debt stock is expected to maintain at 40 percent of the overall debt stock. An IMF team expected in Colombo in the mid part of this week is to finalise the talks on a staff-level agreement for a possible bailout package approved by the Executive Board of

the IMF.

07 Nov 2024 21 minute ago

07 Nov 2024 2 hours ago

07 Nov 2024 3 hours ago

07 Nov 2024 4 hours ago

07 Nov 2024 5 hours ago