26 Oct 2021 - {{hitsCtrl.values.hits}}

The spread between Sri Lanka’s market lending and deposit rates had already been widening in the run-up to August, a trend which only got more pronounced from the rate hike in the latter part of that month, sending the lending rates higher much faster than the deepest rates, according to a comparison of rates.

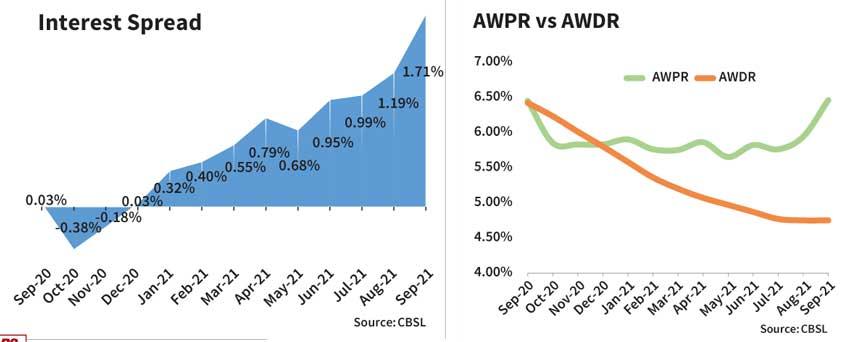

According to the mostly watched market lending and deposit rates parsed by First Capital Research during the year through September 2021, while there has been a negligible to a more modest gap between the two beginning from December last year, which is nothing unusual, the spread began to widen by over 100 basis points since August, when the Monetary Board delivered a surprise, yet a much overdue rate hike.

By the end of September, the spread has widened up to 171 basis points, predominantly on the fast ascent seen in the weekly prime lending, compared with the weighted average deposit rate. By the end of September, the two rates stood at 6.46 percent and 4.75 percent, respectively, which led to the above spread.

The behaviour of the two market rates demonstrates that the deposit rates, which continued their descent through July 2021, have plateaued thereafter while the lending rates have climbed and continuing.

The most recent data available through the end of last week further underscored this with the prime lending further rising to 7.23 percent by October 22, while the average deposit rate had remained unchanged at 4.75 percent by October 13.

This makes the spread widening up to 248 basis points but it would be just a matter of time the deposit rates would also catch up, according to economic analysts.

Rating agency ICRA Lanka a few days ago said the continuous shortage in liquidity in the money market could soon prompt the local banks to compete for funds, pushing the deposit rates higher.

Signs are already seen with certain commercial banks offering in the north of 7.0 percent for their one-year term deposits. The one-year treasury bill, which climbed up to 8.17 percent last week at the primary auction, is also a leading indicator for the deposit rates to follow suit.

However, while the average deposit rate may not fully capture the recent increases in the deposit rates in the banking sector, due to its broad nature, average new deposit rate and the new fixed deposit rates have both risen in August by 20 basis points each, indicating that the same trajectory for September and October.

The two rates, which bottomed out in August, logged 26 and 27 basis point increases, respectively to 5.19 percent and 5.35 percent by October 13, according to the latest data available.

However, with the inflation rising at 5.7 percent in Colombo and 6.2 percent nationally in September, savers will still lose money on their bank savings.

17 Nov 2024 1 hours ago

17 Nov 2024 3 hours ago

17 Nov 2024 5 hours ago

17 Nov 2024 5 hours ago

17 Nov 2024 5 hours ago