15 Aug 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market experienced limited activity during the day on the back of lean trades.

Very thin volumes were registered during the day, mostly centred on the liquid maturities 2026, 2027. 01.02.26 traded at 10.55 percent, 01.06.26 traded at 11.05 percent, 01.08.26 traded at 11.10 percent, whilst 15.12.27 traded at 12.30 percent.

Furthermore, the mid-tenure maturities enticed trade during the day as 15.05.30 registered at 13.25 percent.

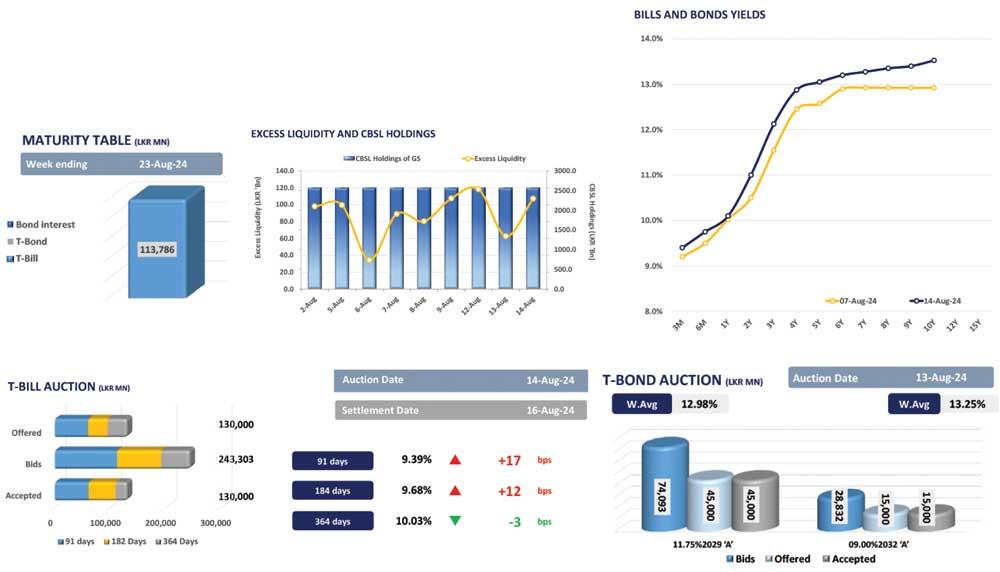

Meanwhile, the Central Bank held its Rs.130.0 billion weekly T-bill auction yesterday, where the 91 day and 182 day witnessed higher acceptance during the auction, while they were accepted at a weighted average yield rate (WAYR) of 9.39 percent (+17 basis points (bps)) and 9.68 percent (+12bps), respectively.

Notably, the 364-day maturity was accepted lower, compared to the previous T-bill auction, at a WAYR of 10.03 percent (-3 bps).

Overnight liquidity inclined during the day to record at Rs.107.1 billion from Rs.62.7 billion, which was recorded during the previous day. The Central Bank holdings remained stagnant at Rs.2,575.6 billion for two consecutive weeks.

On the external side, the Sri Lankan rupee slightly appreciated against the US dollar for the fifth consecutive day, recording at Rs.299.3. However, depreciated against most of the global currencies namely, GBP, EUR JPY and CNY.

26 Nov 2024 29 minute ago

26 Nov 2024 42 minute ago

26 Nov 2024 2 hours ago

26 Nov 2024 2 hours ago

26 Nov 2024 3 hours ago