05 Jun 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

By First Capital Research

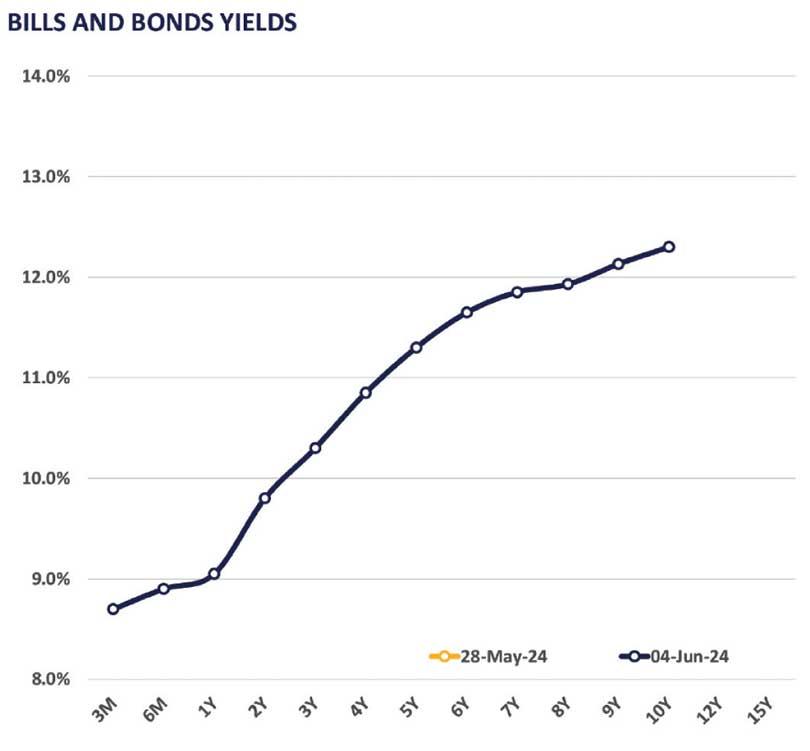

The secondary market yield curve remained broadly stable continuing the sluggish trend from the previous session, backed by limited activity and thin volumes during yesterday.

The subdued sentiment in the market was mainly influenced by the lingering uncertainty ahead of the IMF board meeting which is to be held on the 12th Jun-24 regarding the disbursement of the IMF 3rd tranche alongside the anticipated Bond auction that is scheduled for the 13th Jun-24 which resulted the investors to pivot into a wait and see approach.

Furthermore, 15.12.26 tenor traded at 9.80%, 01.09.27 maturity traded at 10.37%. Towards the long end of the curve 01.10.30 traded between the range of 11.80% - 11.88%. On the external side LKR broadly remained stagnant compared to the USD recording at Rs. 301.9.

Overnight liquidity was recorded at Rs. 161.1 billion whilst CBSL Holding remained stagnant at Rs. 2,635.6.

28 Nov 2024 17 minute ago

28 Nov 2024 2 hours ago

28 Nov 2024 5 hours ago

27 Nov 2024 8 hours ago

27 Nov 2024 9 hours ago