20 Dec 2019 - {{hitsCtrl.values.hits}}

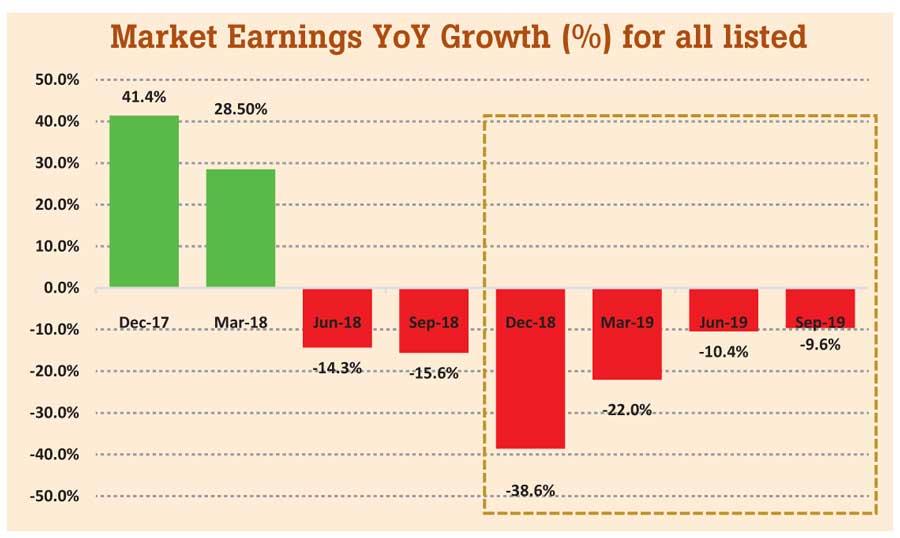

Earnings of the 264 companies listed on the Colombo Stock Exchange declined by 9.6 percent year-on-year (YoY) to Rs.45.8 billion during the September quarter, though slightly better than the previous quarter, and considerably better than March 2019 and December 2018 quarters.

According to First Capital Research, the decline in earnings was primarily due to the sluggish performance of Insurance (-48 percent YoY), Consumer Services (-495 percent YoY), Capital Goods (-39 percent YoY) and Food, Beverage and Tobacco

(-12 percent YoY) sectors.

However, an earnings upside was witnessed in Material (108 percent YoY), Consumer, Durable & Apparel (+13600 percent YoY) and Energy (646 percent YoY) sectors negating the negative performance in the above-mentioned sectors.

Insurance, Consumer Services, Capital goods and Beverage and Tobacco sectors weaken the quarterly earnings growth. Lackluster performance in Insurance, Consumer Services and Food, Beverage and Tobacco was mainly owing to the lower consumer spending stemmed from subdued economic activities.

Insurance sector earnings recorded a substantial drop mainly due to earnings decline in Softlogic Life Insurance PLC (-85 percent YoY) from a deferred tax adjustment and Union Assurance PLC (-91 percent YoY) due to the increased transfer of insurance contract liabilities to the life fund.

Consumer Services sector earnings declined and posted a loss of Rs.1.67 billion relatively to a profit of Rs. 0.4 billion in Sep 2018 as a result of the drop in tourist arrivals subsequent to the Easter Sunday attacks. Food, Beverage and Tobacco sector earnings dipped by 12 percent YoY to Rs.7.8 billion led by Browns Investments PLC, Melstacorp PLC and tea plantation companies.

Browns Investments posted a loss of Rs.1.19 billion compared to a loss of Rs 0.6 billion due to higher finance and admin cost. Melstacorp earnings dropped by 58 percent due to hefty taxes while the cost of sales also surged against the same period last year.

Profit dip witnessed across the tea plantation counters due to weaker tea prices further dragged down the Food Beverage and Tobacco sector earnings.

Material Consumer, Durable & Apparel and Energy sectors posted a healthy performance. Material sector saw a profit growth of 108 percent YoY to Rs.1.8 billion driven by Tokyo Cement PLC (573 percent YoY). Tokyo Cement profits were boosted due to operational efficiencies and increase in maximum retail price.

Consumer, Durable & Apparel sector saw an impressive earnings growth of 13600 percent YoY with Teejay Lanka PLC, Hayleys Fabric PLC and Ambeon Holdings PLC posting earnings growth of 84 percent, 83 percent and 184 percent respectively.

Teejay Lanka and Hayleys Fabric earnings growth was supported by efficiency improvements, strong order book and stable cotton prices.

Energy sector posted a strong earnings growth of 646 percent YoY in profits as a result of turnaround in Laugfs Gas PLC, which posted earnings of Rs.17 million compared to Rs.305 million loss posted in September 2018 and improved performance in Lanka IOC PLC due to higher focus on bunkering, lubricant operations and export market.

15 Nov 2024 4 hours ago

15 Nov 2024 5 hours ago

15 Nov 2024 6 hours ago

15 Nov 2024 6 hours ago

15 Nov 2024 7 hours ago