01 Feb 2024 - {{hitsCtrl.values.hits}}

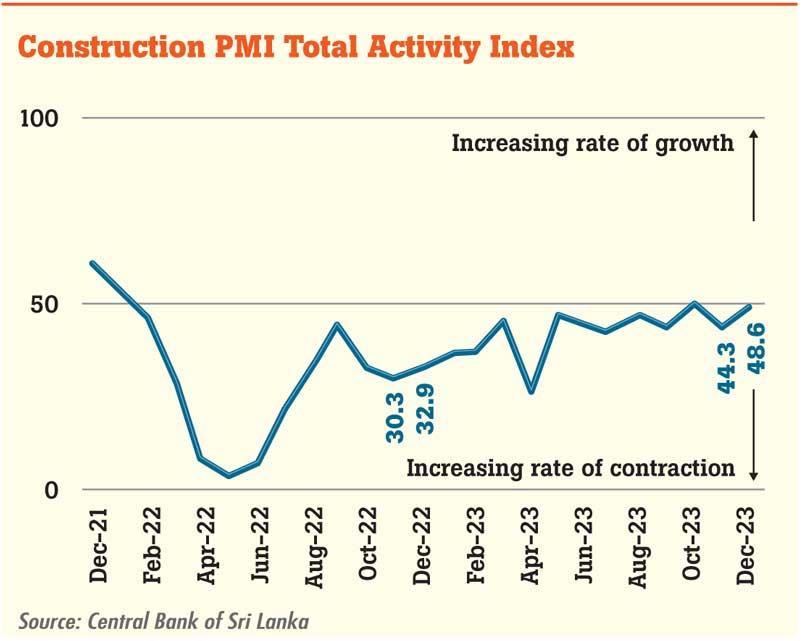

Sri Lanka’s construction sector in December moved closer towards neutrality, showing a slower contraction in activities when compared with the previous month.

According to the Construction Purchasing Managers’ Index (PMI), compiled by the Central Bank every month, the industry recorded a total activity index value of 48.6 in December 2023.

In the PMI, a value of 50.0 indicates a neutral level, signifying neither expansion nor contraction, while values above 50 suggest expansion and values below 50 indicate a decline in the respective economic activity.

While the limited availability of project work continued to hamper the activity levels, new orders declined in December,

broadly at a similar pace compared to the previous month.

In the PMI, a value of 50.0 indicates a neutral level, signifying neither expansion nor contraction, while values above 50 suggest expansion and values below 50 indicate a decline in the respective economic activity. While the limited availability of project work continued to hamper the activity levels, new orders declined in December, broadly at a similar pace compared to the previous month. Many respondents mentioned that currently they are heavily relying on foreign-funded projects. Employment continued to contract, mainly due to the layoffs, in line with the project completions. Further, the Quantity of Purchases remained contracted during the month, since the ongoing work and upcoming projects continued to decline. In the meantime, the Suppliers’ Delivery Time remained lengthened in December. With the lack of upcoming projects and impact of tax revisions on price levels, the industry outlook for the next three months is on the downside.

27 Oct 2024 6 hours ago

27 Oct 2024 9 hours ago

27 Oct 2024 9 hours ago

27 Oct 2024 27 Oct 2024

27 Oct 2024 27 Oct 2024