12 Mar 2021 - {{hitsCtrl.values.hits}}

Despite rising metal prices in tandem with the recovery in global demand, ICRA Lanka Limited said that local importers could hold the prices of metal through the medium-term as they might have built loss absorption capacity, as they didn’t revise down prices when the global market prices collapsed last year.

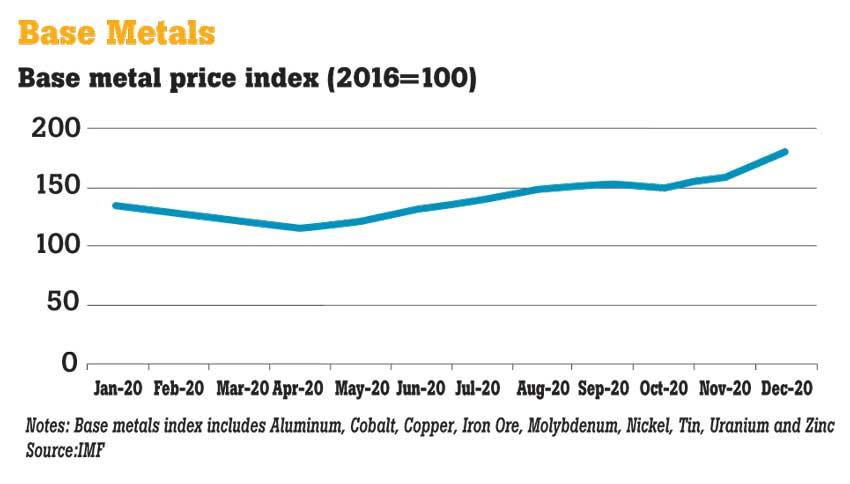

The world’s commodities prices slumped in 2020 when the pandemic slowed down industrial activities to a greater extent. Hence, 2020 marked the lowest global commodities prices in recent history.

“Base metal markets are expected to return to normalcy in 2021 supported by the increase in investment expenditure by governments around the world and recovering global industrial activity. As per the forecasts copper, aluminum, and iron ore – key industrial metals – will see their prices increasing by around 14 to16 percent this year,” ICRA Lanka said in a recent report on global commodities prices and their implications on the Sri Lankan economy.

“When the global metal prices collapsed in 1Q 2020, the local importers did not drop the prices but in fact increased due to import restrictions. Hence, they may have developed some loss absorbing capacity to hold the prices in the medium term,” the rating agency added.

Even if there is a pass down effect, ICRA Lanka said that large-scale construction companies would less likely to experience margin erosion, but the small to medium scale contractors could feel the implications more acutely.

Industrial metal is a widely used commodity in the construction sector.

“Item rated contracts have provisions that would enable the construction companies to claim raw material cost increases based on the monthly published price indexes. Therefore, many large-scale construction contractors are less likely to experience margin erosions due to raw material price increases,” ICRA Lanka said. “However, small-to-medium scale contractors who generally enter into fixed price contracts, may have to absorb some losses,” the rating agency added.

Sri Lanka imported around US$ 563 million worth of base metals in 2019.

19 Nov 2024 8 hours ago

19 Nov 2024 9 hours ago

19 Nov 2024 19 Nov 2024

19 Nov 2024 19 Nov 2024

19 Nov 2024 19 Nov 2024